EUR/USD Price Forecast: Buyers waiting for fresh clues

EUR/USD Current price: 1.1695

- The US Dollar maintains the negative tone amid speculation that the Fed will cut rates in September.

- The German Harmonized Index of Consumer Prices was confirmed at 1.8% YoY in July.

- EUR/USD eased from a fresh two-week peak, but buyers hold the grip.

The EUR/USD pair extends its positive momentum on Wednesday and hit a fresh two-week high of 1.1719 during European trading hours. Market players keep selling the US Dollar (USD) amid a better mood triggered by the release of the United States (US) Consumer Price Index (CPI). Inflation, as measured by the index, rose 2.7% in the year to July, while the core annual reading printed at 3.1%. Despite being above the Federal Reserve’s (Fed) goal, the figures are well below feared.

The central bank has refrained from trimming the benchmark interest rates amid speculation US President Donald Trump’s tariffs could trigger fresh inflationary spikes. However, price pressures have remained pretty stable for the last year or so, making policymakers acknowledge that the impact of widespread levies had not been as terrible as feared.

Data-wise, Germany confirmed that the Harmonized Index of Consumer Prices (HCIP) rose at a 2% annualized pace in July, as previously estimated.

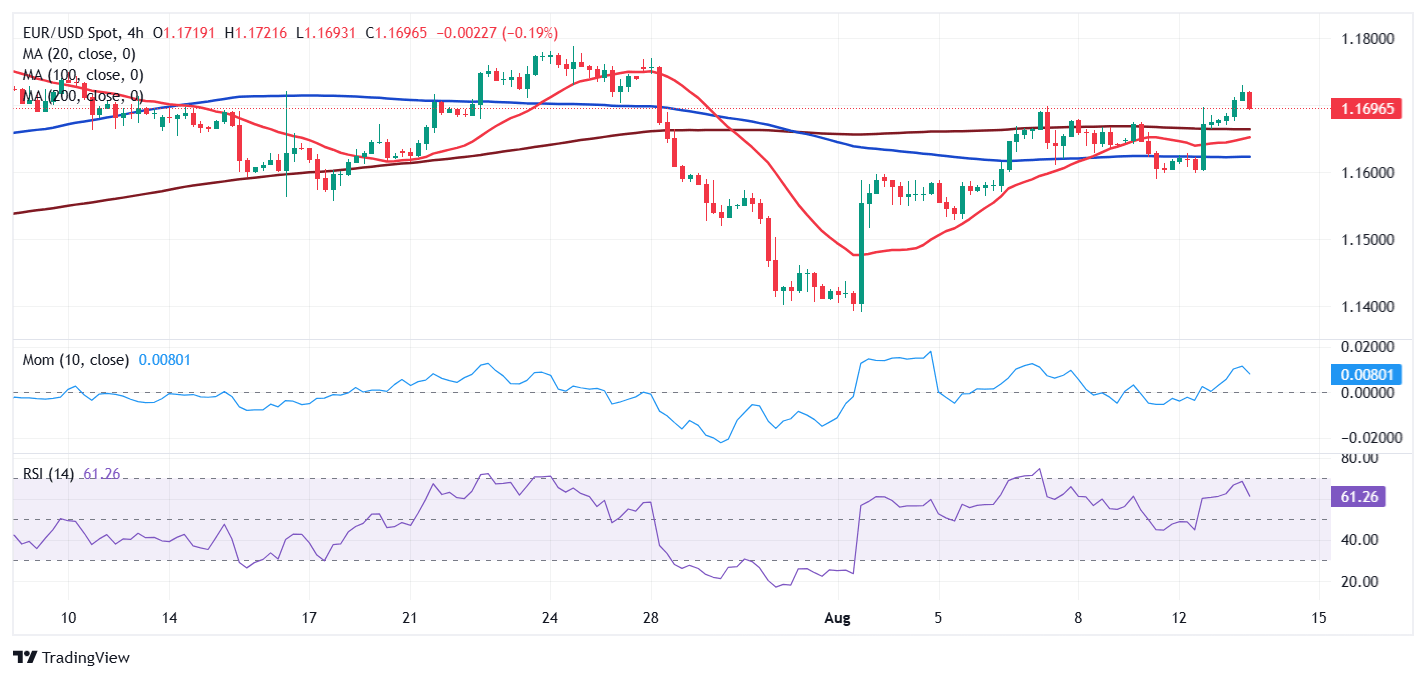

EUR/USD short-term technical outlook

The daily chart for the EUR/USD pair shows it retreated and is currently hovering below the 1.1700 mark, yet that overall, the risk remains skewed to the upside. The pair keeps trading above all its moving averages, with a flat 20 SMA providing support at around 1.1590. Technical indicators, in the meantime, head north, although the Momentum indicator remains below its 100 line, suggesting buyers are not fully in.

In the near term, and according to the 4-hour chart, the EUR/USD pair is neutral-to-bullish. The pair advanced beyond all its moving averages, which, anyway, remain directionless and confined to a tight range, reflecting the latest absence of directional strength. Other than that, technical indicators hold within positive levels, although with uneven directional strength, failing to provide clues on what’s next for the pair.

Support levels: 1.1665 1.1620 1.1590

Resistance levels: 1.1715 1.1750 1.1785

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.