EUR/USD Price Forecast: Extra gains should not be ruled out

- EUR/USD came under pressure following another test of the 1.1400 barrier.

- The US Dollar picked up pace and advanced markedly on firmer data and trade.

- The US Consumer Confidence improved to 98.0 in May, the CB reported.

Sellers regained the upper hand around the Euro (EUR) on turnaround Tuesday. Against that, EUR/USD failed to extend an early breakout above the 1.1400 barrier, coming under pressure pari passu with the widespread marked rebound in the US Dollar (USD) and revisiting the low-1.1300s, or two-day troughs.

The improved tone in the Greenback helped the US Dollar Index (DXY) advance to two-day highs near 99.60 on the back of better-than-expected US Consumer Confidence results and a move lower in US yields across different maturity periods.

Tariff delay generates new hope for Euro

Following US President Donald Trump's decision to postpone a proposed 50% tax on EU imports until July 9, a fresh feeling of trade hope lifted spirits around the single currency. Indeed, Trump said that a "very nice call" with the European Commission (EC) marked a turning point and verified that the border tax, originally scheduled to go live on June 1, would be delayed until July 9.

Leaders in the EU, meanwhile, voiced optimism for a quick resolution to stop the continuous transatlantic trade conflict.

Furthermore, helping the euro was the larger background. The dollar has come under pressure as US trade deals with China and the United Kingdom still lack genuine impetus; risk-sensitive currencies like the euro have some breathing space here.

Divergence in Fed-ECB policy still affects markets

A major subject for the FX market is still monetary policy differences between the Federal Reserve (Fed) and the European Central Bank (ECB).

Though markets continue to price in two cuts by year-end—possibly beginning in September—the Fed maintained interest rates constant in May, even if inflation and trade risks were lowering.

The ECB cut its deposit rate by 25 basis points in May to 2.25%, and market participants seem to have started to pencil in another quarter-point rate cut as soon as in June.

ECB officials, in the meantime, kept the cautious tone. On this, Bundesbank President Joachim Nagel indicated that it is still premature to make a decision regarding a potential interest rate cut next month.

In addition, Philip Lane, the chief economist of the central bank, stated that while most indicators pointed towards a continued decline in euro area inflation, there were also worries, including the potential for unsuccessful EU-US trade negotiations, which could result in an uptick in inflation.

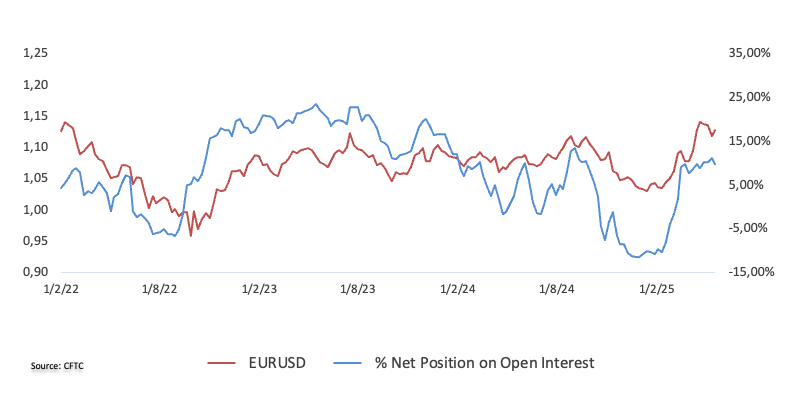

Speculative flows turn caution

The most recent CFTC data for the week ending May 20 shows net long speculative holdings in the euro dropped to a four-week low of around 74.5K contracts. But total open interest rose to around 760K , the highest level since December 2023, indicating more general involvement. Reducing net short holdings by commercial traders also indicated a more wary institutional view.

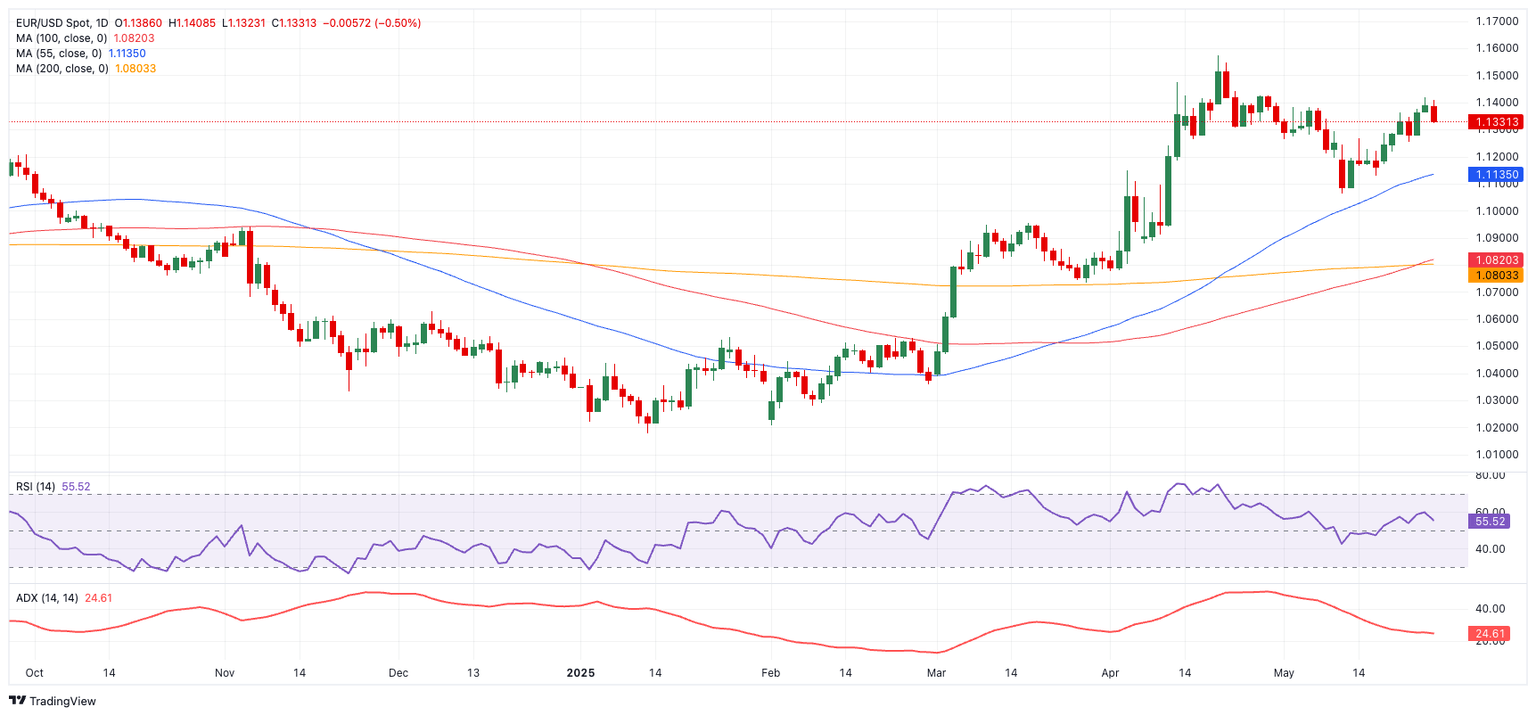

Technical outlook: Momentum gives way but signals mixed

Though momentum signals suggest a probable loss of steam, the technical picture for EUR/USD is still positive.

Key resistance comes from the April high of 1.1572, then the 1.600 psychological threshold, and last from the October peak at 1.1692.

On the downside, temporary support comes at the 55-day SMA at 1.1141, followed by the May low at 1.1064 and then the important 1.1000 region. A breach below that zone would expose the 200-day SMA at 1.0810.

Momentum indications are becoming more subdued. Remarkably close to 25, the Average Directional Index (ADX) indicates that the trend is still alive but losing strength. The Relative Strength Index (RSI), meanwhile, has eased toward 55, indicating rising—though not yet overheated—bullish pressure.

EUR/USD daily chart

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.