EUR/USD Price Forecast: Outlook appears unclear

- EUR/USD managed to regain traction and reverse Monday’s sell-off.

- The US Dollar traded on the defensive amid rising scepticism around trade.

- US CPI lost some impulse in April. Focus now shifts to Producer Prices.

The Euro (EUR) regained some composure on turnaround Tuesday, with EUR/USD bouncing off recent lows near 1.1060 amid renewed US Dollar (USD) weakness. The move came as market participants showed some scepticism following the recent upbeat developments in US-China trade relations.

The US Dollar Index (DXY) retreated from five-week highs just below the 102.00 mark, despite extra gains in US yields across different time frames.

Trade optimism supported the Greenback

Investor sentiment improved on Monday following news that the United States and China had agreed to a sharp reduction in reciprocal tariffs—from over 100% to just 10%—in a move aimed at de-escalating trade tensions. The agreement includes a 90-day pause, during which the US will maintain a 20% tariff on fentanyl-linked imports from China, keeping the overall tariff burden at 30%.

The progress follows last week’s announcement of a US-UK trade deal and bullish remarks from President Trump, who hinted at further agreements on the horizon.

The lack of extra details on the agreement, in combination with rising doubts over a more sustainable agreement seem to have weighed on the US Dollar on Tuesday, motivating USD sellers to return to the market.

Central bank divergence in focus

Policy divergence between the Federal Reserve (Fed) and the European Central Bank (ECB) is increasingly shaping market dynamics.

While the Fed held rates steady and maintained a hawkish bias, the ECB moved in the opposite direction, cutting its key rate by 25 basis points last month to 2.25%.

Markets are now betting on another ECB rate cut as early as June, deepening the divergence and casting doubt over the Euro’s capacity to sustain recent gains should the Fed remain on a more restrictive path.

Meanwhile, traders grew more confident that the Fed would hold off on cutting interest rates until September, though they continued to price in two 25-basis-point reductions by year-end, all following the US-China deal as well as below-expectations US inflation in April.

Speculative support remains resilient

Despite recent price action, speculative interest in the Euro remains firm. CFTC data through May 6 showed net long positions holding steady at around 75.7K contracts—near multi-month highs—while open interest climbed to around 738K contracts, the highest level since September 2024.

Commercial hedgers, however, remained net short, underscoring persistent caution among corporates amid lingering macro uncertainty.

Technical outlook: Heavy resistance caps upside

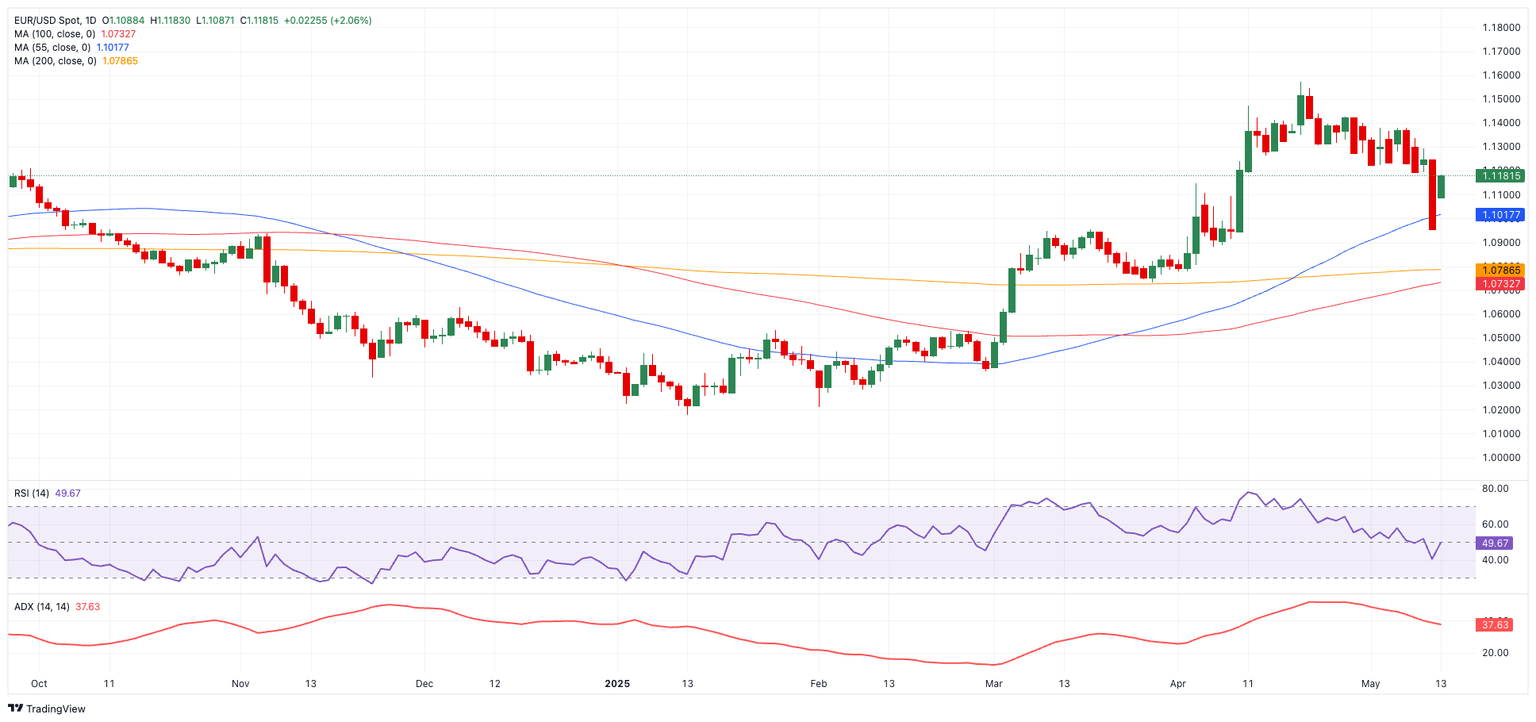

EUR/USD continues to face stiff resistance near its 2025 high of 1.1572 (April 21), with 1.1600 and the October 2021 peak at 1.1692 marking critical ceilings.

Support lies at the May low of 1.1067 (May 12), followed by the 55-day SMA at 1.1028 and the 200-day SMA at 1.0794.

Momentum indicators are flashing mixed signals. The Relative Strength Signal (RSI) has rebounded to around 48, suggesting potential near-term recovery, while the Average Directional Index (ADX) near 37 indicates an ongoing trend, though with waning strength.

EUR/USD daily chart

Outlook: Choppy trading ahead

EUR/USD is likely to remain headline-sensitive, caught between supportive speculative flows and a deteriorating policy outlook. With rate paths diverging and geopolitical shifts ongoing, volatility is expected to persist in the near term.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.