EUR/USD Price Forecast: Decent contention remains at 1.1060

- EUR/USD reversed recent weakness and approached the 1.1400 barrier.

- The US Dollar traded in a volatile fashion, eventually selling off sharply.

- Trade uncertainty resurged following a US court ruling.

The Greenback comes under pressure after hitting new multi-day highs past 100.50 when tracked by the US Dollar Index (DXY) on Thursday, while investors continue to digest results from the domestic calendar ahead of comments from Fed officials. The single currency managed to regain the smile on Thursday, prompting EUR/USD to set aside two daily retracements in a row and refocus on the key hurdle at 1.1400 the figure.

Indeed, the fresh upside impulse in the pair came in response to the deep decline in the US Dollar (USD), which navigated a very volatile session, hitting new highs around 100.50 during early trade, just to reverse that move and retreat to the 99.20 zone as the US session drew to a close.

Tariff concerns hurt the Dollar

On Thursday, the US trade policy became prominent again after a US federal judge dealt a significant blow to one of Trump's signature economic initiatives by blocking his attempt to impose broad tariffs on imports from nearly every country in the world.

In a decision that calls into question the limits of presidential power, the Court of International Trade (CIT) ruled that the White House's emergency statute did not provide the president the right to act unilaterally on trade. Instead, the New York-based court reiterated that Congress, not the president, has the constitutional authority to regulate trade with foreign states.

The White House has replied by asking the court to stay the verdict while it files an appeal.

It is worth recalling that following a proposed 50% tariff on EU goods until July 9, increased trade optimism boosted sentiments across both the Euro (EUR) and the US Dollar.

Considering the broader context, the US Dollar has been negatively affected by growing scepticism regarding US trade discussions with China and the United Kingdom, which have continued to lack actual urgency; however, new opportunities for US-EU talks appear to have revitalised the currency, prompting a closer look at risk-sensitive currencies.

The omnipresent divergence in Fed-ECB policy

Monetary policy differences between the Federal Reserve (Fed) and the European Central Bank (ECB) remain a hot subject in the FX galaxy.

Despite lower inflation and trade uncertainty, the Fed held interest rates constant in May. Two cuts are expected by the end of the year, most likely beginning in September.

The release of the latest Minutes revealed that the Fed is facing "difficult trade-offs" as inflation and unemployment rise, with estimates of greater recession risk. The combination of inflation and unemployment will require central bank authorities to decide whether to combat inflation with tighter monetary policy or to decrease interest rates to promote growth and employment.

Back to the ECB, the bank reduced its deposit rate by 25 basis points to 2.25% in May, and market participants seem to expect another quarter-point rate cut as early as June.

Meanwhile, ECB officials maintained their cautious stance. Bundesbank President Joachim Nagel said that it is still too early to predict a potential interest rate cut next month.

Furthermore, Philip Lane, the central bank's chief economist, said that although most signals pointed to a long-term decline in eurozone inflation, there were some worries, including the prospect of failed EU-US trade talks, which might lead to a rise in inflation.

Meanwhile, the ECB is poised to lower interest rates for the eighth time in 13 months next week due to low inflation and widespread worry about US tariffs.

Speculative flows become cautious

The most recent CFTC data for the week ending May 20 show that net long speculative holdings in the EUR dropped to a four-week low of around 74.5K contracts. However, total open interest rose to over 760K, the highest level since December 2023, indicating more involvement. Commercial traders' lower net short holdings indicated a more cautious institutional view.

What techs are showing?

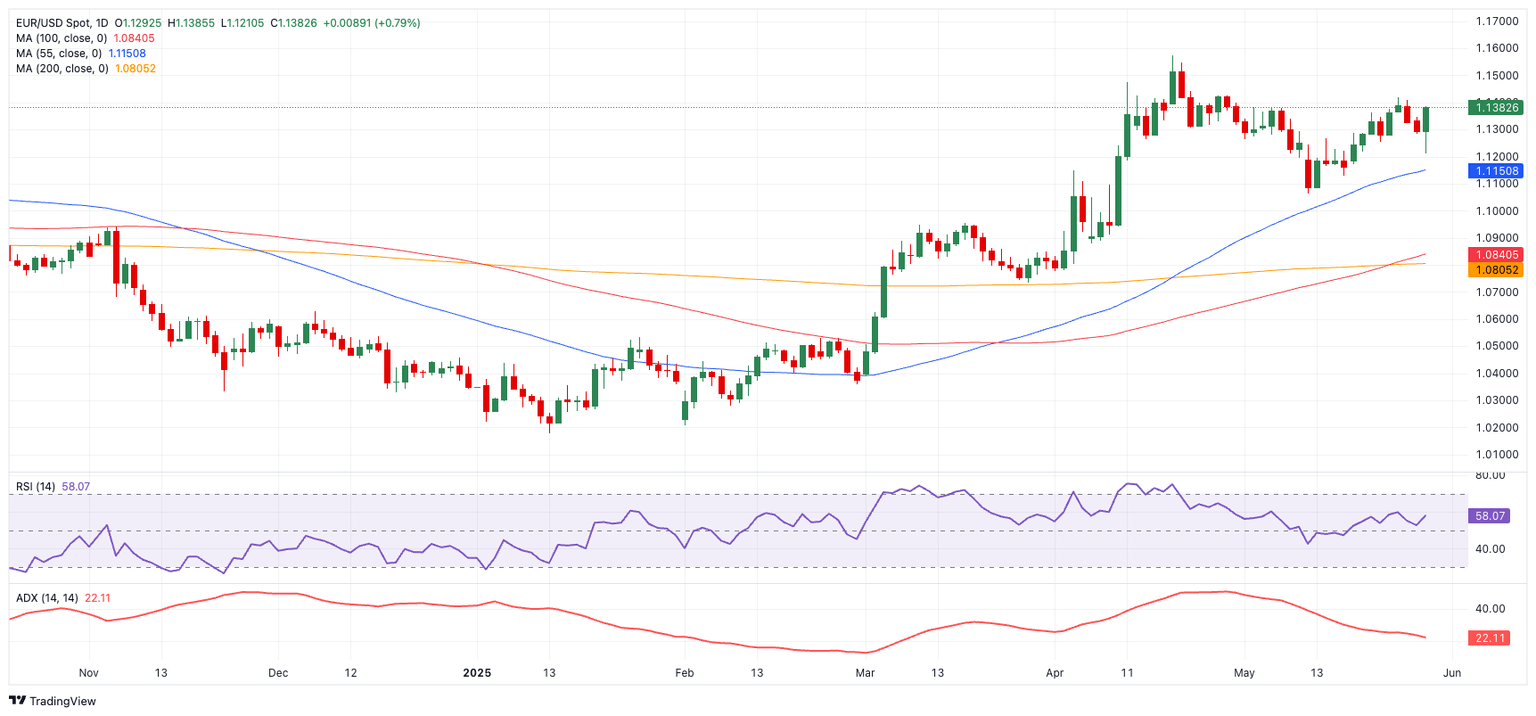

Although momentum indicators suggest a probable loss of steam, the EUR/USD technical picture remains robust.

Key resistance comes from the April high of 1.1572, then the round level of 1.600, and lastly the October 2024 high of 1.1692.

On the downside, the 55-day SMA at 1.1157 offers temporary support, followed by the May low at 1.1064 and, eventually, the critical 1.1000 zone. A breach below that level would show the 200-day SMA at 1.0812.

Momentum signs are becoming more subdued. The Average Directional Index (ADX) is at 22, suggesting that the trend is still active but losing strength. Meanwhile, the Relative Strength Index (RSI) has climbed above 58, indicating a pickup in the bullish pressure.

EUR/USD daily chart

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.