EUR/USD Price Forecast: Corrective advance likely to attract more sellers

EUR/USD Current price: 1.0897

- The poor performance of Asian and European indexes help the US Dollar.

- ECB President Christine Lagarde is due to speak during US trading hours.

- EUR/USD retains its bearish tone, a near-term upward correction possible.

The EUR/USD pair kept grinding south early on Wednesday, falling during European trading hours to 1.0874, its lowest since August 2. The poor performance of equities undermines the market’s mood while providing a near-term boost to the US Dollar (USD). Weaker-than-anticipated earnings in Europe are the main reason behind stocks’ decline, although Asian indexes also fell, as concerns about an escalation in the Middle East conflict undermined the mood.

The USD also found support in comments from former President Donald Trump. The Republican candidate defended proposals to dramatically raise tariffs on foreign imports in an interview with Bloomberg, claiming tariffs is “the most beautiful word in the dictionary.”

Meanwhile, the macroeconomic calendar remained light throughout the European morning and had little to offer during American trading hours. The European Central Bank (ECB) President Christine Lagarde is due to speak at the Bank of Slovenia. As for the United States (US), the country published MBA Mortgage, which fell by 17% in the week ended October 11, and the Export Price Index and the Import Price Index for September, which fell by 0.7% and 0.4%, respectively, on a monthly basis.

EUR/USD short-term technical outlook

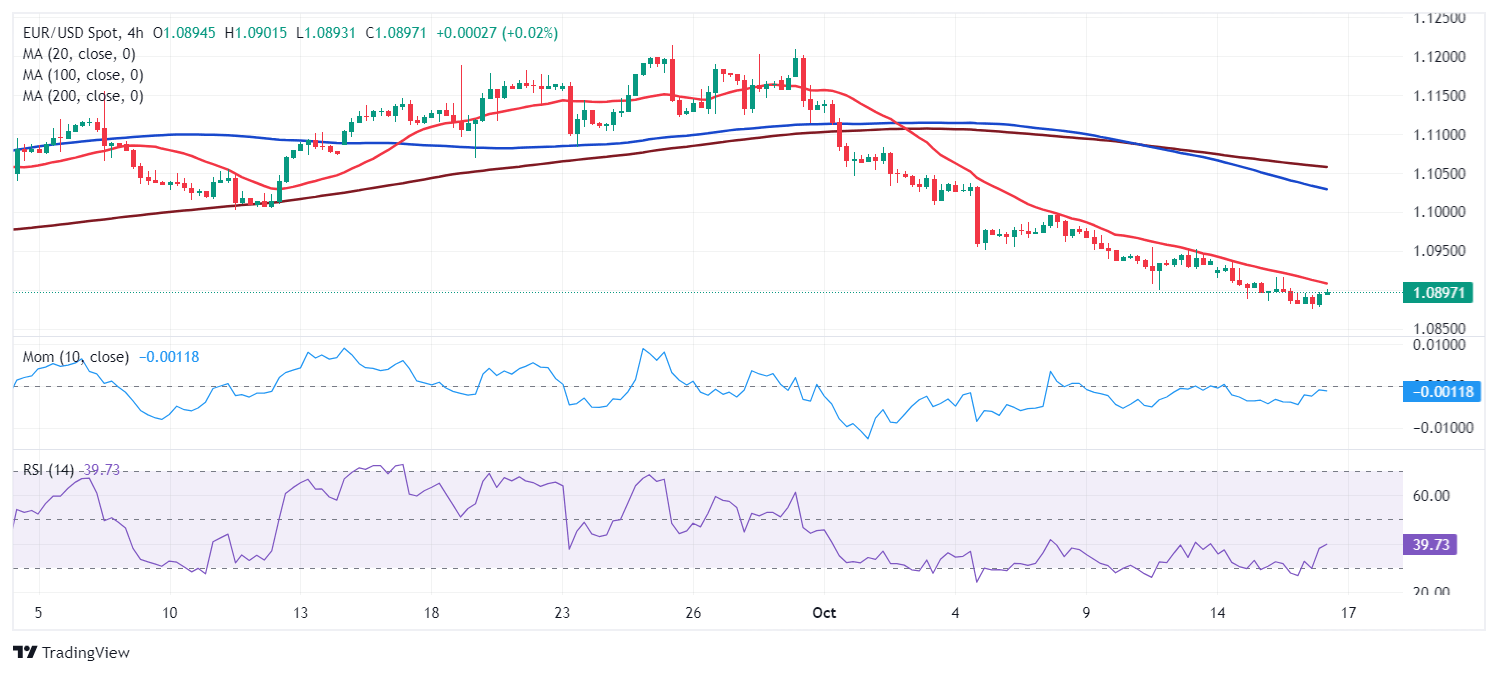

Technically, EUR/USD is bearish, albeit a corrective advance is not out of the table. In the daily chart, the pair is trading below a flat 100 Simple Moving Average (SMA) while a firmly bearish 20 SMA keeps extending its decline above the longer one. A directionless 200 SMA provided intraday support, converging with the aforementioned low at 1.0874. Finally, the Momentum indicator keeps heading south near oversold readings, while the Relative Strength Index (RSI) indicator bounced just marginally from around its 30 level, hinting at a potential upward correction but falling short of confirming it.

The near-term picture also suggests a corrective advance is possible. The 4-hour chart shows technical indicators turned higher but remain within negative levels and with limited upward strength. At the same time, moving averages maintain their sharp bearish slopes above the current level, with the 20 SMA providing dynamic resistance at around 1.0910. Overall, the risk remains skewed to the downside, with the 1.0800 mark in sight in the upcoming sessions.

Support levels: 1.0875 1.0840 1.0805

Resistance levels: 1.0910 1.0945 1.0990

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.