EUR/USD Forecast: Modest bounce do not grant additional gains

EUR/USD Current price: 1.0830

- Weekend news put investors in cautious mode in a data-scarce week.

- Federal Reserve speakers and US inflation take the spotlight in the upcoming days.

- EUR/USD bounced from around 1.0800 but lacks enough strength to extend the rally.

The US Dollar is marginally lower on Monday, helping EUR/USD to retain the 1.0800 threshold. Nevertheless, the Greenback maintains most of its central-banks-inspired gains and trades not far from its March low of 1.0794. The week started in slow motion, with the Easter Holiday and a scarce macroeconomic calendar exacerbating the consolidative stage.

Meanwhile, weekend news spurred risk aversion. A terrorist attack in Russia triggered alerts in most developed countries amid concerns the attacks will multiply, as a result, gains among high-yielding currencies are limited. Additionally, stock markets trade with a sour tone. Wall Street flirted with record highs on Friday but shed gains ahead of close, leading to caution combined with profit-taking across Asian and European counterparts.

Finally, financial markets are taking note of Federal Reserve (Fed) officials’ words. Late on Friday, Bank of Atlanta President Raphael Bostic said he expects just one rate cut this year, downgrading his two-cut forecast. More Fed speakers will hit the wires in the upcoming days, likely triggering some action.

Data-wise, the focus is on Friday, when the United States (US) will release the Personal Consumption Expenditures (PCE) Price Index report. The core annual PCE Price Index is the Fed’s favorite inflation gauge, and the news could affect rate-cut expectations.

EUR/USD short-term technical outlook

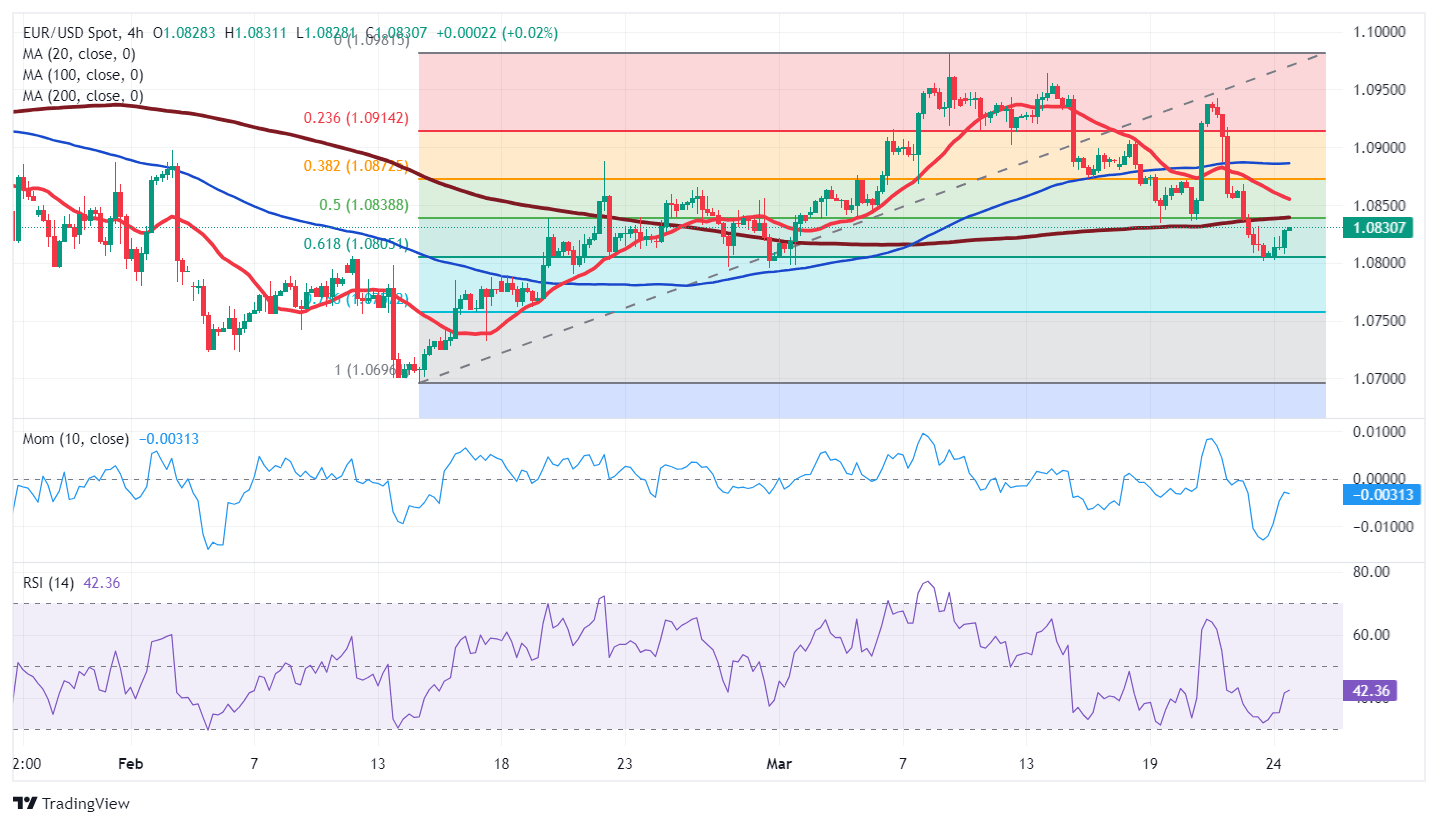

The EUR/USD pair bounced from the 61.8% Fibonacci retracement of the 1.0694/1.0981 rally at 1.0803 while holding below the 50% retracement at 1.0840. Technical readings in the daily chart show the risk remains skewed to the downside as the pair develops below all its moving averages, which remain directionless. At the same time, technical indicators have pared their slides but consolidate within negative levels, reflecting limited buying interest.

The near-term picture is quite similar. In the 4-hour chart, EUR/USD develops below its moving averages, with the 20 Simple Moving Average (SMA) heading south well above the current level. At the same time, the 200 SMA converges with the aforementioned Fibonacci resistance, reinforcing the relevance of the 1.0840 region. Finally, the Momentum indicator recovers modestly from oversold readings, while the Relative Strength Index (RSI) indicator grinds higher but remains within negative levels.

Support levels: 1.0795 1.0750 1.0710

Resistance levels: 1.0845 1.0890 1.0920

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.