EUR/USD Price Forecast: Next on the downside comes 1.1460

- EUR/USD added to the ongoing weakness and broke below 1.1600.

- The US Dollar gathered extra steam following firm US CPI readings in June.

- The ZEW’s Economic Sentiment improved in Germany and the Euroland.

The Euro (EUR) slipped further and flirted with four‑week lows against the US Dollar (USD) on turnaround Tuesday, dragging EUR/USD into the red for a fifth consecutive day and returning to the sub-1.1600 region.

Trade jitters flare

The White House said it will hold off on any new tariff decisions until August 1, but the spectre of a widening trade skirmish is already looming.

Recent US threats of 30% levies on EU goods, coupled with last week's announcements of 25% tariffs on Japanese and South Korean imports and a 50% hit on copper, have reignited fears of a broader confrontation, ultimately bolstering the value of the Greenback.

Central banks at odds

Federal Reserve (Fed) Minutes from the June gathering revealed a divided Committee: some policymakers wanted immediate rate cuts, while others urged caution until tariff‑driven inflation effects become clearer.

Indeed, futures continue to suggest a potential easing later this year, assuming that the price pressures prove to be temporary. Speaking about prices, US CPI data showed inflationary pressure picked up pace in June, bolstering recent comments from Chief Powell as well as lending support to the view of a cautious Fed.

In contrast, the European Central Bank (ECB) has signalled it will only loosen policies further if clear evidence of a slowdown in external demand emerges. On this, the bank’s Deposit Facility Rate stands at 2.00% following a cut in early June.

Speculators pile in

CFTC data to July 8 show speculative net longs in the single currency ballooning to over 120.5K contracts, the highest since December 2023, while institutional players have upped their net shorts to roughly 177K contracts, also a multi‑month peak. Furthermore, open interest also climbed for a third straight week, hitting about 806K contracts.

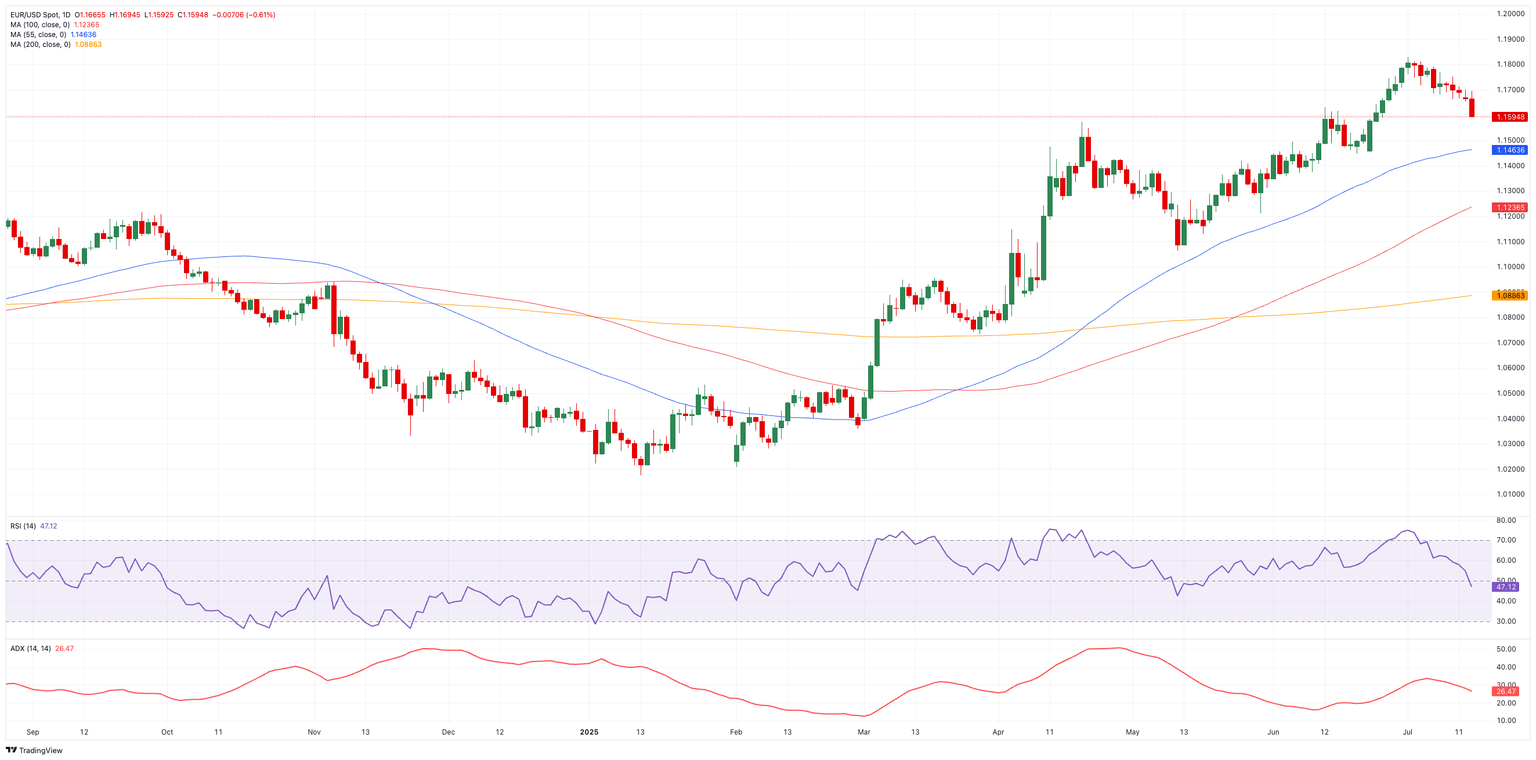

Chart watch

On the upside, EUR/USD must clear its 2025 high of 1.1830 (July 1) before eyeing the long‑standing June 2018 peak at 1.1852.

To the downside, if spot clears its July base of 1.1592 (July 15), it could then attempt to revisit the interim support at the 55‑day SMA of 1.1461, ahead of the weekly trough at 1.1210 (May 29) and the May base at 1.1064 (May 12), all en route to the pivotal 1.1000 mark.

Technical indicators have shifted to a bearish mode: the Relative Strength Index (RSI) has dropped below 48, indicating potential for further downside, while the Average Directional Index (ADX), at around 27, suggests a healthy, conviction-driven trend.

EUR/USD daily chart

Short-term outlook

The prospect of Fed cuts versus an ECB pause could lend fresh impetus to the European currency and push EUR/USD higher. However, any sustained rally is hindered by persistent trade tensions and the unpredictability of US tariff policy.

ECB FAQs

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy for the region. The ECB primary mandate is to maintain price stability, which means keeping inflation at around 2%. Its primary tool for achieving this is by raising or lowering interest rates. Relatively high interest rates will usually result in a stronger Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

In extreme situations, the European Central Bank can enact a policy tool called Quantitative Easing. QE is the process by which the ECB prints Euros and uses them to buy assets – usually government or corporate bonds – from banks and other financial institutions. QE usually results in a weaker Euro. QE is a last resort when simply lowering interest rates is unlikely to achieve the objective of price stability. The ECB used it during the Great Financial Crisis in 2009-11, in 2015 when inflation remained stubbornly low, as well as during the covid pandemic.

Quantitative tightening (QT) is the reverse of QE. It is undertaken after QE when an economic recovery is underway and inflation starts rising. Whilst in QE the European Central Bank (ECB) purchases government and corporate bonds from financial institutions to provide them with liquidity, in QT the ECB stops buying more bonds, and stops reinvesting the principal maturing on the bonds it already holds. It is usually positive (or bullish) for the Euro.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.