EUR/USD Forecast: Key levels stay intact amid geopolitical uncertainty

- EUR/USD has been trading in a very narrow range on Friday.

- Market mood is improving on reports claiming Russia is withdrawing troops.

- US President Joe Biden will host a meeting with international leaders on the Russia-Ukraine conflict.

EUR/USD has been having a tough time making a decisive move in either direction as investors try to navigate through mixed headlines surrounding the Russia-Ukraine conflict. The pair needs to break out of the 1.1350-1.1400 range to determine its next short-term direction.

In a letter to the UN Secretary-General, Russia reiterated its claim that Ukraine had committed war crimes in Donbas. Commenting on this development, US Secretary of State Anthony Blinken told the UN Security Council that Russia was manufacturing a pretext for an attack on Ukraine. The greenback, however, failed to capitalize on the risk-averse market environment as it struggled to find demand amid slumping US Treasury bond yields.

Early Friday, Ifax news agency reported that Russia's mechanised infantry units were heading back to their bases after completing drills in Crimea. This headline allowed risk flows to return to markets in the European morning but EUR/USD stayed relatively quiet as the west is yet to confirm a de-escalation of the situation.

Later in the day, US President Joe Biden will host a meeting on the Russia-Ukraine conflict with leaders of Canada, France, Germany, Italy, Poland, Romania, Britain, the EU and NATO.

Further escalation of geopolitical tensions could make it difficult for EUR/USD to edge higher ahead of the weekend. Although a negative shift in risk sentiment could provide a boost to the dollar, another leg lower in US T-bond yields on risk aversion could limit the currency's gains and help EUR/USD find support.

The European Commission will release the preliminary February Consumer Confidence data for the eurozone and the January Existing Home Sales will be featured in the US economic docket.

EUR/USD Technical Analysis

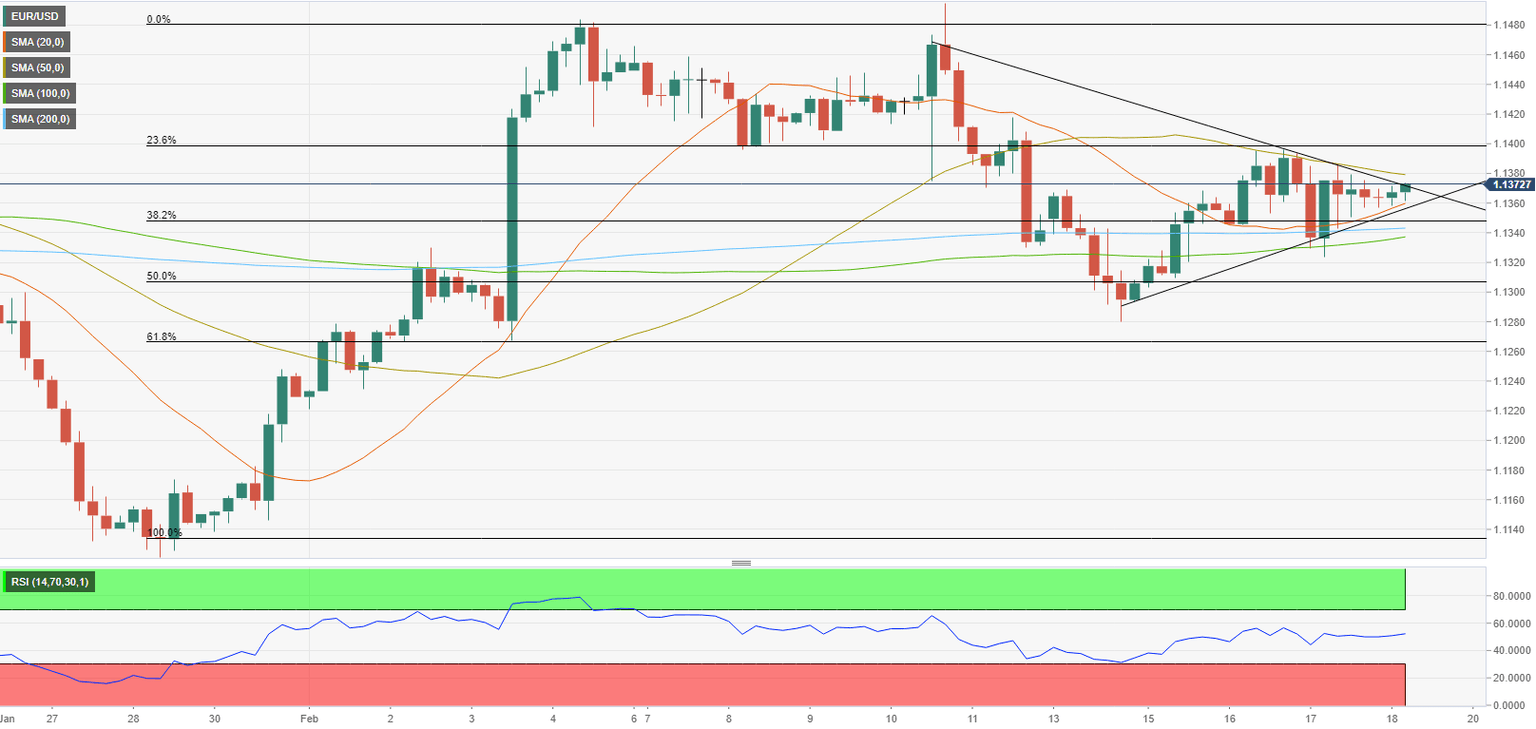

On the four-hour chart, EUR/USD is trading within a symmetrical triangle and the Relative Strength Index (RSI) indicator is moving sideways around 50, highlighting the pair's indecisiveness.

On the upside, 1.1400 (psychological level, Fibonacci 23.6% retracement of the latest uptrend) aligns as the first technical resistance. In case this level turns into support, 1.1450 (static level) and 1.1480 (static level) could be targeted.

Significant support seems to have formed at the 1.1340/1.1350 area (Fibonacci 38.2% retracement of the latest uptrend, 200-period SMA and 100-period SMA). The bearish pressure could gather strength below that level and the pair could extend its slide toward 1.1300 (psychological level, Fibonacci 50% retracement).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.