EUR/USD Price Forecast: Further selling threatens the 1.1000 level

- EUR/USD retreated to new two-week lows near 1.1030.

- The Dollar resumed its uptrend despite lower yields across the curve.

- The US ISM Manufacturing PMI rose to 47.2 in August.

Following a promising start to the new trading week, EUR/USD came under renewed downside pressure and slipped back to the 1.1030 region on Tuesday, reaching two-week lows on the back of the resurgence of the upside impetus in the US Dollar (USD).

In the meantime, spot appears to have found some initial support near the 1.1030 zone, which is close to the 61.8% Fibonacci retracement of the August rally.

Concerning the Greenback, the US Dollar Index (DXY) crept higher and approached the 102.00 barrier, or two-week peaks, bolstered by investors’ sentiment, the selling pressure in the risk complex, and prudence ahead of key US data releases due later in the week.

On the monetary policy front, investors are closely watching for clues on the expected size of the Fed's interest rate cut in September, particularly after Fed Chair Jerome Powell suggested in his speech at the Jackson Hole Symposium in late August that it might be time to recalibrate monetary policy. Powell also indicated that, barring any unexpected developments, the labour market is unlikely to add significantly to inflationary pressures in the near term, and stressed that the Fed does not want to see further cooling in labour market conditions.

Regarding the above, the upcoming US Nonfarm Payrolls (NFP) report will be especially significant following the Fed’s shift from a focus on combating inflation to preventing job losses, as the employment data could determine the extent of the Fed's anticipated rate cut.

According to the CME Group's FedWatch Tool, the likelihood of a 25 bps rate cut in September is around 63%.

As for the European Central Bank (ECB), its latest minutes revealed that policymakers did not see a strong reason to cut interest rates last month, but they also warned that the issue could be revisited in September, given the ongoing impact of high rates on economic growth.

However, recent reports suggest that ECB policymakers are increasingly divided over the growth outlook, a disagreement that could influence rate cut discussions in the months ahead. Some are concerned about a potential recession, while others remain focused on persistent inflationary pressures. The central debate revolves around how slowing economic growth and a possible recession might impact inflation—the ECB's main concern—as it aims to bring inflation down to 2% by the end of 2025.

Nonetheless, the release of lower-than-expected flash CPI data for August in Germany and the broader Eurozone may challenge the cautious approach by rate setters, potentially opening the door for the central bank to consider another rate cut at its meeting on September 12.

On this point, ECB board member Isabel Schnabel, known for her conservative stance on policy, argued that inflation concerns should take priority over growth. In a speech on Friday, she asserted that monetary policy should continue to focus on returning inflation to the target in a timely manner. While she acknowledged that growth risks have increased, she maintained that a soft landing is still more likely than a recession.

In summary, if the Fed opts for further or more substantial rate cuts, the policy gap between the Fed and the ECB could narrow over the medium to long term, potentially benefiting EUR/USD. This is particularly possible as markets anticipate two more rate cuts from the ECB this year.

However, over the longer term, the U.S. economy is expected to outperform Europe's, suggesting that any sustained weakness in the dollar may be limited.

Lastly, speculators (non-commercial traders) have increased their net long positions in the Euro (EUR) to levels not seen since January, while commercial players (such as hedge funds) have raised their net short positions to multi-month highs, driven by a significant increase in open interest.

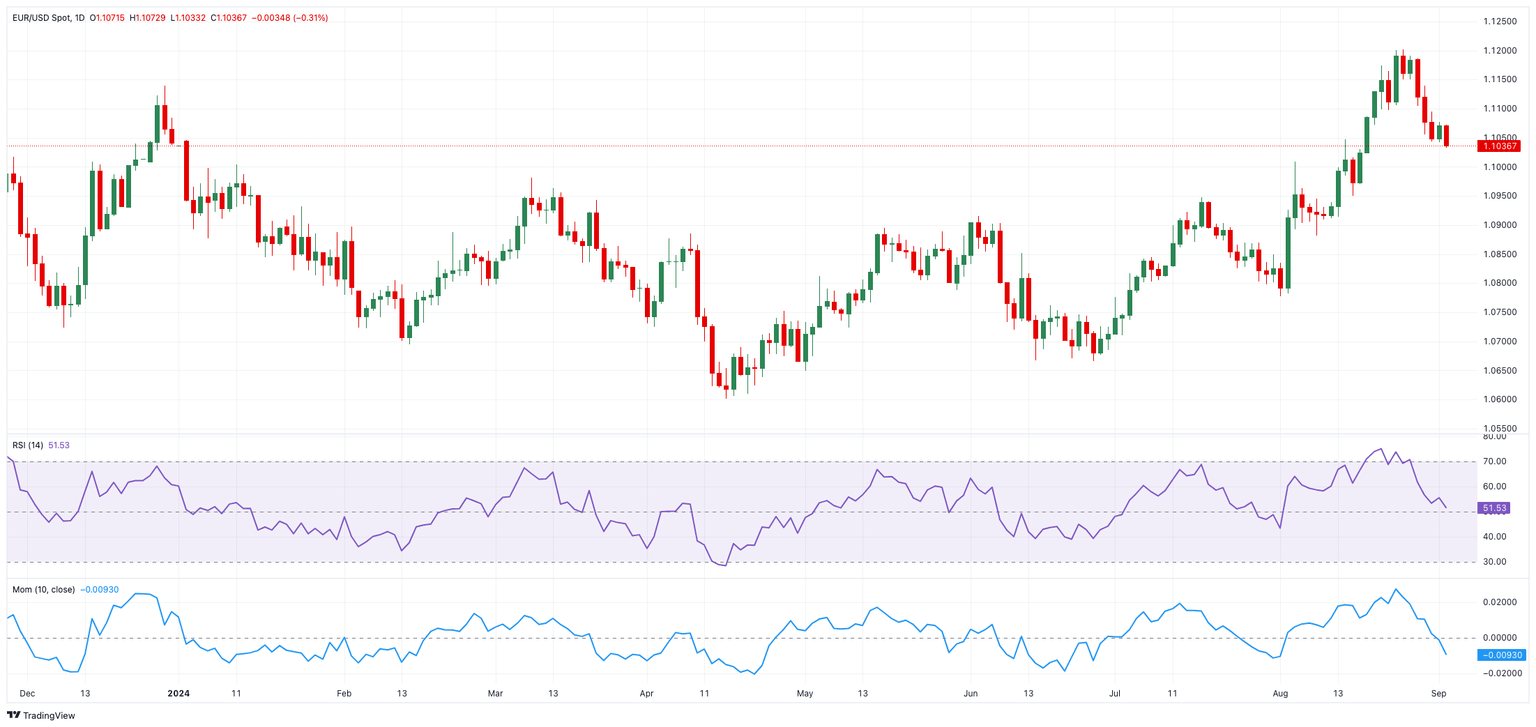

EUR/USD daily chart

EUR/USD short-term technical outlook

Further north, the EUR/USD is likely to test its 2024 top of 1.1201 (August 26), ahead of the 2023 peak of 1.1275 (July 18) and the 1.1300 round level.

The pair's next downside target is the preliminary 55-day SMA at 1.0903, which comes prior to the weekly low of 1.0881 (August 8) and the key 200-day SMA at 1.0853. Down from here emerges the weekly low of 1.0777 (August 1), seconded by the June low of 1.0666 (June 26) and the May bottom of 1.0649 (May 1).

Meanwhile, the pair's upward trend is projected to continue as long as it remains above the key 200-day SMA.

The four-hour chart reveals a return of negative sentiment. The initial resistance is at the 55-SMA at 1.1114 prior to 1.1201. Instead, 1.1033 offers quick support, closely followed by 1.1030 and the 200-SMA at 1.0973. The relative strength index (RSI) tumbled to around 30.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.