EUR/USD Price Forecast: Recovery seems to lack conviction

- EUR/USD was unable to maintain its bullish tone past 1.1260 on Wednesday.

- The US Dollar trimmed earlier losses and managed to clock humble gains.

- Investors will now look at US Retail Sales and Chief Powell.

The Euro (EUR) surrendered its early uptick midweek, with EUR/USD fading the initial advance to weekly highs in the 1.1260-1.1270 band as the US dollar (USD) regained composure toward the end of the NA session.

Indeed, the US Dollar Index (DXY) reclaimed the 101.00 barrier after bottoming out near 100.30 during early trade, with further upside in US yields also contributing to the late recovery in the Greenback.

Tariff relief props up risk appetite—but doubts linger

A wave of scepticism swept through markets despite recent upbeat headlines on US–China trade, prompting a bit of a reversal in USD strength.

Markets initially cheered news that the US and China had agreed to a significant tariff rollback, slashing reciprocal levies from over 100% to just 10%. The deal also included a 90-day pause, with the US keeping a 20% tariff on fentanyl-related imports from China—holding the overall tariff load at 30%.

That announcement followed last week’s US–UK trade agreement and bullish rhetoric from President Trump, who teased more deals in the pipeline.

Still, the lack of detail in the US–China deal raised red flags for investors. Doubts about whether the agreement signals lasting progress weighed on sentiment, dragging the dollar lower and giving the euro room to rebound.

Fed–ECB policy gap widens

The growing policy divergence between the Federal Reserve (Fed) and the European Central Bank (ECB) is another key theme in FX markets right now.

While the Fed kept rates steady and stuck with its hawkish tilt, the ECB cut rates by 25 basis points last month, bringing its deposit facility rate down to 2.25%. With another ECB cut potentially on the table as soon as June, the divergence is becoming more pronounced.

Traders are now leaning toward the Fed holding off on rate cuts until September, though markets still see two 25 basis points cuts by year-end—especially after the US–China trade news and softer-than-expected US inflation data for April.

Spec positioning still backs the Euro

Despite recent chop in price action, speculative flows into the euro remain robust. CFTC data through May 6 showed net longs holding around 75.7K contracts, near recent highs, while open interest climbed to 738K—the most since September 2024.

Still, commercial players remain net short, suggesting corporates remain wary amid the uncertain macro landscape.

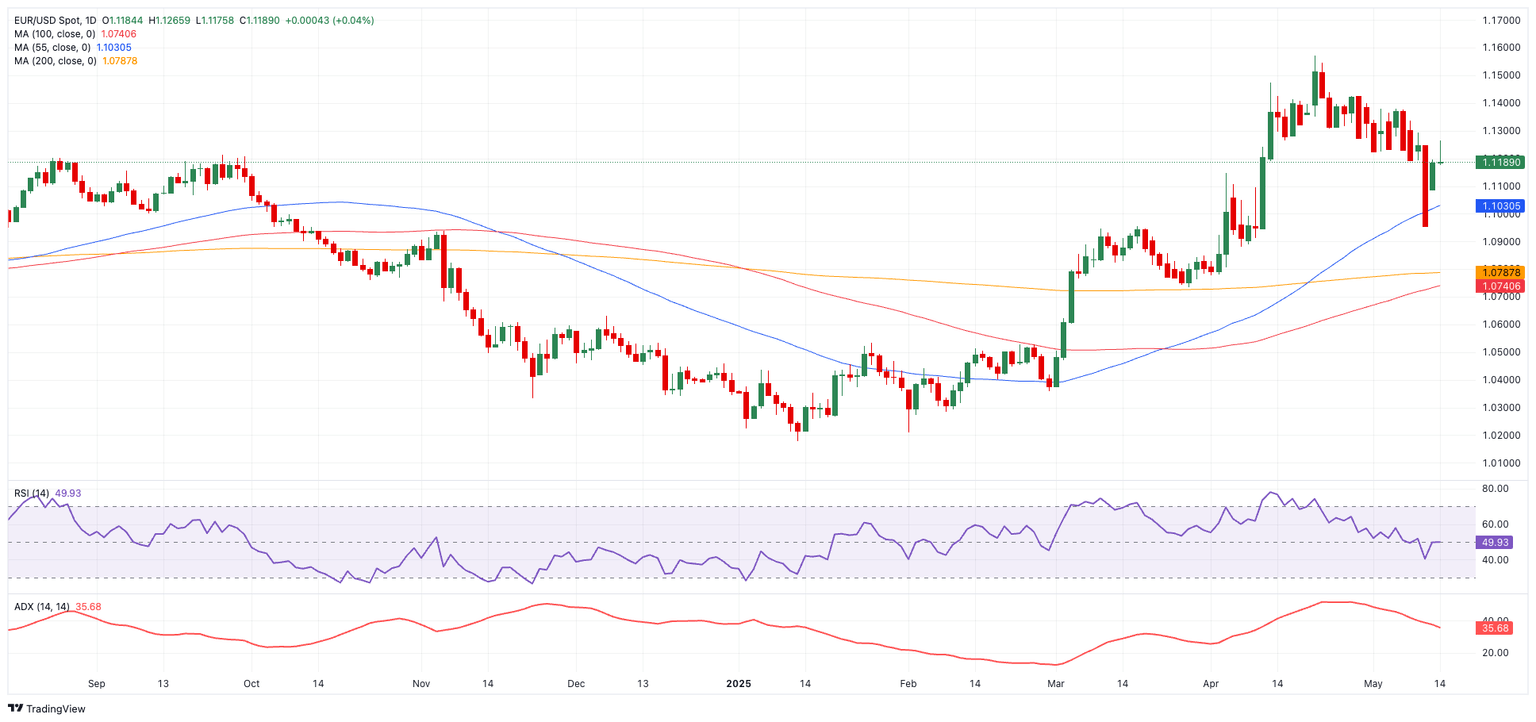

Technicals: Resistance still a headache

EUR/USD is struggling to break through major resistance at its 2025 high of 1.1572 (April 21). Beyond that, the 1.1600 level and the October 2021 peak at 1.1692 present further hurdles.

On the downside, key support sits at the monthly low of 1.1064 (May 12), followed by the transitory 55-day SMA at 1.1041 and the critical 200-day SMA at 1.795.

Momentum indicators are mixed. The Relative Strength Index (RSI) has ticked up to around 48, hinting at a possible short-term bounce, while the ADX near 37 signals an ongoing but weakening trend.

EUR/USD daily chart

Outlook: Expect more choppiness

EUR/USD looks set for a period of headline-driven volatility. While speculative support is holding up, the widening policy gap between the Fed and ECB—and lingering uncertainty over trade and geopolitics—means the euro is likely to stay in choppy waters for now.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.