EUR/USD Forecast: Higher highs still in sight

EUR/USD Current Price: 1.2285

- US Senate delayed the discussion about expanding coronavirus-relief aid.

- Coronavirus-related concerns hurt the market’s mood amid rising cases in the EU and the US.

- EUR/USD trades above its former year’s high and is poised to continue advancing.

The EUR/USD pair reached a fresh 2020 high of 1.2309 this Wednesday, as speculative interest kept selling the greenback heading into the year-end. News that the US Senate has delayed a decision on increasing coronavirus-relief checks added pressure on the dollar. Republican Senator Mitch McConnell blocked a move by colleague Bernie Sanders to allow a vote on increasing stimulus checks from $600 to $2,000, although Treasury Secretary Steve Mnuchin announced that direct payments of $ 600 would be out as soon as this week. Coronavirus-related concerns affected European equities, as most indexes closed the day in the red.

Wall Street recovered part of the ground lost on Tuesday, giving the American currency a breather ahead of the close. Data wise, the macroeconomic calendar had little to offer. The US published November Wholesale inventories, which were down 0.1% in the month. The Goods Trade Balance posted a deficit of $ 84.82 billion in the same month. Finally, Pending Home Sales decreased by 2.6% MoM, missing expectations. This Thursday, the country will publish Initial Jobless Claims for the week ended December 25, foreseen at 833K.

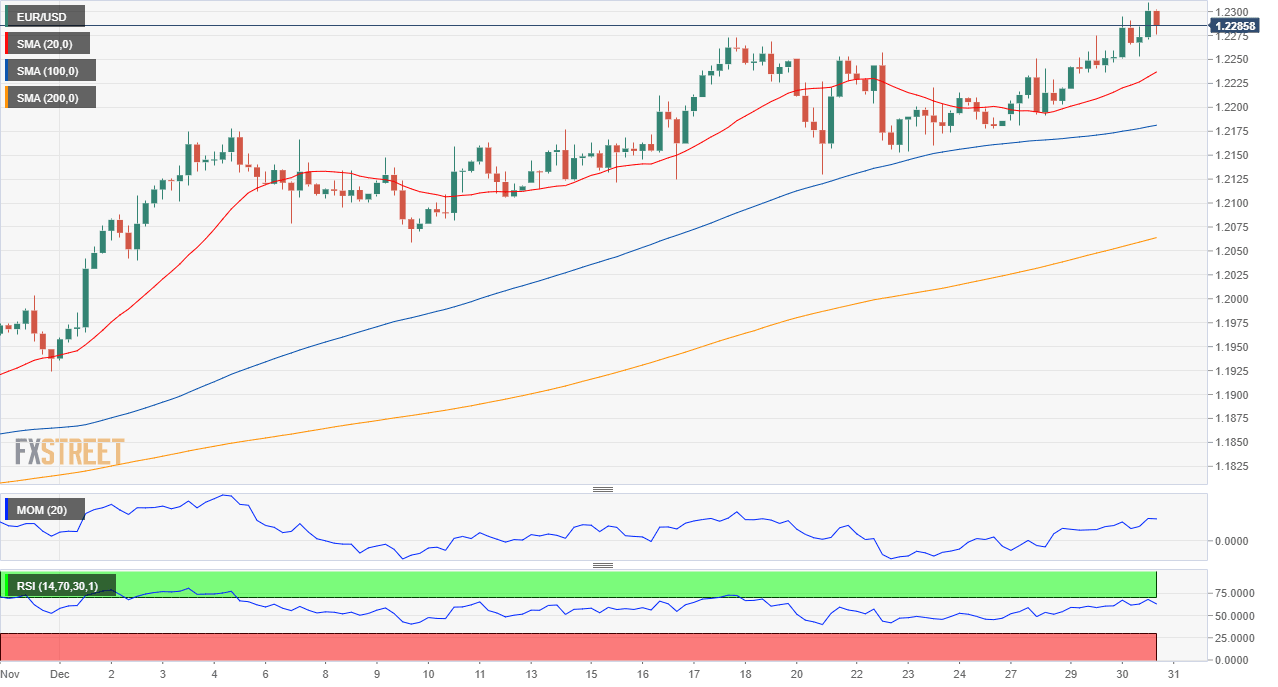

EUR/USD short-term technical outlook

The EUR/USD pair retreated from the mentioned high but held above the former top at 1.2273, keeping the risk skewed to the upside. The pair hovers around 1.2280, and the 4-hour chart shows that it keeps developing above bullish moving averages. Technical indicators remain within positive levels with uneven strength but without signs of upward exhaustion. Further gains are now expected on an extension above 1.2310, with the pair targeting 1.2413, April 2018 monthly high.

Support levels: 1.2250 1.2210 1.2175

Resistance levels: 1.2310 1.2345 1.2390

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.