EUR/USD Price Forecast: Further choppy trade on the cards near term

- EUR/USD added to Friday’s gains, breaking above the 1.1700 hurdle on Monday.

- The US Dollar succumbed to the selling pressure amid steady trade unease.

- Attention shifts to Powell’s speech on Tuesday and the ECB event on Thursday.

The recent optimism in the Euro (EUR) gained momentum on Monday, as EUR/USD successfully retested the area just beyond the crucial 1.1700 barrier, simultaneously reaching three-day peaks.

Trade tensions soured sentiment

Even after Washington pushed its next tariff decision back to August 1, markets remain jittery. Threats of 30% duties on European exports, 25% levies on Japanese and South Korean imports, and a hefty 50% surcharge on copper have stoked fears of a global trade conflagration, driving investors into the relative safety of the greenback in the past few days.

In the meantime, trade negotiations have been given special attention, with diplomats indicating that the EU is considering extensive "anti-coercion" measures. If an agreement fails, these measures would allow the bloc to target US services or restrict access to public tenders.

President Trump has indicated the possibility of imposing 30% duties on imports from Europe should an agreement not be reached by the August 1 deadline.

Central banks heading separate ways

Minutes from June’s Federal Reserve (Fed) meeting revealed a Committee divided between those pressing for immediate rate cuts and colleagues urging caution until the inflationary fallout from new tariffs becomes clear.

June’s uptick in US consumer prices only bolstered Jerome Powell’s cautious approach, yet futures markets still lean toward a modest easing later in the year.

By contrast, the European Central Bank (ECB) lowered its deposit rate to 2.00% in early June, warning that fresh stimulus will depend on more pronounced signs of weak external demand. Investors anticipate the ECB to initiate a "pause" during its meeting later this week.

Bullish specs vs. rising commercial shorts

Positioning data through July 15 showed that speculators ramped up bullish wagers on the Euro, increasing their net longs to nearly 128.2K contracts, the highest level since December 2023. Commercial traders increased their net shorts to around 184.2K contracts, which is the highest level in a few months. Open interest has also gone up for the fourth week in a row, this time to just over 820K contracts, the most since March 2023.

Technical roadmap

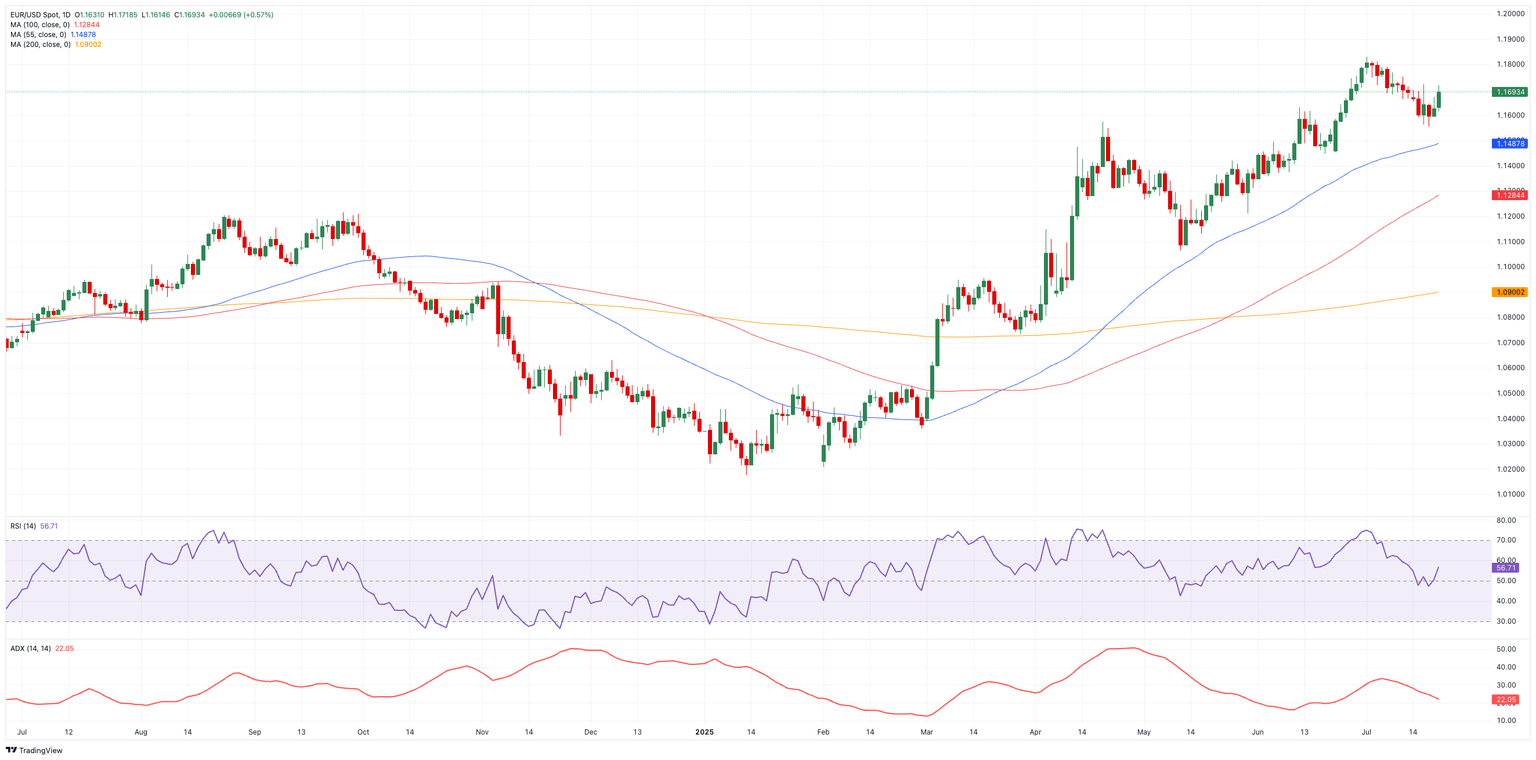

On the upside, EUR/USD needs to vault above its 2025 high of 1.1830 (July 1) before aiming for the June 2018 peak at 1.1852.

On the other hand, a breach of July’s base at 1.1556 could trigger a slide toward the transitory 55‑day moving average at 1.1485, then the May 29 weekly low of 1.1210, and ultimately the psychologically critical 1.1000 mark.

Momentum indicators remain lukewarm: the Relative Strength Index (RSI) advances to nearly 57, while an Average Directional Index (ADX) around 22 suggests the current trend lacks real conviction.

EUR/USD daily chart

What to watch

The current uncertainty surrounding US tariff policy, coupled with the increasing divergence in policy between the Fed and ECB, suggests that the euro may face challenges in regaining its previous strength. Nonetheless, any definitive indication that Washington is reducing tariff threats, or a more conciliatory stance from the Fed, could swiftly shift the balance in favour of the single currency.

Euro FAQs

The Euro is the currency for the 19 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency. A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall. Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.