EUR/USD Price Forecast: Buyers retain control despite mounting risk aversion

EUR/USD Current price: 1.1578

- The escalation of the Middle East conflict likely to keep markets in risk-off mode.

- European Central Bank officials keep hinting at a pause in interest rate cuts.

- EUR/USD poised to extend its advance, waiting for a clearer catalyst.

The EUR/USD pair advances on Monday, approaching the 1.1600 threshold early in the American session. The US Dollar (USD) started the week with a firmer tone, gaping higher against most major rivals, amid the Middle East conflict. Iran and Israel kept exchanging airstrikes throughout the weekend, with civil casualties accumulating on both sides.

USD safe-haven demand, however, was short-lived. The Greenback resumed its decline during European trading hours, retaining its soft tone during American trading hours.

Meanwhile, the Eurozone (EU) calendar remained scarce, although a couple of European Central Bank (ECB) officials were on the wires. Bundesbank President Joachim Nagel noted the ECB achieved its goal, but added policymakers “must” retain full optionality on interest rates, adding that uncertainty is high enough for the ECB to contribute to increasing it.

Across the pond, the US published the NY Empire State Manufacturing Index for June, which fell to -16 from the -9.2 posted in May. The reading also missed the expected improvement to -5.5.

The macroeconomic calendar will become more interesting in the upcoming days, as Germany will release the June ZEW survey on Economic Sentiment, while the US will publish May Retail Sales

EUR/USD short-term technical outlook

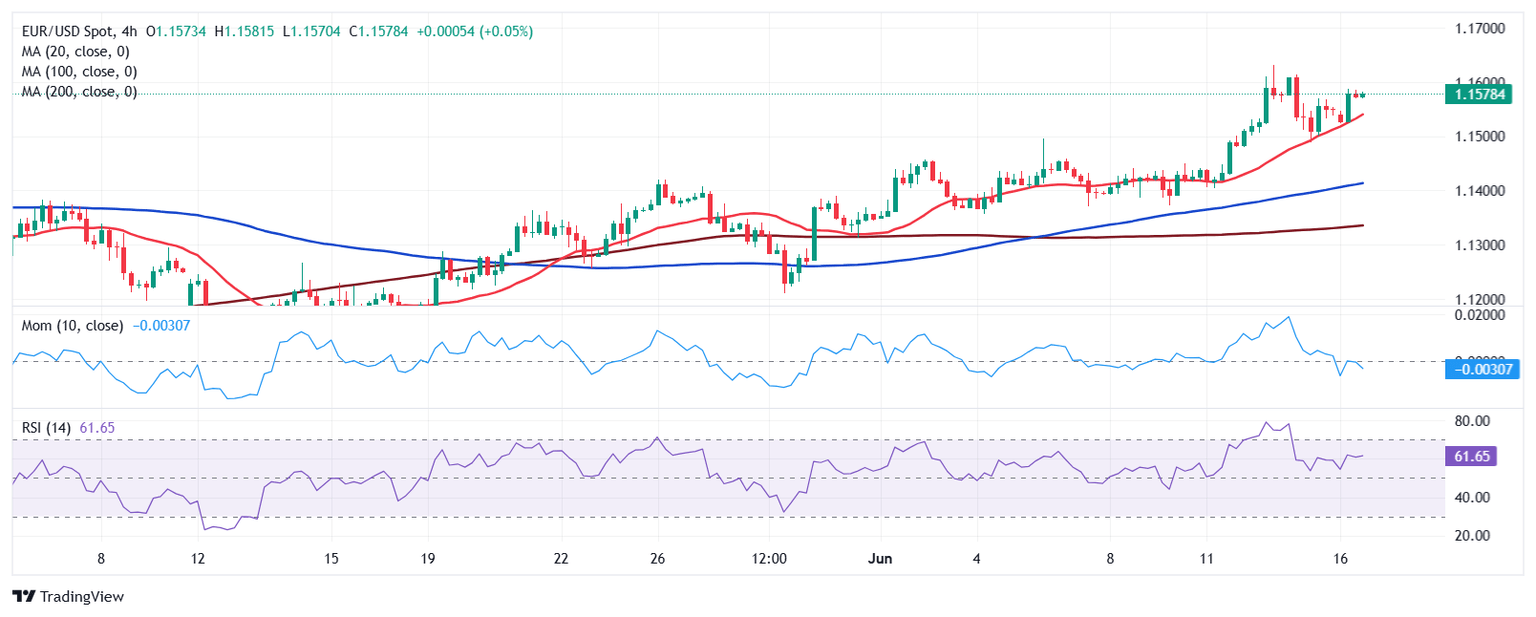

The EUR/USD pair is up on a daily basis, although posting a third consecutive lower high on a daily basis. The same chart shows the pair keeps developing far above all its moving averages, with the 20 Simple Moving Average (SMA) accelerating north and currently at around 1.1400. At the same time, technical indicators resumed their advances within positive levels, with the Relative Strength Index (RSI) indicator approaching overbought readings. Overall, EUR/USD is poised to extend its advance.

The near-term picture shows the risk skews to the upside, although the momentum is limited. The pair found intraday buyers around a bullish 20 SMA, providing dynamic support at around 1.1530. The 100 and 200 SMAs, in the meantime, offer neutral-to-bullish slopes far below the shorter one. Finally, technical indicators hold well above their midlines, yet without clear directional strength.

Support levels: 1.1530 1.1490 1.1440

Resistance levels: 1.1600 1.1640 1.1685

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.