EUR/USD Price Forecast: Gaining downward traction amid mounting risk aversion

EUR/USD Current price: 1.1717

- US President Donald Trump’s back and forth with tariffs weigh on the market’s mood.

- The US NFIB Fussiness Optimism Index eased to 98.6 in June from the previous 98.8.

- EUR/USD at risk of falling towards 1.1630 according to near-term technical readings.

The EUR/USD pair retains a soft tone on Tuesday, trading a handful of pips above the 1.1700 mark, yet with limited bullish potential. The US Dollar (USD) eased throughout the first half of the day, following news that United States (US) President Donald Trump delayed, once again, the implementation of reciprocal tariffs.

After sending letters to multiple countries announcing fresh levies ranging between 25% and 40%, Trump extended the grace period until August 1, from the previous July 9. Even further, he signaled there could be more delays in order to negotiate trade deals. Wall Street closed in the red, and the USD came under selling pressure with the news, although no major level gave up.

The mood started souring during European trading hours, with local indexes feeling the heat and weighing on US futures. The USD recovered and aims higher in the near term, early in the American session.

Data-wise, there’s not much to take care of. There were no relevant news in Europe, while the US published the NFIB Fussiness Optimism Index for June, which eased to 98.6 from the previous 98.8. The country will later release the May Consumer Credit Change and weekly API oil data.

EUR/USD short-term technical outlook

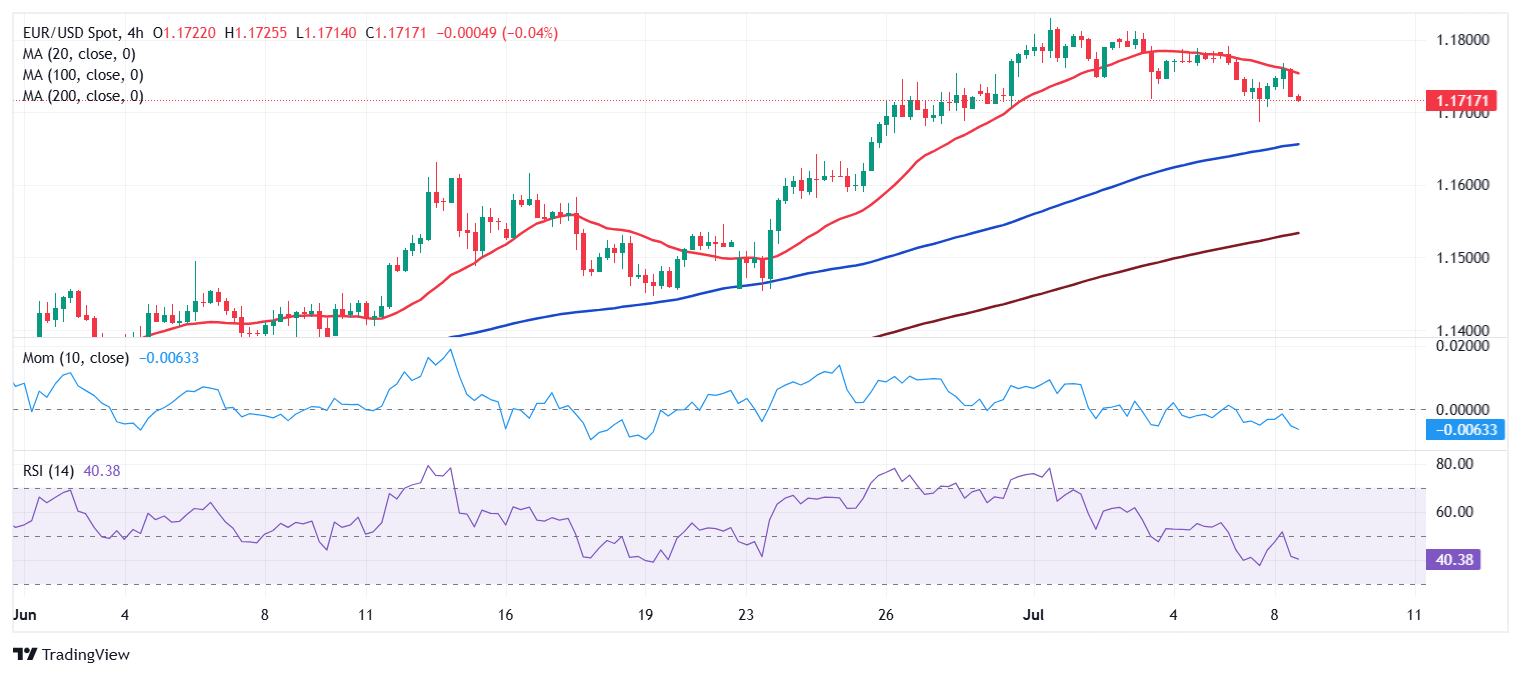

The EUR/USD pair is holding on to modest intraday gains, yet down from its peak at 1.1767. From a technical perspective, the daily chart shows the bullish case remains firm in place. EUR/USD develops far above bullish moving averages, with the 20 Simple Moving Average (SMA) currently at around 1.1630. Technical indicators, in the meantime, grind marginally higher well into positive levels and after correcting overbought conditions.

The 4-hour chart shows that the EUR/USD pair keeps finding sellers at around a bearish 20 SMA, while developing far above bullish 100 and 200 SMAs. At the same time, technical indicators resumed their slides after failing to overcome their midlines. Another leg lower seems likely, as long as sellers keep rejecting advances at around 1.1770.

Support levels: 1.1685 1.1635 1.1590

Resistance levels: 1.1770 1.1800 1.1830

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.