EUR/USD Forecast: The rally is set to continue

EUR/USD Current Price: 1.2280

- Concerns about the recent coronavirus cases’ surge weigh on the sentiment.

- US Initial Jobless Claims contracted to 787K in the week ended December 25.

- EUR/USD is consolidating yearly gains, retaining its bullish stance.

The EUR/USD pair gives up some ground after reaching a fresh 2020 high on Wednesday at 1.2309. The pair is quiet in ultra-thin market conditions as the world celebrates Year-End. The greenback retains the doubtful honor of being the weakest currency across the FX board, undermined by mounting virus concerns, but also but resurgent demand for the pound after the UK Parliament backed the post-Brexit deal.

The EU hasn’t published macroeconomic data while the US has just released Initial Jobless Claims for the week ended December 25, which came in at 787K against the 833K expected. Wall Street is poised to open with losses, following the lead of its European counterparts. US markets are due to close earlier today, which means activity will likely stall shortly.

EUR/USD short-term technical outlook

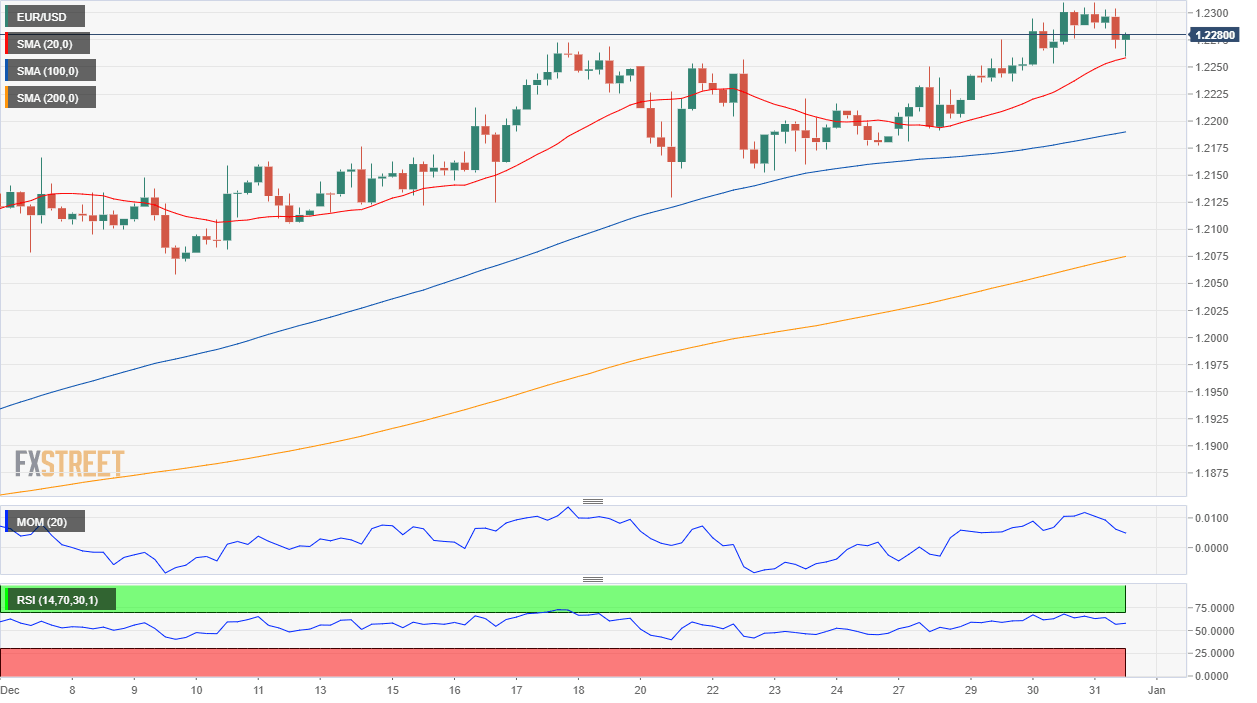

From a technical point of view, the EUR/USD pair retains its bullish stance. The 4-hour chart shows that it bounced from a bullish 20 SMA, currently providing dynamic support around 1.2260. The longer moving averages maintain their bullish slopes well below the current level, while technical indicators consolidate within positive levels.

Support levels: 1.2260 1.2220 1.2175

Resistance levels: 1.2320 1.2350 1.2385

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.