EUR/USD Price Forecast: Outlook remains constructive above the 200-day SMA

- EUR/USD left behind four daily pullbacks in a row and regained 1.0800.

- The US Dollar made a U-turn, reversing a multi-day recovery.

- The US Consumer Confidence dropped to multi-year lows in March.

EUR/USD managed to regain some balance, setting aside four consecutive daily declines and reclaim the 1.0800 barrier and above on turnaround Tuesday, soon afyer hitting three-week lows in the 1.0780-1.0775 band, an area that coincides with the temporary 100-day Simple Moving Average (SMA).

Driving this upward move was a resurgent downward bias in the US Dollar (USD), which prompted the US Dollar Index (DXY) to challenge the 104.00 barrier and halt a multi-day rebound.

Investors, in the meantime, continued to assess the impact of tariff developments as well as some improvement in the Russia-Ukraine crisis.

Trade tensions, stagflation fears, and the Dollar

Uncertainty surrounding US trade policies—marked by President Trump’s unpredictable tariff announcements—has been rattling markets since Inauguration Day.

Although Canada and Mexico received a temporary reprieve until April 2, the possibility of a broader trade war still looms large. This risk weighs on economic growth prospects and complicates the Federal Reserve’s (Fed) policy path.

Tariffs can add to inflationary pressures, potentially prompting the Fed to maintain or even tighten its policy stance. Yet, the very same tariffs could dampen overall economic momentum. This tug-of-war is leaving the Dollar’s near-term outlook murky.

Let’s recall that, on Monday, President Trump signalled upcoming tariffs on automobiles, aluminium, and pharmaceuticals. He argued these measures would ensure the United States has adequate supplies of key goods in the event of future conflicts or crises.

However, last Friday Trump also suggested that some countries might get some breaks on tariffs on April 2.

Euro supported by Russia-Ukraine peace progress

The Euro (EUR) may find some stability on reports of progress in the Russia-Ukraine conflict.

Trump added that a US-Ukraine revenue-sharing agreement on Ukrainian critical minerals could be finalized soon, noting that discussions are underway for American companies to potentially acquire stakes in Ukrainian power plants.

In latest news, Ukrainian President Volodymyr Zelenskiy announced on Tuesday that a truce covering the Black Sea and energy infrastructure had taken immediate effect. He also warned that, should Moscow breach these agreements, he would appeal to Donald Trump for additional weapons and sanctions against Russia.

Earlier, the United States confirmed that it had brokered separate deals with both Kyiv and Moscow to guarantee safe navigation in the Black Sea and to enforce a ban on strikes targeting energy facilities in the two countries.

Central banks in focus

Last Wednesday, the Federal Reserve (Fed) kept its benchmark interest rate unchanged, signalling a possible 50-basis-point rate cut by year-end.

Policymakers pointed to a slowdown in economic activity and a likely dip in inflation, despite nudging their 2025 inflation forecast higher to 2.7% (from 2.5% in December). The Fed also cut this year’s growth outlook to 1.7% (from 2.1%) and cautioned about “unusually elevated” economic risks.

Fed Chair Jerome Powell noted that tariffs may already be exerting upward pressure on prices but stressed the central bank will remain patient in adjusting policy unless conditions deteriorate significantly.

The European Central Bank (ECB) similarly lowered its benchmark rates by 25 basis points and indicated it might ease further if uncertainty persists.

Policymakers trimmed Eurozone growth forecasts while raising near-term inflation estimates, although they still expect a gradual pullback in price pressures by 2026.

Some analysts suggest the ECB could consider pausing its easing cycle sooner than anticipated, a move that might bolster the Euro.

ECB President Christine Lagarde warned that a US-EU trade conflict could shave up to 0.5 percentage points off Eurozone growth if both sides escalate tariffs, though deeper trade integration could help offset the damage. She also applauded Germany’s increased fiscal spending, despite its impact on bond yields.

Positioning: Euro bulls resurface

Speculative net long positions in the Euro climbed for the second straight week, nearing 60K contracts—levels not seen since late September 2024. Hedge funds (commercial players) remained net short for the fourth consecutive week, yet they boosted total contracts to a multi-month high of about 92.4K, according to the latest CFTC Positioning Report (week ending March 18).

EUR/USD technical outlook

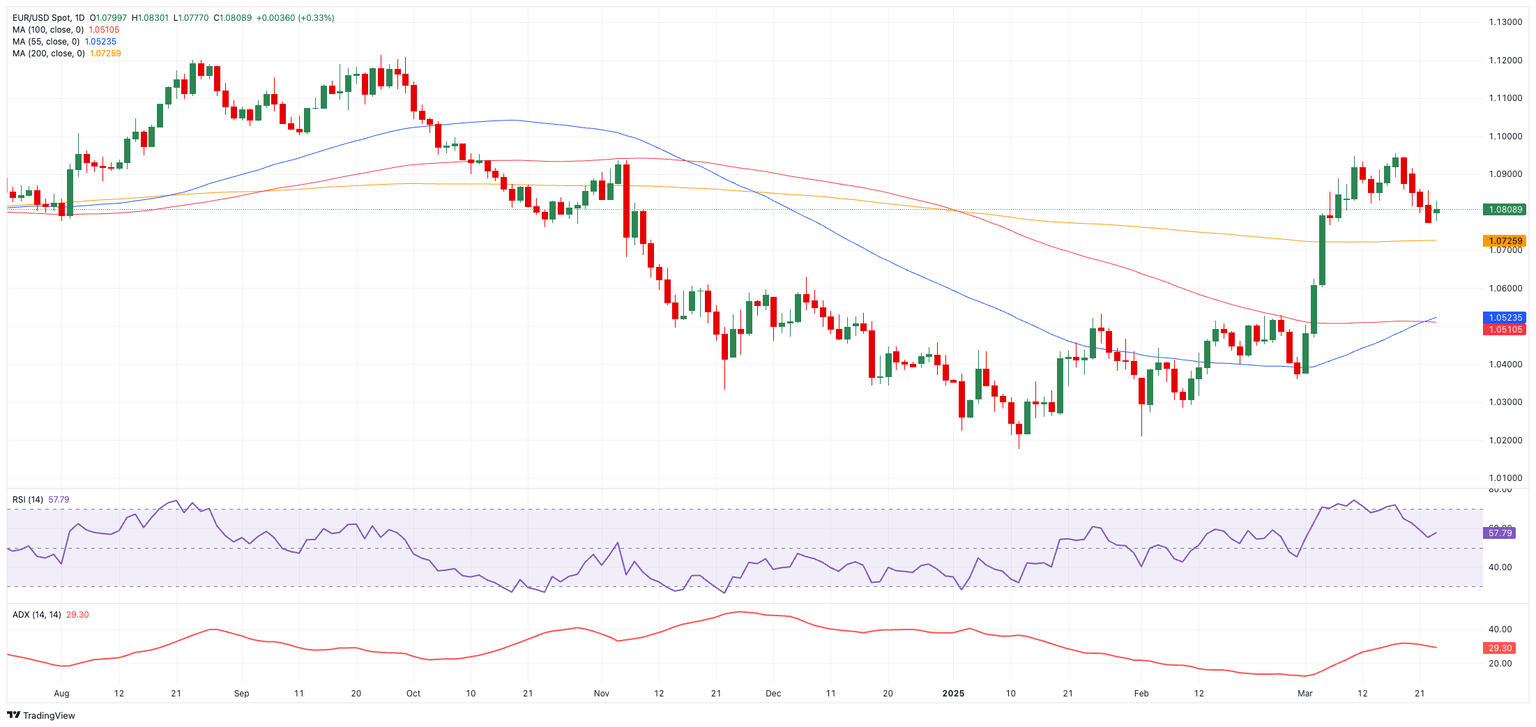

On the upside, key resistance levels stand at 1.0954 (March 18 year-to-date high), 1.0969 (23.6% Fibonacci retracement), and the psychologically significant 1.1000 mark.

In contrast, notable support emerges at 1.0728 (200-day SMA), followed by 1.0520 (provisional 100-day SMA), 1.0514 (the 55-day SMA), 1.0359 (February 28 low), 1.0282 (February 10 low), 1.0209 (February 3 low), and 1.0176 (2025 bottom from January 13).

Meanwhile, momentum indicators have adopted a more bearish tone, with the Relative Strength Index (RSI) hovering around 58 and the Average Directional Index (ADX) rising to around 30, suggesting an intensifying uptrend.

EUR/USD daily chart

What to watch

EUR/USD is set to remain highly sensitive to trade headlines, central bank signals, and Eurozone growth indicators—especially as Germany ramps up fiscal stimulus. Progress (or setbacks) in Russia-Ukraine peace efforts could also spark rapid shifts in sentiment. Keep a close eye on geopolitical news and major economic data releases that could reshape the pair’s short-term direction.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.