EUR/USD Price Forecast: Fed cuts, ECB patience, and political turmoil in France

- EUR/USD regained some balance following Monday’s sharp decline.

- The US Dollar met fresh selling bias after another Trump-Fed episode.

- The US Consumer Confidence eased a tad in August, said the Conference Board.

The Euro (EUR) bounced back on Tuesday, with EUR/USD reclaiming the 1.1660–1.1670 band after shaking off Monday’s pullback. The move higher came as the US Dollar (USD) lost ground, weighed down by President Trump’s attempt to fire Fed Governor Lisa Cook, a move that rattled confidence in the US central bank’s independence.

Trade tensions cool, but tariffs bite

Washington and Beijing extended their trade truce by 90 days, narrowly avoiding fresh tariffs. Trump delayed the hikes until November 10, while China pledged reciprocal steps. Even so, tariffs remain steep: 30% on Chinese goods headed to the US and 10% in the other direction.

The US and EU also reached a compromise: Washington imposed a 15% tariff on most European imports, while Brussels agreed to scrap duties on US industrial goods and open up more access for American farm and seafood products. A cut to the US tariff on European cars is on the table, but only once the EU passes new legislation.

French politics back in focus

In Europe, attention is turning to France. Prime Minister Francois Bayrou faces a September 8 confidence vote on his sweeping budget cuts.

The far-right National Rally, the Greens, and now the Socialists have all said they won’t back him, leaving his minority government hanging by a thread.

If Bayrou loses, President Emmanuel Macron could appoint a new prime minister, keep Bayrou on in a caretaker role, or call a snap election.

Fed: Waiting on the data

The Federal Reserve (Fed) kept interest rates steady at its last meeting. Chair Jerome Powell took a balanced tone, not committing to a move but leaving the door wide open for a rate cut as soon as next month. He warned that the risks to the job market are growing, even as inflation has not yet cooled to the Fed’s target.

Investors are now laser-focused on the August Nonfarm Payrolls (NFP) report due September 5 and the next round of inflation data the following week, which could tip the scales on whether the Fed cuts rates.

ECB: Steady for now

Across the Atlantic, the European Central Bank (ECB) sounded more relaxed. President Christine Lagarde described eurozone growth as “solid, if a little better,” and policymakers are in no rush to ease.

Markets currently expect the ECB to keep rates on hold well into next year, with the first cut pencilled in for spring 2026.

Speculators build on bullish bets

Commodity Futures Trading Commission (CFTC) data showed net long Euro positions rising to a three-week high near 118.7K contracts, while institutional net shorts eased to a two-week low. Additionally, open interest has climbed for a second straight week, suggesting positioning is firming.

Levels to watch

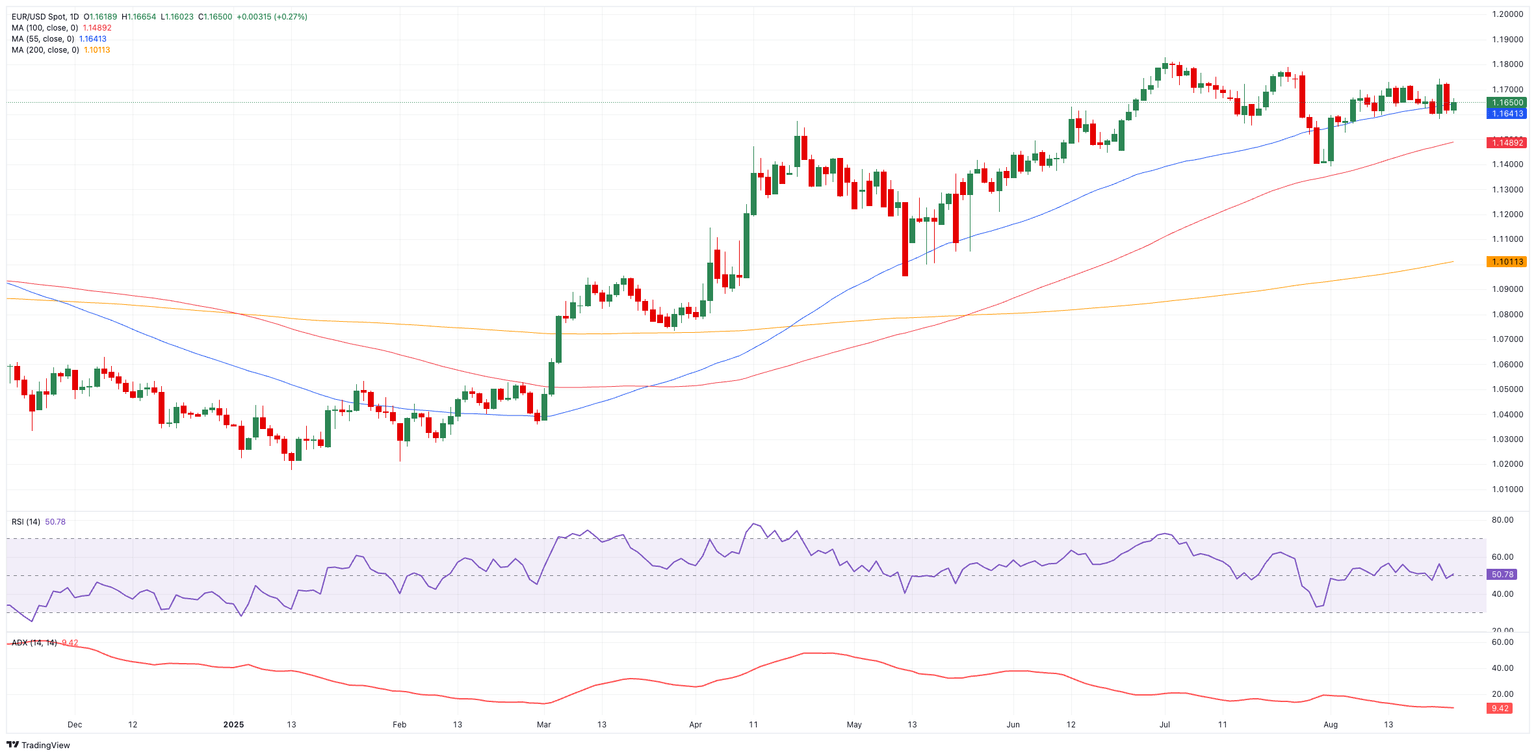

Initial resistance sits at the August top at 1.1742 (August 22), seconded by the weekly peak at 1.1788 (July 24) and the 2025 ceiling at 1.1830 (July 1). A break higher could open the way to the September 2021 top at 1.1909, just shy of the 1.2000 mark.

On the downside, temporary support is seen at the 100-day simple moving average (SMA) at 1.1495, ahead of the August floor at 1.1391 (August 1) and the weekly base of 1.1210 (May 29).

Momentum indicators are mixed: The Relative Strength Index (RSI) hovers just above 50, a neutral reading that hints at mild upside potential. Meanwhile, the Average Directional Index (ADX) is stuck below 11, showing the market is drifting without a clear direction.

EUR/USD daily chart

Looking at the big picture

So far, EUR/USD is expected to stick to its consolidative phase. A breakout will likely need a catalyst, either from fresh Fed signals or new headlines on trade. Until then, developments around the Greenback look set to keep the edge when it comes to price direction.

ECB FAQs

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy for the region. The ECB primary mandate is to maintain price stability, which means keeping inflation at around 2%. Its primary tool for achieving this is by raising or lowering interest rates. Relatively high interest rates will usually result in a stronger Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

In extreme situations, the European Central Bank can enact a policy tool called Quantitative Easing. QE is the process by which the ECB prints Euros and uses them to buy assets – usually government or corporate bonds – from banks and other financial institutions. QE usually results in a weaker Euro. QE is a last resort when simply lowering interest rates is unlikely to achieve the objective of price stability. The ECB used it during the Great Financial Crisis in 2009-11, in 2015 when inflation remained stubbornly low, as well as during the covid pandemic.

Quantitative tightening (QT) is the reverse of QE. It is undertaken after QE when an economic recovery is underway and inflation starts rising. Whilst in QE the European Central Bank (ECB) purchases government and corporate bonds from financial institutions to provide them with liquidity, in QT the ECB stops buying more bonds, and stops reinvesting the principal maturing on the bonds it already holds. It is usually positive (or bullish) for the Euro.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.