EUR/USD Forecast: Under pressure ahead of the ECB’s decision

EUR/USD Current Price: 1.1089

- Trump’s threat to impose tariffs of European vehicles weighs on the EUR.

- The market’s sentiment improved a bit, but investors remain cautious.

- EUR/USD at risk of falling sharply if it loses the 1.1065 level.

The greenback is weaker against most major rivals as the market sentiment is in better shape this Wednesday. However, the shared currency remains subdued, with the EUR/USD pair trading below the 1.1100 figure and near its January low of 1.1074, achieved during Asian trading hours. The lack of interest in the EUR may be related to the upcoming ECB Monetary Policy Meeting this Thursday, as speculative interest wants to hear from Mrs Lagarde before taking firmer positions. Also, Trump´s threats to impose tariffs on European cars weigh.

The EU didn’t release relevant macroeconomic data. As for the US, it just published January 17 MBA Mortgage Applications, which were down by 1.2%. The Chicago Fed National Activity Index was down to -0.35 in December, worse than anticipated. Later in the day, the US will release December Existing Home Sales, seen up by 1.2% when compared to a month earlier.

EUR/USD short-term technical outlook

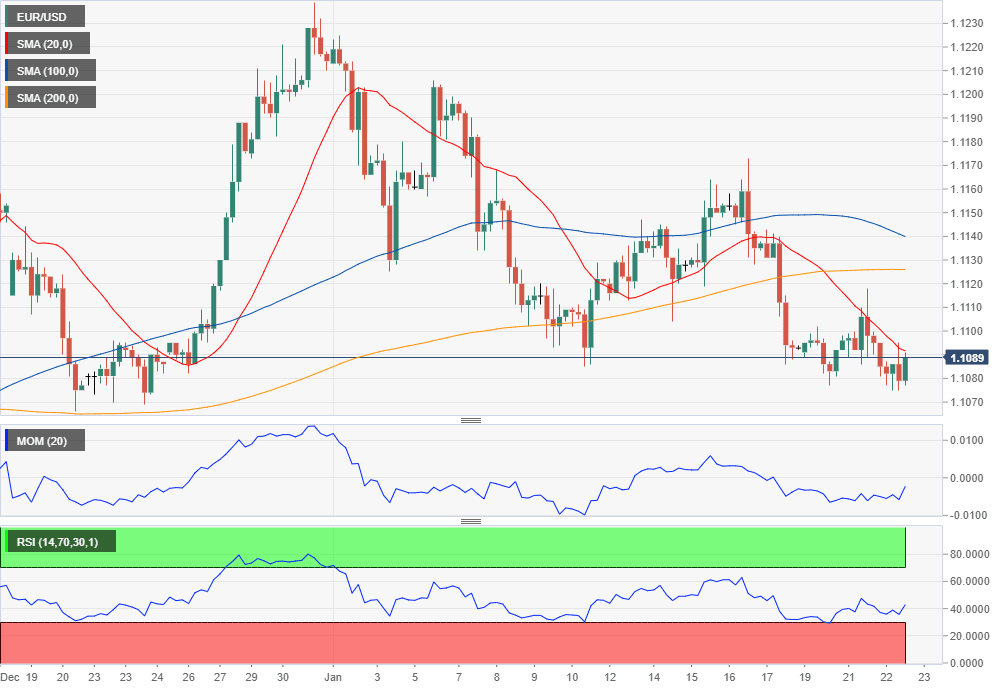

The EUR/USD pair is bearish, according to the 4-hour chart, as the pair continues to develop below all of its moving averages, and with a firmly bearish 20 SMA providing dynamic resistance. The Momentum indicator faltered around its mid-line, slowly turning south, while the RSI consolidates at around 43, all of which reflects the absence of buying interest. The main support is 1.1065, with a steeper decline expected on a break below it.

Support levels: 1.1065 1.1020 1.0980

Resistance levels: 1.1110 1.1145 1.1180

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.