EUR/USD Price Forecast: Extra advances look at the Dollar

- EUR/USD surpassed the 1.1600 hurdle to hit new multi-year peaks on Thursday.

- The US Dollar sold off to more than three-year troughs on data, trade uncertainty.

- The ECB’s Schnabel said the bank’s monetary policy is in a “good place”.

The Euro (EUR) extended its weekly advance on Thursday, rising to fresh multi-year highs against a broadly weaker US Dollar (USD).

Indeed, EUR/USD rose to the 1.1630 zone for the first time since October 2021, while the US Dollar Index (DXY) slipped further below the key 98.00 threshold, dragged down by falling yields across different time frames and the absence of concrete progress on the trade front.

Trade détente lifts risk appetite

Markets continued to digest the renewed dialogue between the US and China. In fact, officials from both sides have been meeting in London since Monday, working toward a potential trade truce. US President Donald Trump described the agreement as "done" on Wednesday, noting that Beijing had committed to supplying magnets and rare earth materials under the new framework.

The White House confirmed the deal allows Washington to impose a 55% cumulative tariff on Chinese goods, divided into a 10% “reciprocal” levy, a 20% tax targeting fentanyl trafficking, and a 25% duty addressing existing trade barriers. In response, Beijing would apply a 10% tax on US imports.

Monetary divergence in focus

Beyond trade developments, diverging central bank policy paths continued to drive FX sentiment.

In May, the Federal Reserve (Fed) held rates steady, maintaining a data-driven posture amid disinflationary trends and softening US indicators. Market participants now see a growing chance of a rate cut by September followed by increasing chances of an extra cut in October.

In contrast, the European Central Bank (ECB) cut its deposit rate by 25 basis points last Thursday, taking the Deposit Facility Rate to 2.00%. However, the message came in on an unexpected hawkish tone.

Indeed, President Christine Lagarde ruled out further immediate easing, suggesting only a significant deterioration in trade conditions would prompt a reassessment. Upgraded growth projections added to the ECB's cautious confidence.

Speculators lean into euro strength

CFTC data through June 3 revealed a rise in net long positions on the single currency to around 82.8K contracts, the highest in three weeks. Open interest, meanwhile, climbed above 781K contracts, the strongest level since 2021. Furthermore, commercial hedgers ramped up their short exposure to nearly 138.3K contracts, pointing to institutional demand for downside protection.

Key technical levels

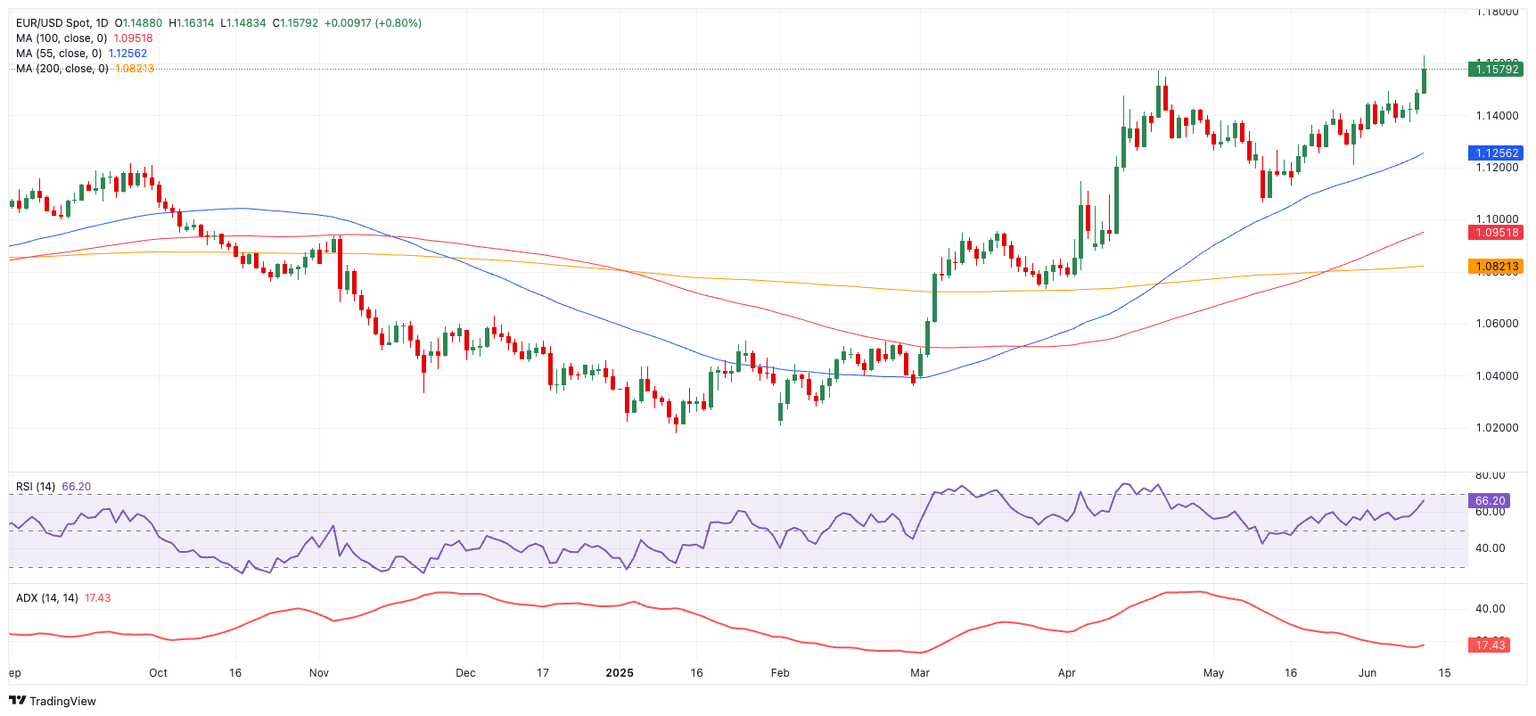

EUR/USD remains comfortably above its 200-day SMA at 1.0828, preserving its bullish medium-term structure.

Immediate resistance stands at the 2025 high of 1.1631 (June 12), followed by the October 2021 peak at 1.1692 (October 28) and the 1.1700 milestone.

Interim support is seen at the 55-day SMA at 1.1264, ahead of the weekly low of 1.1210 (May 29) and the May floor at 1.1064 (May 12).

Momentum indicators offer a mixed picture. The Average Directional Index (ADX), hovering near 18, suggests a lack of trend strength, while the Relative Strength Index (RSI) past 66 continues to signal upside bias.

AUD/USD daily chart

What to watch

On the data front, markets await Germany’s final inflation report on June 13, followed by euro zone trade balance and industrial output figures.

ECB FAQs

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy for the region. The ECB primary mandate is to maintain price stability, which means keeping inflation at around 2%. Its primary tool for achieving this is by raising or lowering interest rates. Relatively high interest rates will usually result in a stronger Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

In extreme situations, the European Central Bank can enact a policy tool called Quantitative Easing. QE is the process by which the ECB prints Euros and uses them to buy assets – usually government or corporate bonds – from banks and other financial institutions. QE usually results in a weaker Euro. QE is a last resort when simply lowering interest rates is unlikely to achieve the objective of price stability. The ECB used it during the Great Financial Crisis in 2009-11, in 2015 when inflation remained stubbornly low, as well as during the covid pandemic.

Quantitative tightening (QT) is the reverse of QE. It is undertaken after QE when an economic recovery is underway and inflation starts rising. Whilst in QE the European Central Bank (ECB) purchases government and corporate bonds from financial institutions to provide them with liquidity, in QT the ECB stops buying more bonds, and stops reinvesting the principal maturing on the bonds it already holds. It is usually positive (or bullish) for the Euro.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.