EUR/USD Price Forecast: Extra gains remain in the pipeline

- EUR/USD could not extend another breakout of the 1.1400 barrier on Tuesday.

- The US Dollar picked up renewed buying interest on easing US-China tensions.

- Consumer Confidence in Germany improved to -20.6 in May, said GfK.

The European currency gave away part of Monday’s gains vs. the US Dollar (USD), motivating EUR/USD to retreat to the 1.1370 region following an early advance to the 1.1420-1.1425 band.

On the other side of the equation, the US Dollar Index (DXY) managed to regain some balance and approach the 99.40 zone, where that bullish attempt seems to have fizzled out.

Tariff hopes tempered by market scepticism

The firmer note around the US Dollar came in as investors continued to digest hints by the White House of a possible de-escalation of the trade conflict with China. However, investors remained cautious, with many expressing doubt over whether concrete progress is being made behind the scenes.

Central bank divergence remains well in place

The Federal Reserve (Fed) left its benchmark rate unchanged at 4.25%–4.50% in March, with Chair Jerome Powell emphasising the Fed’s continued commitment to fighting inflation. He reiterated that policy will remain data-driven, particularly as new tariffs raise concerns over potential stagflation.

Meanwhile, the European Central Bank (ECB) moved in the opposite direction, delivering a 25 basis-point rate cut to 2.25% and softening its language by removing references to “restrictive” policy. The dovish tone has raised expectations for another cut as early as June, further widening the policy divergence with the Fed.

Speculative bets continue to favour the Euro

CFTC data through April 22 revealed steady optimism toward the single currency, with net long positions easing a tad to around 65K contracts, or two-week lows. Commercial hedgers, meanwhile, maintained their short exposure around 118K contracts, while open interest increased to six-week peaks near 720K contracts.

Technical outlook

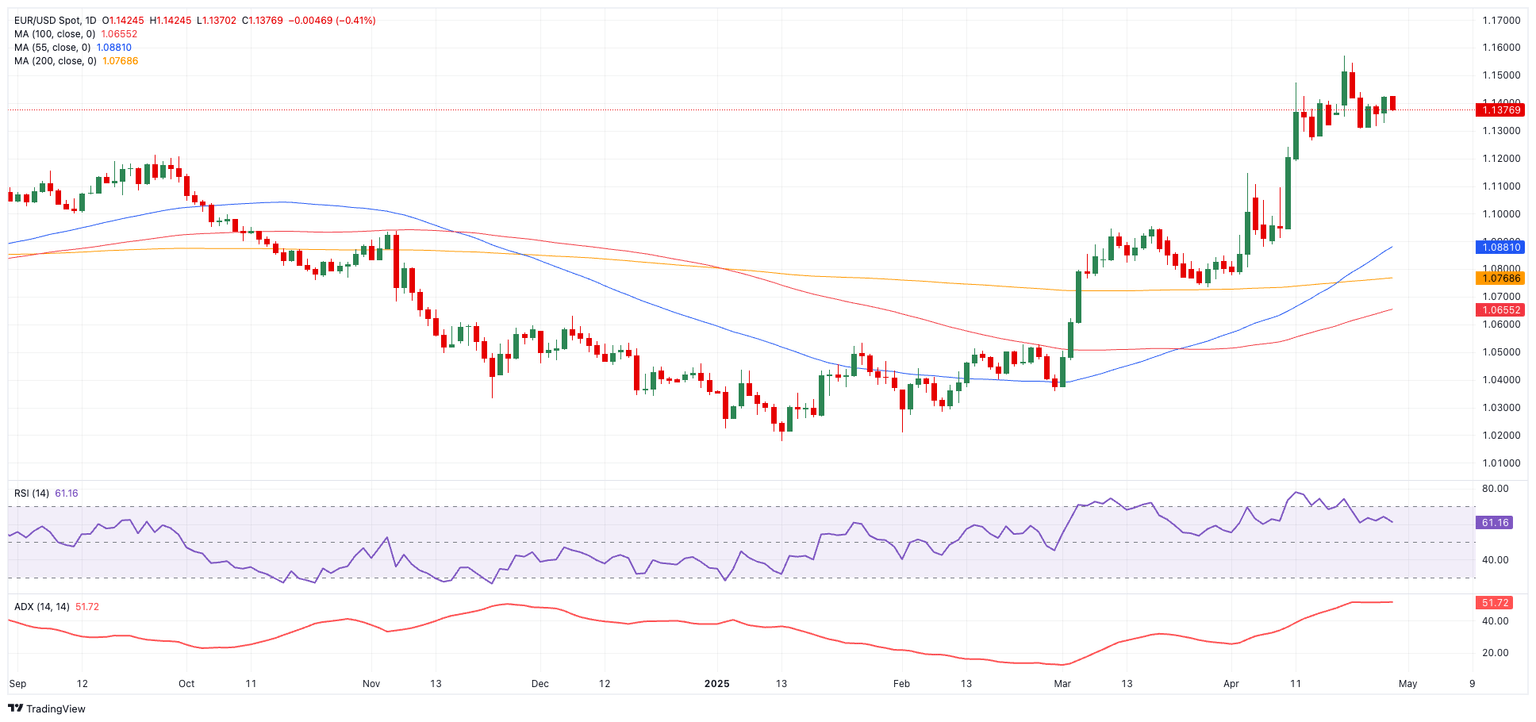

EUR/USD faces immediate resistance at the 2025 high of 1.1572, followed by the 1.1600 handle and the October 2021 top at 1.1692.

Interim support remains firm at the 55-day SMA at 1.0882, prior to the critical 200-day SMA at 1.0773, with a secondary floor at the weekly low at 1.0732.

Momentum remains skewed to the upside, with the Relative Strength Index (RSI) around 61 and the Average Directional Index (ADX) holding above 51—pointing to a strong underlying trend.

EUR/USD daily chart

Volatility likely to persist amid diverging policy and trade jitters

As U.S.-China trade policy continues to evolve and monetary paths diverge on either side of the Atlantic, EUR/USD is expected to remain vulnerable to headline-driven volatility. Until clarity emerges from central banks or trade negotiations, sharp swings are likely to define the near-term landscape.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.