EUR/USD Price Forecast: Extra gains need a stronger catalyst

- EUR/USD halted its weekly recovery, revisiting the mid-1.1200s on Thursday.

- The US Dollar regained buying interest and reversed part of its recent drop.

- US flash PMIs surprised to the upside in May. PMIs in Europe came in mixed.

The Euro (EUR) lost momentum on Thursday, with EUR/USD coming under fresh downside pressure following weekly tops north of the 1.1300 hurdle. Indeed, the pair slipped back to the 1.1250 zone, where some initial contention seems to have emerged.

On the other side of the equation, the US Dollar (USD) managed to leave behind part of its recent leg lower and reclaim the psychological 100.00 barrier when tracked by the US Dollar Index (DXY), propped up by not only encouraging but also unexpected firm prints from US business activity in May.

Despite President Trump’s sweeping tax bill cleared the House of Representatives on Thursday, concerns remained well in place when it came to the US fiscal scenario.

Muted optimism on trade supports EUR recovery

EUR/USD has regained balance following sustained pressure on the greenback in the last few days.

Indeed, optimism surrounding a US–China trade agreement featuring a rollback of tariffs from over 100% to 10% and a 90-day pause on further hikes initially lifted sentiment. However, the persistence of a 20% duty on fentanyl-linked imports means the effective tariff rate remains close to 30%, tempering broader enthusiasm and fuelling the generalised scepticism around the sustainability of such an agreement.

Despite upbeat rhetoric from President Trump and recent progress in US–UK trade talks, the absence of substantive follow-through has weighed on the USD, lending support to the Euro and other risk-sensitive assets as of late.

Fed–ECB divergence anchors the narrative

A key driver of recent price action remains the policy divergence between the Federal Reserve (Fed) and the European Central Bank (ECB).

While the Fed has held rates steady this month, markets have started to price in two rate cuts by the end of the year amid soft April inflation and reduced trade risks. The next rate cut might come as soon as in September.

Meanwhile, the ECB lowered its deposit facility rate by 25 basis points to 2.25% last month and may ease again in June. ECB officials, however, remain prudent: Isabel Schnabel and Klaas Knot have both flagged external risks and underscored the need for more data before committing to further action. Meanwhile, their colleague Mario Centeno suggested rates may need to fall below the neutral range of 1.50%–2.00% to keep inflation near the 2% target, given the economy’s fragility.

Speculative interest tilts in favour of the Euro

According to CFTC data for the week ending 13 May, net long positions in the EUR rose to 84.7K contracts, the highest in months, while total open interest rose above 750K for the first time since December 2023. However, commercial traders remained net short, reflecting a more cautious institutional view.

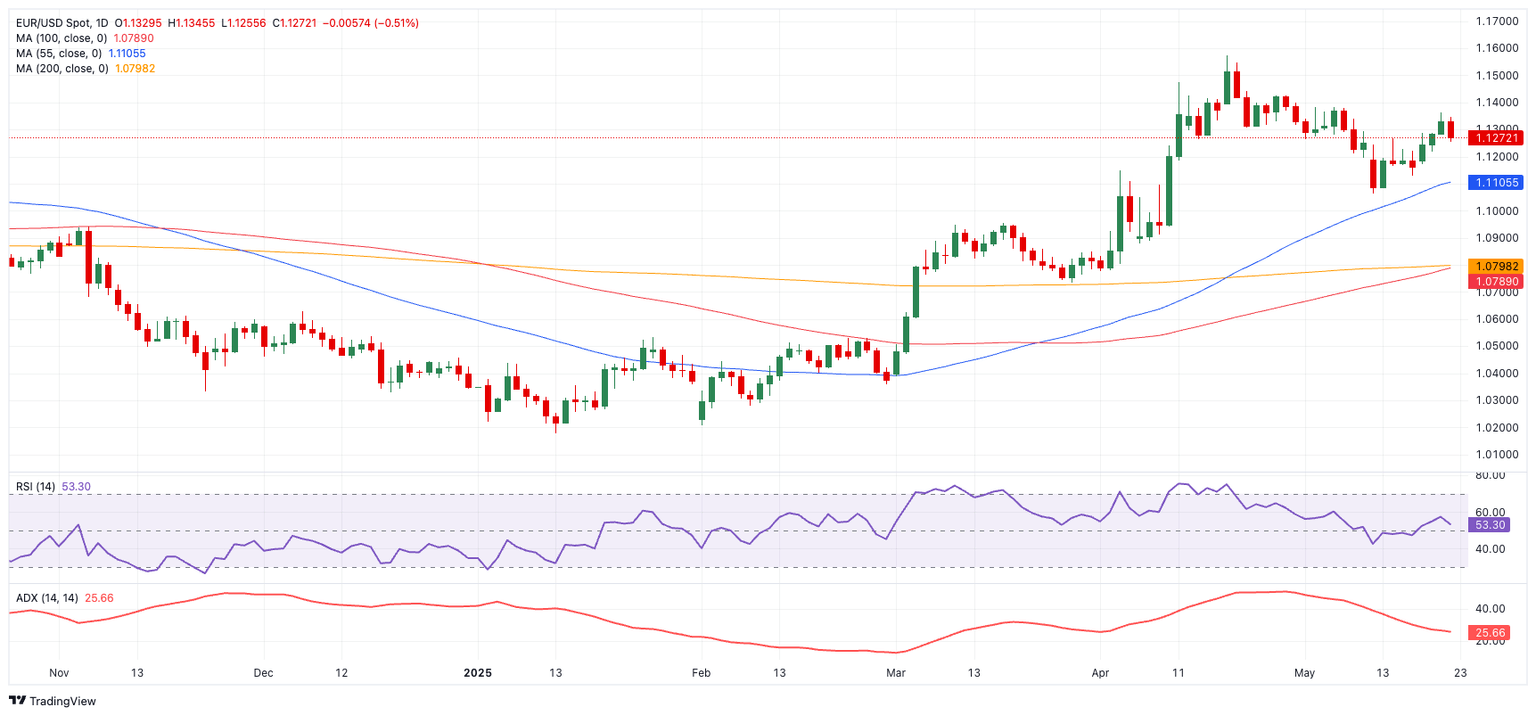

Technical view: Momentum builds, but hurdles remain

Further gains in EUR/USD would bring the 2025 high at 1.1572 (April 21) into view, ahead of the psychological 1.1600 mark and the October 2021 peak at 1.1692 (October 28).

On the downside, initial support lies at the 55-day SMA at 1.1113, prior to the May low of 1.1064 (May 12) and the critical 1.1000 level. A break below the latter could put a test of the 200-day SMA at 1.0805 back on the radar.

When it comes to momentum indicators, the pair seems to be losing its shine. The Relative Strength Index (RSI) receded to 53, pointing to shrinking bullish pressure, while the Average Directional Index (ADX) just below 26 suggests a trend in place but losing some strength.

EUR/USD daily chart

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.