EUR/USD Forecast: Waiting for the Fed? Euro bulls may rage earlier

- EUR/USD has been edging lower as US yields have been rising.

- Speculation about the Fed, US data, and virus developments are eyed.

- Tuesday's four-hour chart is pointing to further gains for the pair.

Will the Federal Reserve send the first hint of tightening? The dollar's next move hinges on the next move by the central bank but that is due out only on Wednesday – the perfect conditions for tense trading on Tuesday. Nevertheless, markets may move earlier.

Apart from favorable technical developments for EUR/USD (described below), there are also fundamental reasons to favor renewed gains for the pair.

First, the reason for the current rise of the dollar stems from higher US bond yields. Returns on 10-year Treasuries has edged up to 1.58%. However, without any trigger to rise, the ebb and flow of markets may result in a slide back to the bottom of the range – or at least under 1.55%. That could soften the greenback.

Second, Durable Goods Orders for March missed estimates with a meager 0.5% increase – contrary to other upbeat statistics for last month. The Conference Board publishes its Consumer Confidence gauge for April. Are expectations too high there as well?

On the other side of the pond, COVID-19 cases are edging lower and countries are gradually reopening. More importantly, the EU is receiving larger shipments of the Pfizer/BioNTech jabs beginning this week, so reports of an accelerating vaccination rate could also support the euro.

Returning to the Fed, uncertainty remains high and nervous hands could move markets in both directions. On the one hand, the US economy is heating in both the labor market and in prices – the bank's two mandates. On the other hand, around 8.4 million Americans have yet to return to their pre-pandemic jobs and price rises are somewhat skewed due to "base effects."

Federal Reserve Preview: Will Powell power up the dollar? Three things to watch out for

With no significant new data points nor speeches from Fed officials, there is only speculation for now, while other factors are in play.

EUR/USD Technical Analysis

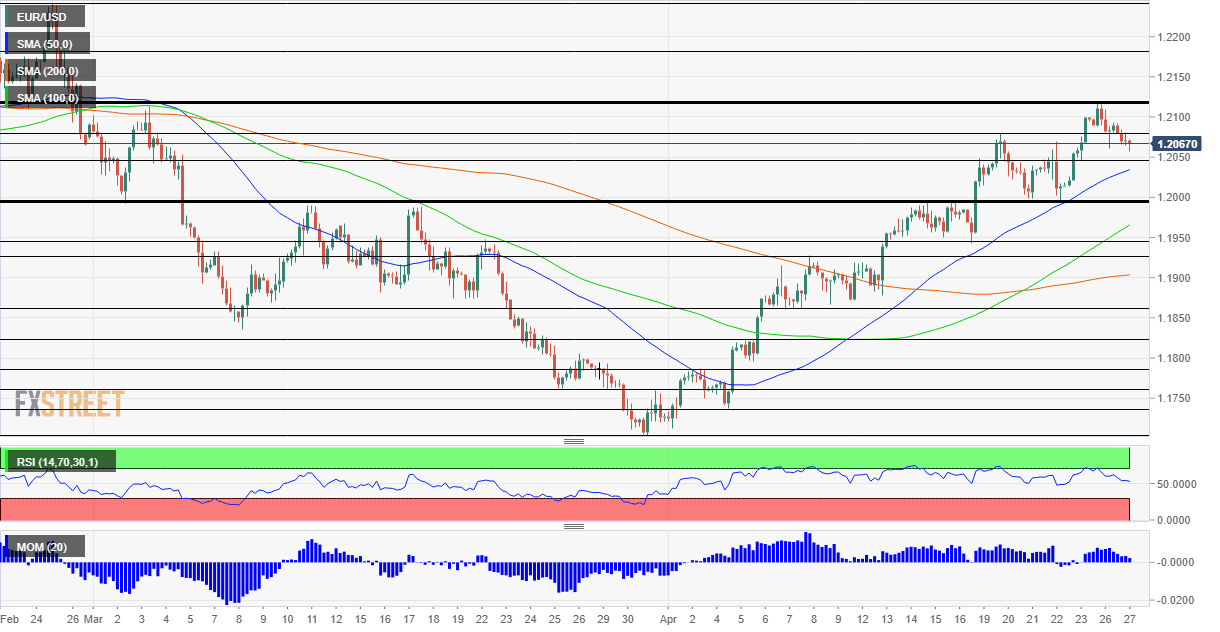

Euro/dollar continues benefiting from upside momentum on the four-hour chart while the Relative Strength Index (RSI) has drifted away from 70 – thus outside overbought territory. The currency pair continues trading above the 50, 100 and 200 Simple Moving Averages.

Overall, bulls are in control.

Some resistance awaits at 1.2080, which was a peak in mid-April. The recent peak of 1.2117 is the next level to watch. It also capped EUR/USD back in March. Further above, the next cap is 1.2180.

Support awaits at 1.2050, which was a swing high several weeks ago. The round 1.20 line is a significant cushion. Further down, 1.1950 awaits the pair.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.