EUR/USD Price Forecast: Bulls retain control amid ECB announcement

EUR/USD Current price: 1.1364

- The European Central Bank trimmed interest rates by 25 bps as expected

- United States President Donald Trump shot at Fed Chair Jerome Powell.

- EUR/USD trades within familiar levels, neutral in the near term but overall bullish.

The FX board entered holiday mood on Thursday, with most major pairs confined to tight intraday ranges throughout the first half of the day. The EUR/USD pair hovered a few pips below the 1.1400 mark after posting an intraday peak of 1.1409 early in the Asian session.

The technical picture does not reflect the macroeconomic one, as there were multiple relevant headlines. On the one hand, Germany released the March Producer Price Index (PPI), which fell by more than anticipated. The annual reading printed at -0.2% after advancing 0.7% in February, while the index was down 0.7% on a monthly basis, against the previous -0.2% and the expected -0.1%.

On the other hand, the European Central Bank (ECB) announced its monetary policy decision. As widely anticipated, ECB officials trimmed the three benchmark interest rates by 25 basis points (bps) each. With this decision, the interest rate on the main refinancing operations, the interest rates on the marginal lending facility and the deposit facility stood at 2.4%, 2.65% and 2.25%, respectively. The announcement had no practical effect on EUR/USD.

The accompanying statement showed policymakers are quite concerned amid the trade war. “The disinflation process is well on track. The euro area economy has been building up some resilience against global shocks, but the outlook for growth has deteriorated owing to rising trade tensions. Trade tensions are likely to have a tightening impact on financing conditions. These factors may further weigh on the economic outlook for the euro area,” the document reads.

In the meantime, United States (US) President Donald Trump was busy on social media. He referred to “productive” talks both with Japanese and Mexican representatives, but gave no further details on progress. More relevantly, he spoke about Federal Reserve (Fed) Chairman Jerome Powell. Trump said that “Too Late= Jerome Powell of the Fed, who is always TOO LATE AND WRONG, yesterday issued a report which was another, and typical, complete “mess!,” adding that “Powell’s termination cannot come fast enough!”

Finally, the US released Initial Jobless Claims, which rose by 215K in the week ended April 12, beating the 225K anticipated. The April Philadelphia Fed Manufacturing Survey, on the contrary, plummeted to -26.4 from 12.5 in March, also missing the 2 anticipated by market players.

ECB President Christine Lagarde kick-started a press conference, and her initial words failed to impress, given that she repeated officials remain data-dependent and that there is no preset path for monetary policy. However, she did refer largely to trade issues and the uncertainty related to them. As she speaks, the EUR/USD pair holds within familiar levels.

EUR/USD short-term technical outlook

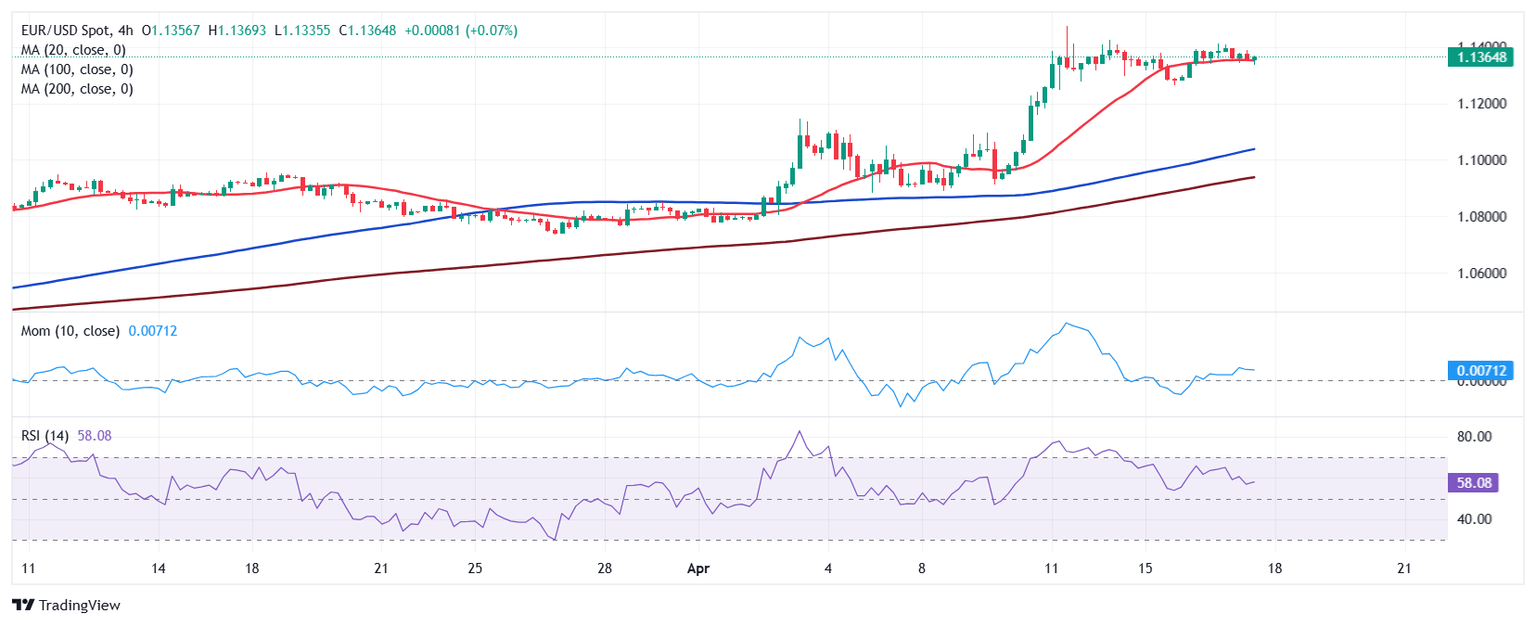

From a technical point of view, the EUR/USD pair trades around 1.1350, and the daily chart shows that the intraday slide barely affects the dominant bullish trend. The pair keeps developing far above all its moving averages, with a bullish 20 Simple Moving Average (SMA) standing at around 1.1000. Technical indicators, in the meantime, eased modestly but remain within overbought readings, without actual downward strength.

In the near term, and according to the 4-hour chart, EUR/USD is neutral. The pair is barely holding above a flat 20 SMA, while the 100 and 200 SMAs maintain firmly bullish slopes over 300 pips below the current level. Finally, technical indicators are stable, the Momentum indicator hovering around its 100 level and the Relative Strength Index (RSI) indicator standing at around 56. The bearish potential seems well-limited, although a near-term slide amid profit-taking ahead of the weekend is not out of the picture.

Support levels: 1.1310 1.1285 1.1240

Resistance levels: 1.1375 1.1425 1.1470

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.