EUR/USD Price Forecast: Further gains need to clear 1.1500

- EUR/USD traded within an erratic range above the 1.1400 hurdle on Tuesday.

- The US Dollar maintained a fluctuating price action close to the 99.00 zone.

- Markets’ attention remains laser-focused on US-China trade talks in London.

The Euro (EUR) added to Monday’s positive bias amid inconclusive price action surrounding the US Dollar (USD). That said, EUR/USD rose further north of 1.1400, briefly reaching two-day highs amid steady caution regarding further US-China trade discussions in the UK.

On the other side of the equation, the US Dollar Index (DXY) kept orbiting the 99.00 region amid marginal moves in US yields across the spectrum.

Trade war: Light at the end of the tunnel?

A sense of steady prudence prevailed among market participants on Tuesday, as the second day of US-China trade discussions appears to have resumed a hopeful path in London; at least this is what one can read from some officials’ comments.

Both China and the US have strict rules against exporting things that are crucial to their national security. This makes their rising economic competition a lot more serious. Beijing has recently reduced its exports of rare minerals, essential for manufacturing everything from military gear to electric automobiles. The reduction occurred when Washington ceased shipping chemicals, machines, and sophisticated technology, including software and components required to make nuclear power, aeroplanes, and semiconductors.

The necessity for emergency negotiations highlights the extreme danger of both sets of measures.

President Trump hiked taxes on Chinese goods in April. In reaction, Beijing banned supplies of critical minerals and magnets. The measures may have impacted American manufacturing, military contractors, and other firms. Both sides are now working swiftly to break the impasse before the restrictions create even greater issues for the world's supply networks.

Policy divergence returns to the fore

Diverging central bank outlooks remain a key driver for the currency market.

The Federal Reserve (Fed) held rates steady in May, with the latest Minutes revealing a split among policymakers on the future path. With inflation cooling, markets are now leaning towards a rate cut in September.

Across the Atlantic, the European Central Bank (ECB) cut its deposit rate by 25 basis points to 2.00% last Thursday. Surprisingly, President Christine Lagarde's message leaned towards a hawkish stance.

That could be the last cut for a while since the growth predictions were a bit better than many expected. Lagarde remarked that the ECB is now well positioned to cope with the issues that are coming up. By not flagging any forthcoming rate cuts and making clear that only a major escalation in trade tensions would change that stance, she signalled neither a push for a tighter policy nor a fresh round of easing. Instead, Lagarde maintained a “steady as she goes” line.

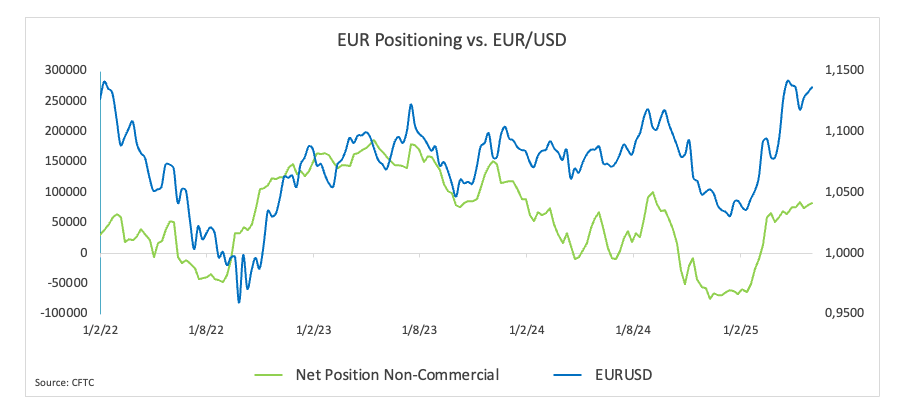

Speculative flows shift toward Euro

CFTC data show a growing bullish tilt on the European currency. Net long positions rose to a three-week high of around 82.8K contracts, while overall open interest rose past 781K contracts, the highest in the last three years. Meanwhile, commercial hedgers expanded their short positions to nearly 138.3K contracts, suggesting growing institutional interest in managing Euro upside risk.

Technical landscape: Bulls maintain control

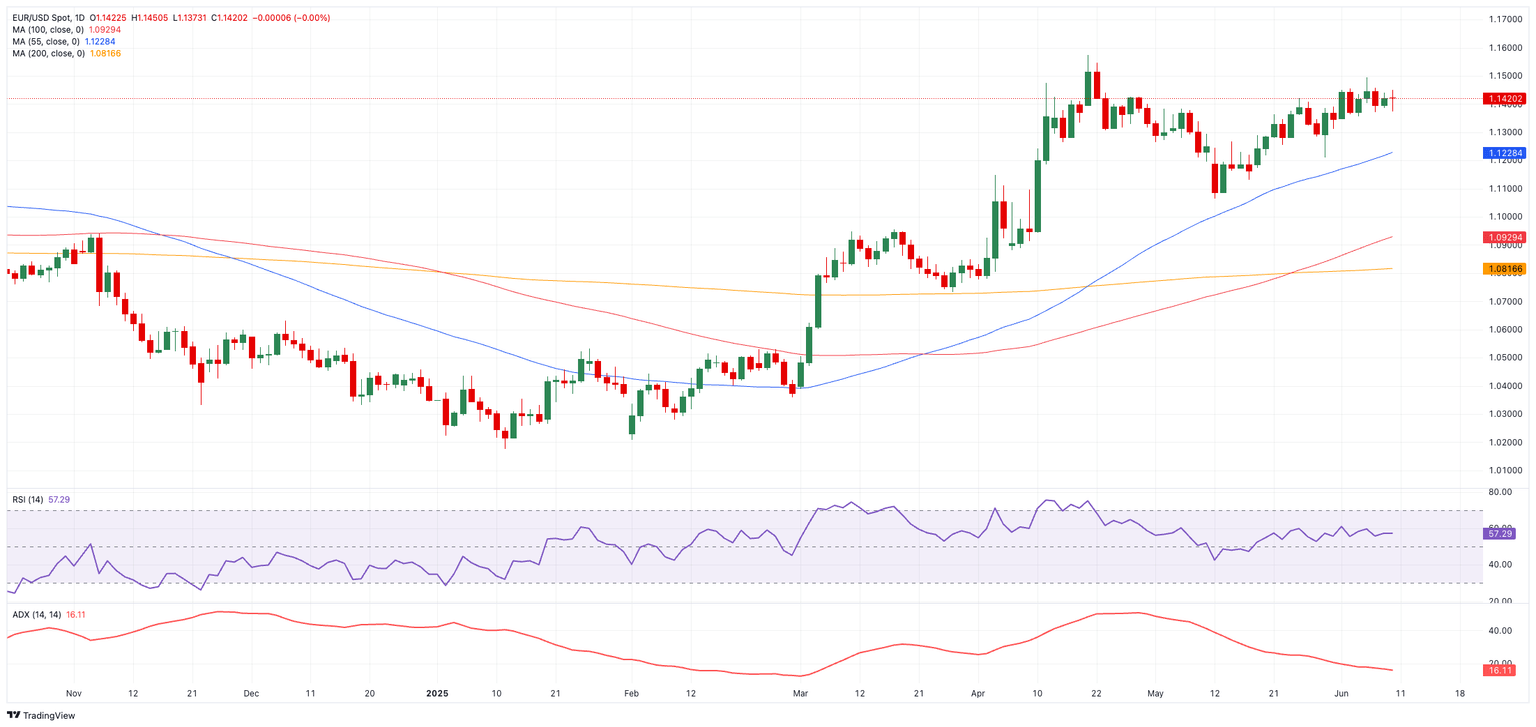

EUR/USD remains firmly above its 200-day simple moving average (SMA) at 1.0823, keeping the broader uptrend intact.

Key resistance levels are seen at the YTD high of 1.1572 (April 21), followed by the 1.1600 round barrier and the October 2021 top at 1.1692.

Just the opposite, interim support sits at the 55-day SMA (1.1236), followed by the May low of 1.1064. A break of 1.1000 could signal deeper losses, potentially toward the 200-day SMA.

Momentum signals remain mixed. The Average Directional Index (ADX), near 16, suggests a weakening trend, though the Relative Strength Index (RSI) above 57 indicates ongoing bullish momentum.

EUR/USD daily chart

Data watch

The eurozone calendar for the current week includes speeches by the ECB’s Buch, Lane and Cipollone on June 11, while Germany’s final Inflation Rate will be released on June 13, followed by EMU’s Balance of Trade results and Industrial Production readings.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.