EUR/USD Forecast: Immediate resistance comes at 1.1000

- EUR/USD reversed Monday’s small advance.

- The resurgence of the risk-off mood weighed on spot.

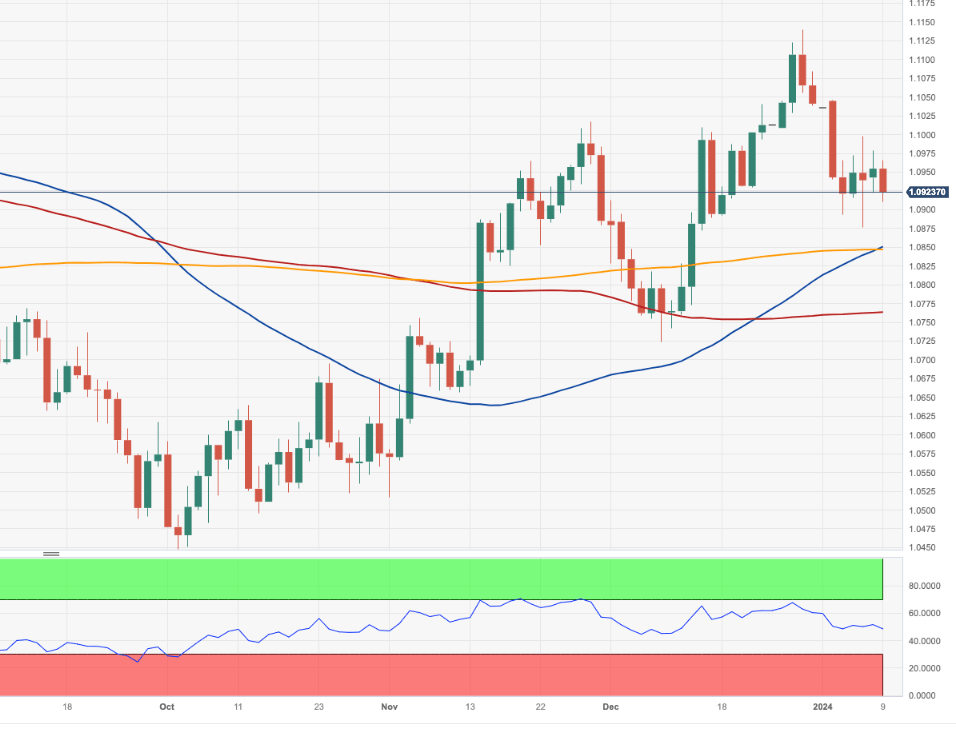

- Key support remains at the 200-day SMA near 1.0850.

EUR/USD faded the slight advance seen at the beginning of the week and receded to the vicinity of the 1.0900 neighbourhood, where some support appears to have emerged on turnaround Tuesday.

The renewed upside pressure in the greenback lifted the USD Index (DXY) to new two-day peaks near 102.70 as investors lean towards safe havens against the backdrop of increasing prudence prior to the release of US inflation figures and consumer sentiment gauges expected in the latter part of the week.

The daily downtick in the pair also came amidst the lack of a clear direction in US yields across different timeframes, while the reference 10-year bund yields ticked higher to the 2.20% region.

Meanwhile, the macroeconomic landscape continues to be shaped by the Federal Reserve's approach to interest rate reductions, in contrast to the relatively subdued stance of the European Central Bank (ECB). Consensus among analysts suggests that the ECB may consider a potential rate cut in the later part of the year.

On the docket, disheartening prints from Germany’s industrial production tagged along the bearish tone in the single currency, while the unexpected improvement in the jobless rate in the broader Euroland appears to have offered some temporary relief.

EUR/USD daily chart

EUR/USD short-term technical outlook

If the EUR/USD falls further and breaks the 2024 low of 1.0892 (January 3), it may come into contact with the crucial 200-day SMA at 1.0845. If the latter is lost, the December 2023 low of 1.0723 (December 8) may return ahead of the weekly low of 1.0495 (October 13, 2023), which is followed by the 2023 low of 1.0448 (October 3) and the round level of 1.0400. The pair's bullish outlook is predicted to be tested below the 200-day SMA.

The 4-hour chart suggests some short-term consolidation. Against this, the first resistance level is at 1.0998, which seems to be strengthened by the proximity of the 55-SMA. The exceeding of this region indicates a possible visit to 1.1139. The MACD has recovered somewhat, underpinning a short-term recovery, while the RSI retreated to the 40 area, allowing for a corrective move.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.