EUR/USD Forecast: US Dollar pressured despite a tepid mood

EUR/USD Current Price: 1.0618

- The German Producer Price Index rose less than anticipated in November, supporting the EUR.

- The US Dollar remains on the back foot after the Bank of Japan's monetary policy decision.

- EUR/USD is technically neutral in the near term, although bulls are in charge on the broader view.

The EUR/USD pair surged on Tuesday and traded as high as 1.0651 as the US Dollar got sold off during Asian trading hours following the Bank of Japan (BoJ) monetary policy decision. The Japanese central bank left its benchmark rate unchanged at -0.1% and maintained the 10-year Japanese Government Bond (JGB) yield at 0.00%, as expected. Policymakers, however, introduced a minor twist: they will allow the 10-year JGB yield to fluctuate between -0.5% and 0.5%, compared to -0.25% and 0.25% previously, and noted that they would review the yield curve control operation.

BoJ Governor Haruhiko Kuroda reaffirmed the central bank's dovish stance, repeating they are ready to ease further and noting it is no time to debate exiting quantitative tightening. Nonetheless, the Japanese Yen (JPY) soared, pushing the US Dollar down across the FX board.

Meanwhile, the EUR partially benefited from encouraging local data. The Euro Area seasonally-adjusted Current Account posted a surplus of €-0.4 billion, beating expectations. More relevantly, the German November Producer Price Index rose at an annual pace of 28.2%, easing from the previous 34.5% and missing expectations of 30%. The United States will later release November Housing Starts and Building Permits.

Stocks trade dip in the red, with European indexes posting modest losses and US ones poised to open below Monday’s close. On the other hand, US Treasury yields advanced, although the yield on the 10-year note keeps adancing at a faster pace than that of the 2-year note, preventing the US Dollar from appreciating.

EUR/USD short-term technical outlook

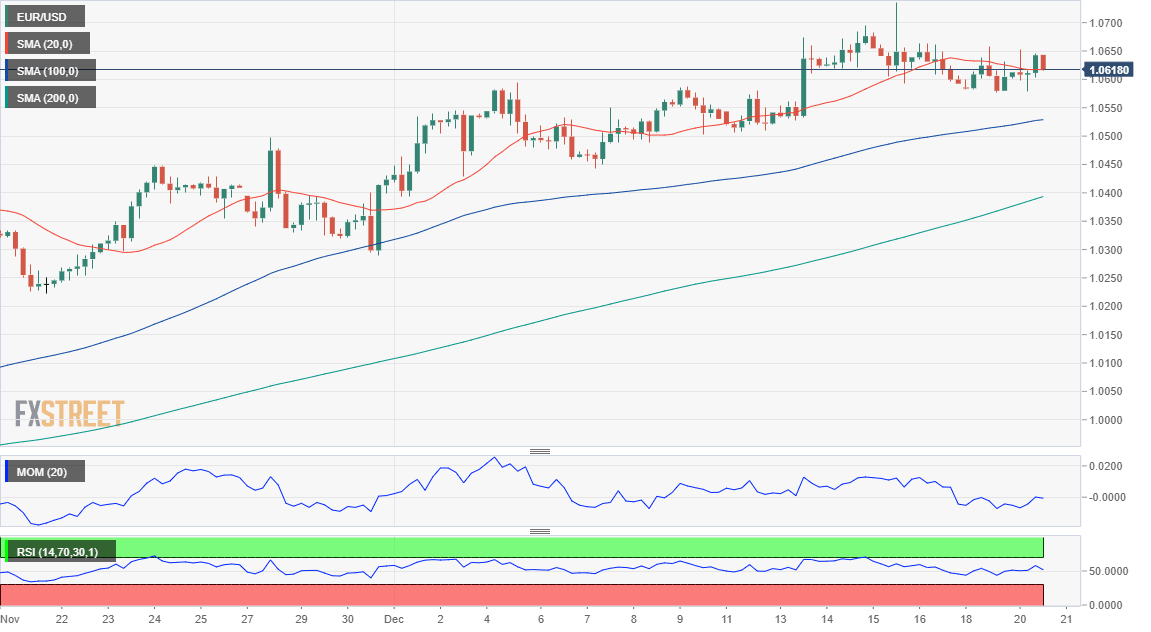

The EUR/USD pair remains within Monday's range, trading a few pips below the mentioned intraday high. In the daily chart, the pair continues to develop above a firmly bullish 20 Simple Moving Average (SMA), which advances above the longer ones and provides dynamic support at around 1.0510. Technical indicators hold well above their midlines but lack evident directional strength. The Momentum turned marginally lower, while the Relative Strength Index (RSI) ticks higher at around 64. Nevertheless, bulls are unwilling to give up, and maintain the upward pressure.

EUR/USD is neutral, according to technical readings in the 4-hour chart. The pair is currently hovering around a mildly bearish 20 SMA, while the longer moving averages maintain their bullish slopes far below the current level. Technical indicators, in the meantime, retreat from around their midlines but remain within neutral readings and without directional strength. The pair needs to clear the 1.0650 price zone to be able to extend gains, although there is no catalyst in sight at the time being.

Support levels: 1.0580 1.0535 1.0480

Resistance levels: 1.0650 1.0695 1.0740

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.