EUR/USD Price Forecast: Near-term outlook remains unclear

- EUR/USD retreated further and broke below the 1.1300 support on Wednesday.

- The US Dollar extended its advance to multi-day peaks on trade hopes.

- The FOMC Minutes showed concerns over both inflation and unemployment.

Sellers maintained control of the Euro (EUR) on Wednesday, sparking the second consecutive daily pullback vs. the US Dollar (USD).

Indeed, EUR/USD remained offered and deflated to three-day troughs near 1.1280 on the back of another solid session in the Greenback, which lifted the US Dollar Index (DXY) to the boundaries of the psychological 100.00 barrier.

The firmer note in the US Dollar remained propped up by steady optimism on the trade front, while rising yields contributed to the daily uptick, and the cautious message from the FOMC Minutes also added to the mood.

On the latter, the Minutes sahowed that the Fed is facing "difficult trade-offs" due to rising inflation and unemployment, with projections of increased recession risks. The combination of inflation and unemployment will force central bank officials to decide whether to prioritise fighting inflation with tighter monetary policy or cut interest rates for growth and employment.

Tariff delay: A double-edged sword for the Euro?

Following US President Donald Trump's decision to postpone a planned 50% tax on EU imports until July 9, renewed hopes on the trade front buoyed emotions throughout both the single currency and the Greenback.

Indeed, Trump said that a "very nice call" with the European Commission (EC) marked a turning point and confirmed that the border fee, which was initially planned to go into effect on June 1, would be postponed until July 9.

Meanwhile, EU leaders expressed hope that the ongoing transatlantic trade battle might be resolved quickly.

Looking at the broader backdrop, the US Dollar has come under pressure as US trade talks with China and the United Kingdom continue to lack true urgency, while renewed prospects of US-EU talks seem to have revived the currency, and thus keeping risk-sensitive currencies under scrutiny.

Divergence in Fed-ECB policy continues to disrupt markets

Monetary policy contrasts between the Federal Reserve (Fed) and the European Central Bank (ECB) continue to be a hot topic in the FX market.

Though markets expect two cuts by the end of the year, probably starting in September, the Fed kept interest rates unchanged in May, despite lower inflation and trade uncertainties.

The ECB dropped its deposit rate by 25 basis points to 2.25% in May, and market players seem to be anticipating another quarter-point rate reduction as early as June.

Meanwhile, European Central Bank officials maintained a cautious tone. Bundesbank President Joachim Nagel said that it is still too early to make a judgement on a likely interest rate drop next month.

Furthermore, Philip Lane, the central bank's chief economist, indicated that although most signs pointed to a prolonged fall in eurozone inflation, there were some concerns, including the possibility of failing EU-US trade discussions, which may result in an increase in inflation.

According to the ECB’s survey, inflation estimates in the eurozone have risen, with people expecting inflation of 3.1% over the next year, up from 2.9% a month earlier and much beyond the ECB's own 2% target. This contradicts the ECB's expectations that price inflation would fall due to slowing economic growth, weaker wage increases, lower energy costs, and a strengthening Euro.

Against this backdrop, the ECB is nearly ready to cut interest rates eight times in 13 months next week because of low inflation and widespread concern over US tariffs.

Speculative flows become cautious.

The most current CFTC figures for the week ending May 20 reveal that net long speculative positions in the EUR fell to a four-week low of around 74.5K contracts. However, overall open interest increased to roughly 760K, the highest level since December 2023, suggesting more widespread participation. Commercial traders', meanwhile, reduced net short positions reflected a more cautious institutional outlook.

What techs are showing

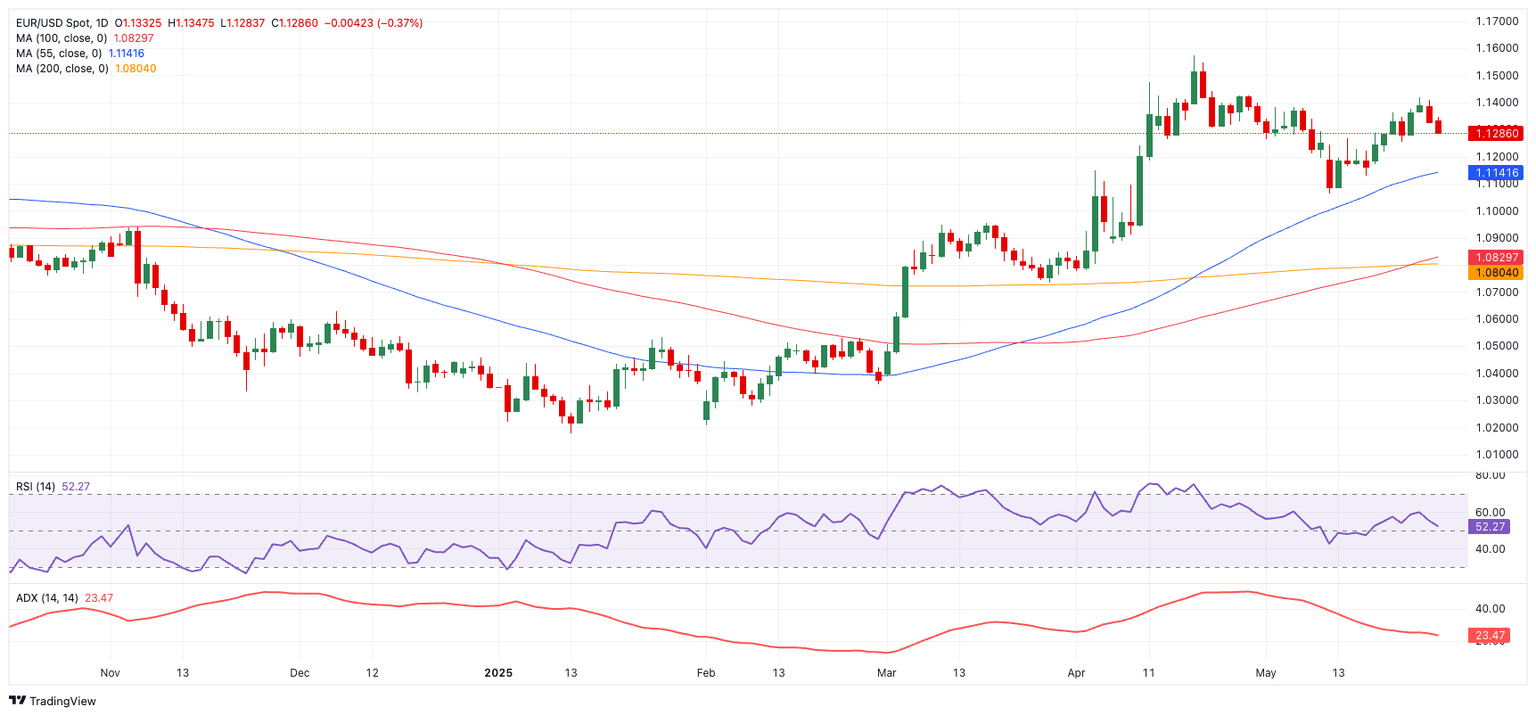

Although momentum signs indicate a potential loss of steam, the technical picture for EUR/USD remains strong.

Key resistance comes from the April high of 1.1572, followed by the round level of 1.600, and finally from the October 2024 top of 1.1692.

On the downside, the 55-day SMA at 1.1148 provides temporary support, ahead of the May low at 1.1064 and finally the crucial 1.1000 zone. A break below that zone would reveal the 200-day SMA at 1.0811.

Momentum indicators are getting more muted. The Average Directional Index (ADX) is close to 24, indicating that the trend is still alive but losing momentum. Meanwhile, the Relative Strength Index (RSI) has eased to 52, suggesting declining. bullish pressure.

EUR/USD daily chart

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.