EUR/USD Price Forecast: Extra losses on the cards as traders eye Fed, tariffs, and French politics

- EUR/USD collapsed to four-day troughs near 1.1600 on turnaround Tuesday.

- The US Dollar gained a strong upside impulse on the back of intense risk aversion.

- August saw the flash Inflation Rate in the euro area tick higher.

The Euro (EUR) gave back part of its recent recovery on turnaround Tuesday, with EUR/USD slipping toward the 1.1600 neighbourhood, hitting its lowest level in four days.

The move came as the US Dollar (USD) strengthened, with the US Dollar Index (DXY) climbing to multi-day highs near 98.60 on the back of a rebound in US yields across maturities and an intense risk-aversion sentiment.

Even so, traders stuck with steady Fed rate-cut bets, while uncertainty lingered around President Trump’s clashes with the Federal Reserve (Fed) and a court ruling that many of his tariffs are illegal, all amid the return to the normal activity of US markets after Monday’s Labor Day holiday.

Trade truce cools nerves, but tariffs stay in place

Global trade tensions eased as Washington and Beijing agreed to extend their truce for 90 days. Trump delayed tariff hikes until November 10, while Beijing pledged reciprocal steps. Still, US imports of Chinese goods will face 30% levies, and US exports to China remain subject to 10% tariffs.

Washington also reached a deal with Brussels, imposing a 15% tariff on most European imports in exchange for the European Union (EU) scrapping duties on US industrial goods and giving wider access to American farm and seafood exports. A cut in US tariffs on European cars could follow, depending on new EU legislation.

France braces for confidence vote

Political risks in Europe are building. French Prime Minister François Bayrou faces a September 8 confidence vote on his budget plan. Opposition parties, including the National Rally, the Greens, and the Socialists, have pledged not to support him, leaving his minority government vulnerable. A defeat could leave President Emmanuel Macron choosing between naming a new prime minister, keeping Bayrou as caretaker, or calling snap elections.

Fed keeps markets guessing

The Fed left rates unchanged at its last meeting, with Chair Jerome Powell warning of labour market risks but noting inflation has yet to return to its target. This implies that a rate cut could potentially occur as early as September.

Traders are watching Friday’s August Nonfarm Payrolls (NFP) and fresh inflation data next week for clues on what the Fed might do next.

ECB signals no rush to ease

The European Central Bank (ECB) has taken a calmer stance. President Christine Lagarde described eurozone growth as “solid, if a little better,” suggesting no immediate plans to loosen policy. Markets currently expect the ECB to stay on hold through 2025, with the first cut pencilled in for spring 2026.

Speculators add to Euro longs

According to the Commodity Futures Trading Commission (CFTC), for the week ending August 26, non-commercial net longs in the Euro climbed to a four-week high at just above 123K contracts. At the same time, institutional net shorts also grew, reaching 173.2K contracts, all amid open interest rising for a third week in a row to around 842.2K contracts.

Tech view: EUR/USD boxed in a range

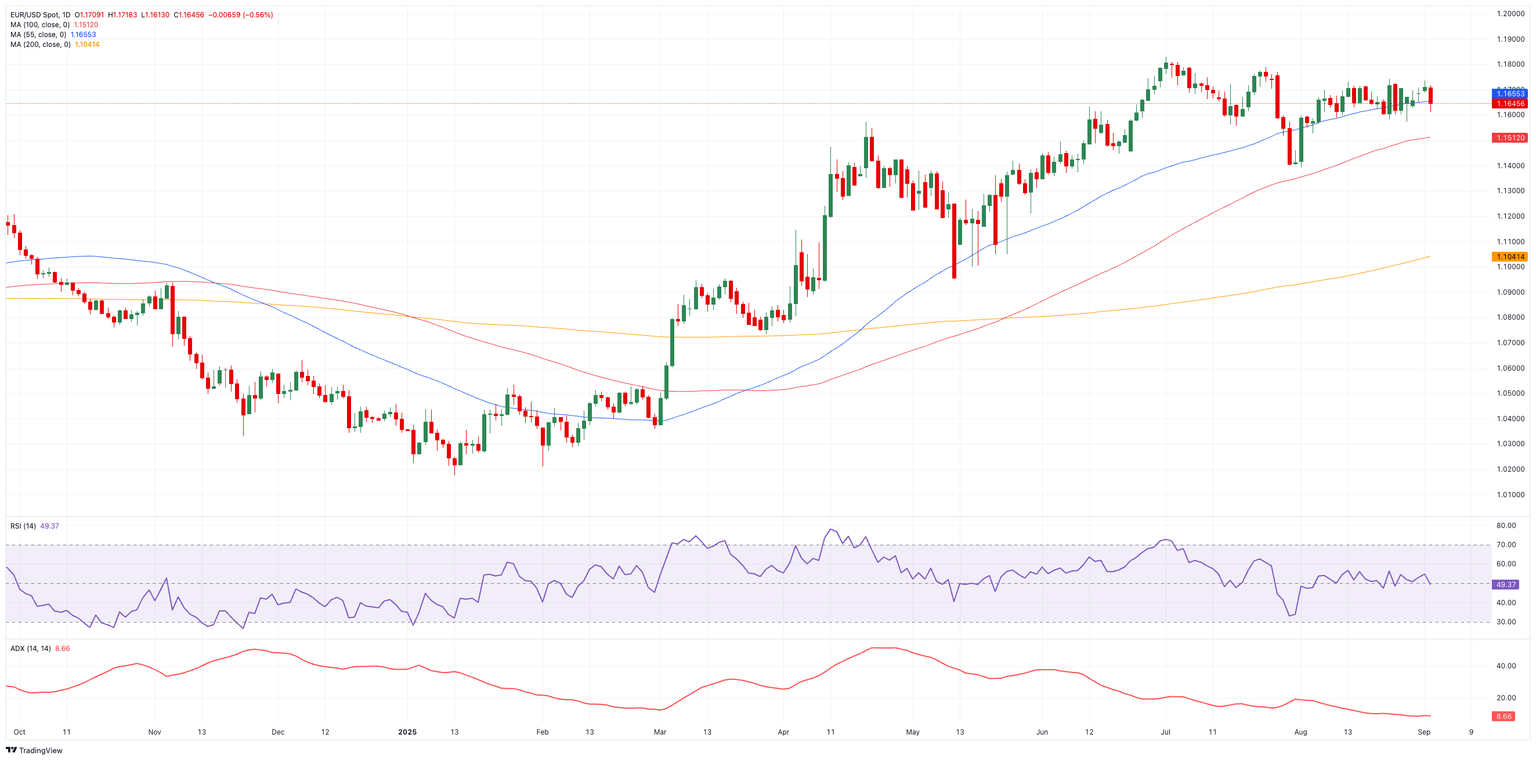

EUR/USD has momentum but remains stuck in a defined range. Resistance is first seen at the August high of 1.1742 (August 22). A break above would bring 1.1788 (July 24) and the 2025 ceiling at 1.1830 (July 1) into play. Further north emerges the September 2021 high at 1.1909, anticipating the psychological 1.2000 mark.

On the other side of the road, interim support is seen at the 100-day Simple Moving Average (SMA) at 1.1517, ahead of the August low at 1.1391 (August 1) and the weekly trough at 1.1210 (May 29).

Momentum signals remain mixed. The Relative Strength Index (RSI) broke below the key 50 yardstick, indicating potential for further weakness, while the Average Directional Index (ADX) near 10 suggests the trend still lacks colour.

Outlook: Dollar sets the tone for now

For now, EUR/USD looks set to stay within its 1.1400–1.1800 range. A breakout will need a clear catalyst, coming from fresh signals from the Fed or another twist in the trade story. In the meantime, price action around the pair should remain at the mercy of developments around the US Dollar.

Tariffs FAQs

Tariffs are customs duties levied on certain merchandise imports or a category of products. Tariffs are designed to help local producers and manufacturers be more competitive in the market by providing a price advantage over similar goods that can be imported. Tariffs are widely used as tools of protectionism, along with trade barriers and import quotas.

Although tariffs and taxes both generate government revenue to fund public goods and services, they have several distinctions. Tariffs are prepaid at the port of entry, while taxes are paid at the time of purchase. Taxes are imposed on individual taxpayers and businesses, while tariffs are paid by importers.

There are two schools of thought among economists regarding the usage of tariffs. While some argue that tariffs are necessary to protect domestic industries and address trade imbalances, others see them as a harmful tool that could potentially drive prices higher over the long term and lead to a damaging trade war by encouraging tit-for-tat tariffs.

During the run-up to the presidential election in November 2024, Donald Trump made it clear that he intends to use tariffs to support the US economy and American producers. In 2024, Mexico, China and Canada accounted for 42% of total US imports. In this period, Mexico stood out as the top exporter with $466.6 billion, according to the US Census Bureau. Hence, Trump wants to focus on these three nations when imposing tariffs. He also plans to use the revenue generated through tariffs to lower personal income taxes.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.