EUR/USD Price Forecast: Parity is back on the table

- EUR/USD suddenly sank to three-week lows near the 1.0200 support.

- The US Dollar advanced to fresh tops on the back of US tariffs.

- Trump opened the door to tariffs on EU imports.

In quite a dreadful start to the new trading week, the Euro (EUR) gapped lower and plummeted to multi-week lows around the 1.0200 region on the back of the abrupt resumption of the demand for the US Dollar (USD).

The strong uptick in the Greenback came as market participants adjusted to news over the weekend that President Donald Trump unleashed a 25% tariff on Canadian and Mexican goods and a 10% charge on Chinese imports.

Against that backdrop, the US Dollar Index (DXY) surged to new three-week highs just below the key 110.00 hurdle. The pronounced advance in the US Dollar, however, lost some traction afterwards in response to some delay in the implementation of tariffs in Mexico. Despite the latter, the tariffs narrative remained a strong support for the Greenback and emerged as a strong driver behind the expected bullish outlook for the currency in the current year.

Fed-ECB divergence to weigh further on EUR

Central banks are now under the microscope. The Federal Reserve (Fed) chose to keep interest rates unchanged on Wednesday, offering little hint about when a cut might come. Despite robust economic growth, persistent inflation and low unemployment, the Fed remains cautious. In a notable shift, it moved from saying inflation “has made progress” to describing price pressures as “elevated,” signaling a more watchful approach as it waits for clearer signs of cooling inflation. The decision to maintain the federal funds rate at 4.25%-4.50% highlights a wait-and-see strategy amid concerns over the impact of Trump’s trade and fiscal policies.

Across the Atlantic, the European Central Bank (ECB) met expectations by cutting rates by 25 basis points and hinted at more easing in the future. The ECB remains hopeful that eurozone inflation will gradually come under control, even as global trade worries persist. While the eurozone economy is still sluggish, recent surveys suggest some improvement, and with inflation just above the ECB's 2% target, the rate cut was seen as justified.

In her press conference, President Christine Lagarde emphasized that the ECB isn’t planning to lower rates below neutral levels to stimulate the economy. She explained that decisions are data-driven, without any commitment to a rapid pace of easing. Lagarde made it clear that a drastic 50 basis point cut was never on the table—only a 25 basis point reduction had unanimous support. She expressed confidence that bloc inflation would reach the 2% target by 2025 but warned that rising global trade tensions could continue to slow economic growth in the near term.

Profit amid the turmoil: Who gains in a trade war?

Tariff tensions, especially those driven by US policy, could further complicate the path of the euro in the near-to-medium term. If tariffs persist, they might fuel US inflation and prompt the Fed to adopt an even more hawkish stance, thereby strengthening the dollar and pressuring its rivals—potentially paving the way for EUR/USD to return to the key parity level.

What about techs?

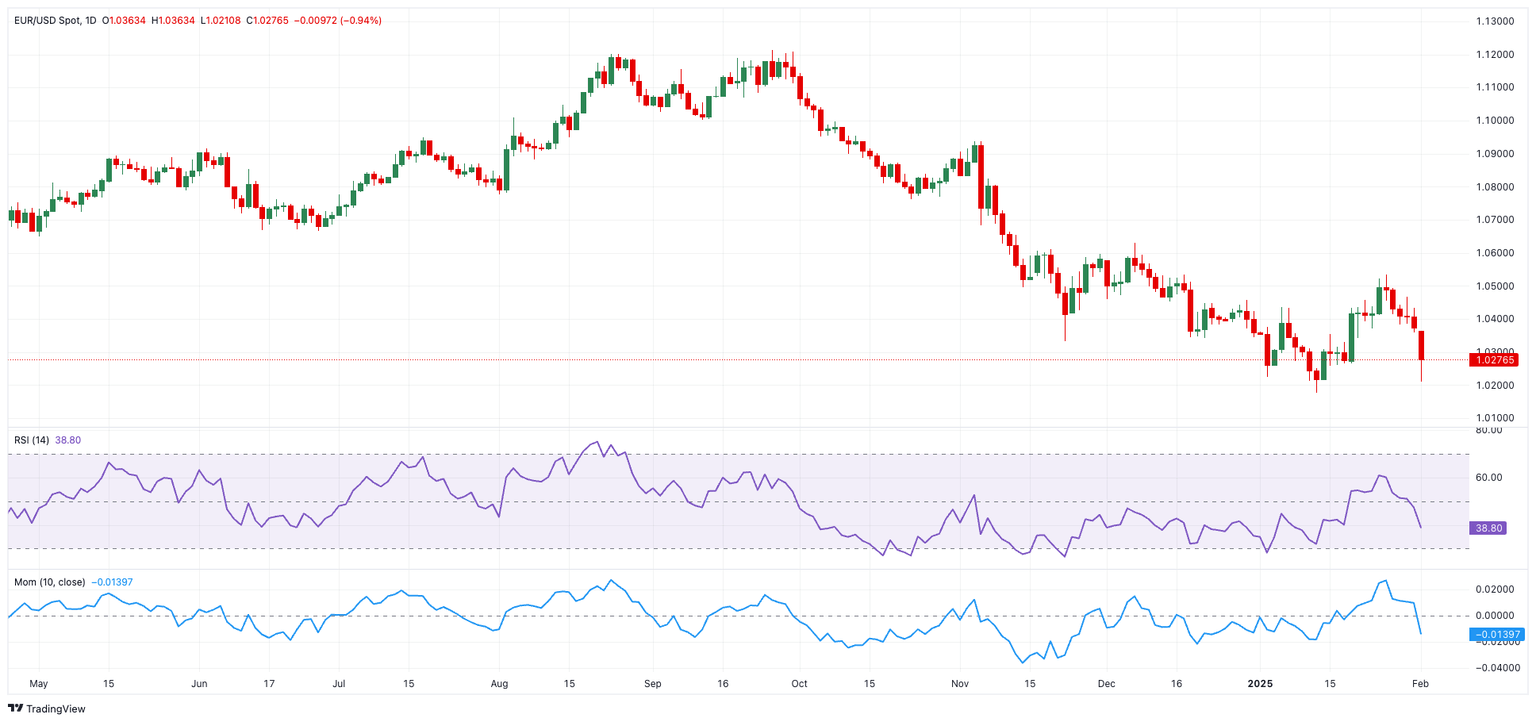

Technically, EUR/USD is navigating uncertain waters. The pair finds initial support at the weekly low of 1.0209 (February 3), prior to 1.0176, its lowest point this year. A drop below this level could pave the way for a move toward 1.0000.

On the upside, resistance is spotted at 1.0532 (the YTD peak from January 27), with further hurdles at the December peak of 1.0629 and the 100-day Simple Moving Average at 1.0651.

Momentum indicators add to the caution: the Relative Strength Index (RSI) has dipped below 40, hinting at weakening momentum, while the Average Directional Index (ADX) near 22 suggests the current trend is losing steam.

EUR/USD daily chart

Negative outlook

Looking ahead, the euro faces a challenging road. The US Dollar's resilience, divergent central bank policies between the ECB and the Fed, and structural issues within the eurozone—such as Germany’s slowing economy—could all hinder sustained gains for the single currency. While short-term rallies might occur, the overall outlook for the euro remains uncertain.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.