EUR/USD Forecast: Optimism not helping the EUR

EUR/USD Current price: 1.1553

- US Initial Jobless Claims contracted to 326K in the week ended October 1.

- Market players are encouraged by US debt limit positive news.

- EUR/USD remains under selling pressure and could reach fresh 2021 lows.

The EUR/USD pair is marginally higher on a daily basis, as the market mood remains positive following news that US Senate Republican Leader Mitch McConnell offered a temporary solution to the debt crisis on Wednesday. The governing body will vote on the proposal during the American afternoon. As a result, stocks trade within positive levels, while demand for government bonds receded.

Generally speaking, the dollar is weaker across the board, although the upside for the shared currency is being limited by dismal local data. Germany published August Industrial Production, which fell by 4% MoM, much worse than the -0.4% expected. The annual reading was 1.7%, well below the 11.4% expected.

The US published September Challenger Job Cuts, which rose 14% to 17,895 from the 24-year low of 15,723 cuts announced in August. Also, Initial Jobless Claims for the week ended October 1 printed at 326K, better than the 348K expected.

EUR/USD short-term technical outlook

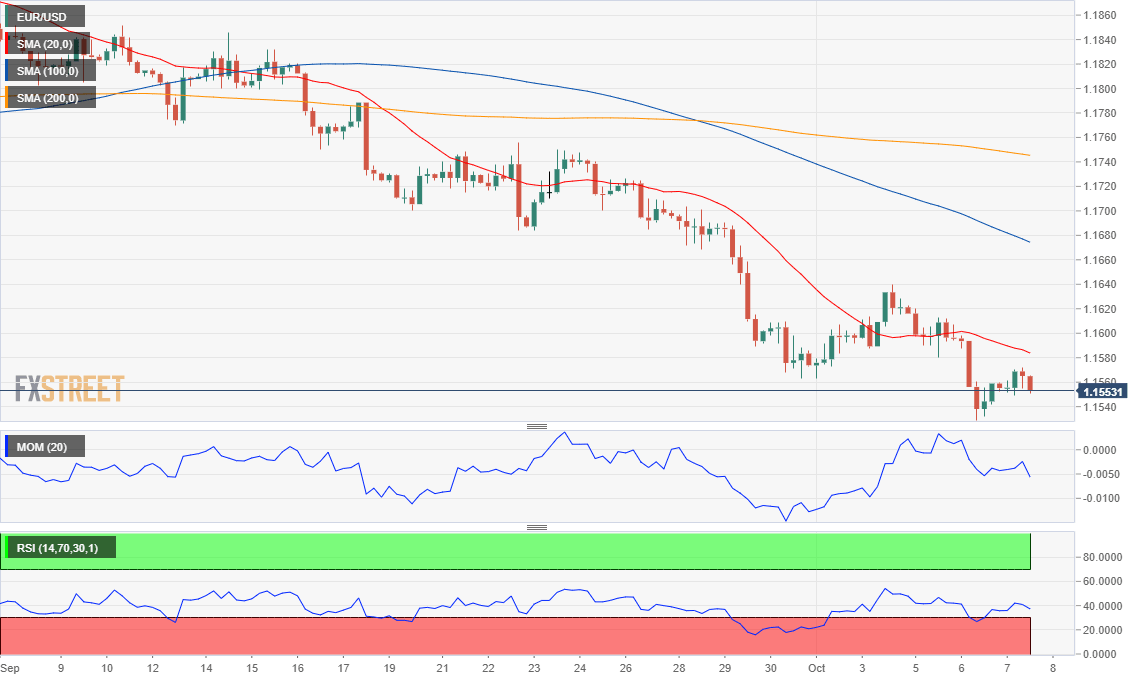

The EUR/USD pair peaked at 1.1571 but currently trades in the 1.1550 price zone, retaining its bearish stance. The 4-hour chart shows that the pair remains below a firmly bearish 20 SMA, which currently stands at around 1.1580, providing dynamic resistance. The Momentum indicator advanced within negative levels, although the RSI turned lower near oversold readings, indicating persistent selling interest. The pair will likely resume its slide on a break below 1.1520, the immediate support level.

Support levels: 1.1520 1.1475 1.1440

Resistance levels: 1.1580 1.1640 1.1685

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.