EUR/USD Forecast: Next hurdle for euro aligns at 1.1040

- EUR/USD has regained its traction following Monday's choppy action.

- Next bullish target for the pair is located at 1.1040 ahead of 1.1080.

- Euro could lose interest if it fails to hold above 1.1000.

The shared currency has started to gather strength early Tuesday after having struggled to find direction on Monday. EUR/USD is trading near 1.1000 and it looks ready to extend its rebound in case risk flows continue to dominate the financial markets.

Oleksiy Arestovich, an adviser to the Ukrainian President's Chief of Staff, said late Monday that the Russia-Ukraine war was expected to end by early May, per Reuters. This development triggered a relief rally during the Asian trading hours and helped the euro find demand.

Nevertheless, markets seem to have turned risk-averse on Tuesday with the Euro Stoxx 500 Index losing more than 1% in the early European session and EUR/USD struggling to build on earlier gains. Similarly, US stock index futures are losing between 0.4% and 0.5%.

Later in the session, January Industrial Production data from the euro area and the ZEW Survey from Germany will be featured in the European economic docket. Investors are likely to ignore these prints and continue to react to changes in risk sentiment.

In case investors continue to price in a possible peace agreement between Russia and Ukraine, EUR/USD should preserve its recovery momentum. On the other hand, the pair could find it difficult to keep its footing if geopolitical tensions re-escalate. Following Monday's comments, the Ukrainian presidential adviser noted early Tuesday that they were at a crossroads. "Either there will be agreement at talks or Russia will go on the offensive," the adviser added.

EUR/USD Technical Analysis

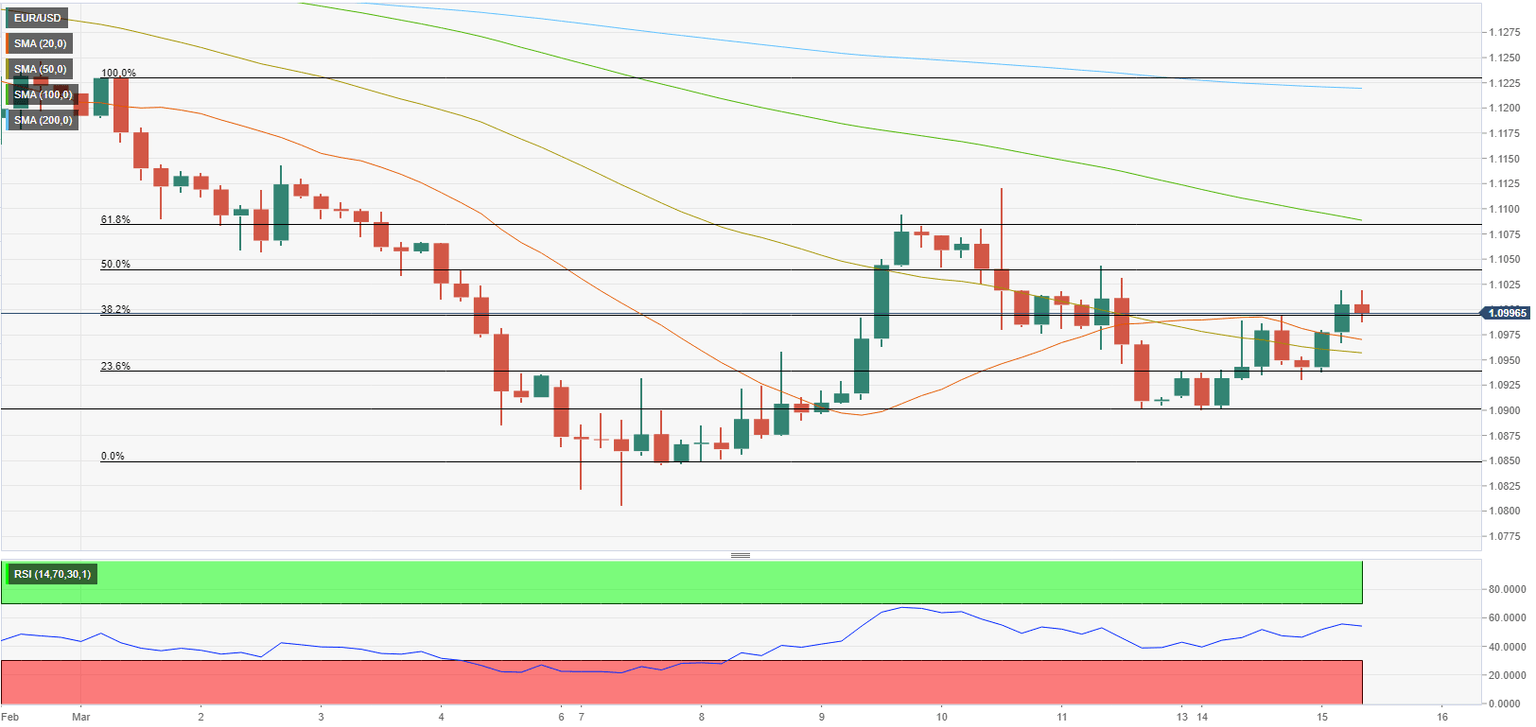

EUR/USD is trading above the 20-period and the 50-period SMAs on the four-hour chart. Additionally, the Relative Strength Index (RSI) indicator on the same chart stays afloat above 50, confirming the bullish tilt in the short term.

In case the pair manages to hold above 1.1000 (psychological level, Fibonacci 38.2% retracement of the latest downtrend), it could target 1.1040 (Fibonacci 50% retracement) and 1.1080 (100-period SMA, Fibonacci 61.8% retracement).

On the downside, 1.0960 (50-period SMA) aligns as interim support ahead of 1.0930 (Fibonacci 23.6% retracement) and 1.0900 (psychological level, static level).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.