EUR/USD Forecast: German inflation could be the catalyst investors need right now

EUR/USD Current Price: 1.0731

- Central banks’ speakers from Europe and the United States repeated their hawkish rhetoric.

- Germany will release the January Harmonized Index of Consumer Prices on Thursday.

- The EUR/USD pair is under mild pressure and at risk of falling further.

The EUR/USD pair traded in a well-limited range on Wednesday, ending with modest losses in the 1.0720 price zone. The market’s enthusiasm triggered by US Federal Reserve (Fed) Chair Jerome Powell was short-lived, as Wall Street opened with a soft tone, later extending its decline to trim half of Tuesday’s gains.

European Central Bank (ECB) officials were on the wires repeating their hawkish rhetoric. ECB policymaker Klaas Knot said that headline inflation appears to have peaked but added that keeping the current pace of hikes into May could well be needed if underlying inflation does not materially abate.

Across the pond, Fed Governor Lisa Cook said that the central bank remains focused on restoring price stability, as inflation is still running too high. She added that they would need a restrictive monetary policy for some time. Also, New York Federal Reserve President John Williams said that the labor market is still very strong and noted that they have more work to do on rates, adding data will determine the path of rate hikes. Finally, Fed Governor Christopher Waller warned that interest rates could go higher than expected.

Data-wise, there were no relevant figures to care of. The United States released MBA Mortgage Applications for the week ended February 3, which increased by 7.4%. On the other hand, Thursday will be a bit more interesting as Germany will finally publish the delayed preliminary estimate of its January Harmonized Index of Consumer Prices (HICP). Inflation is seen up by 10% YoY, increasing from the previous 9.6% but below the current inflationary cycle peak of 11.6% reached in October 2022. Higher numbers could be seen as support for the hawkish European Central Bank (ECB) case, pushing EUR/USD higher.

Also, the Euro Zone will release the European Commission releases Economic Growth Forecasts, while the United States will unveil weekly unemployment figures.

EUR/USD short-term technical outlook

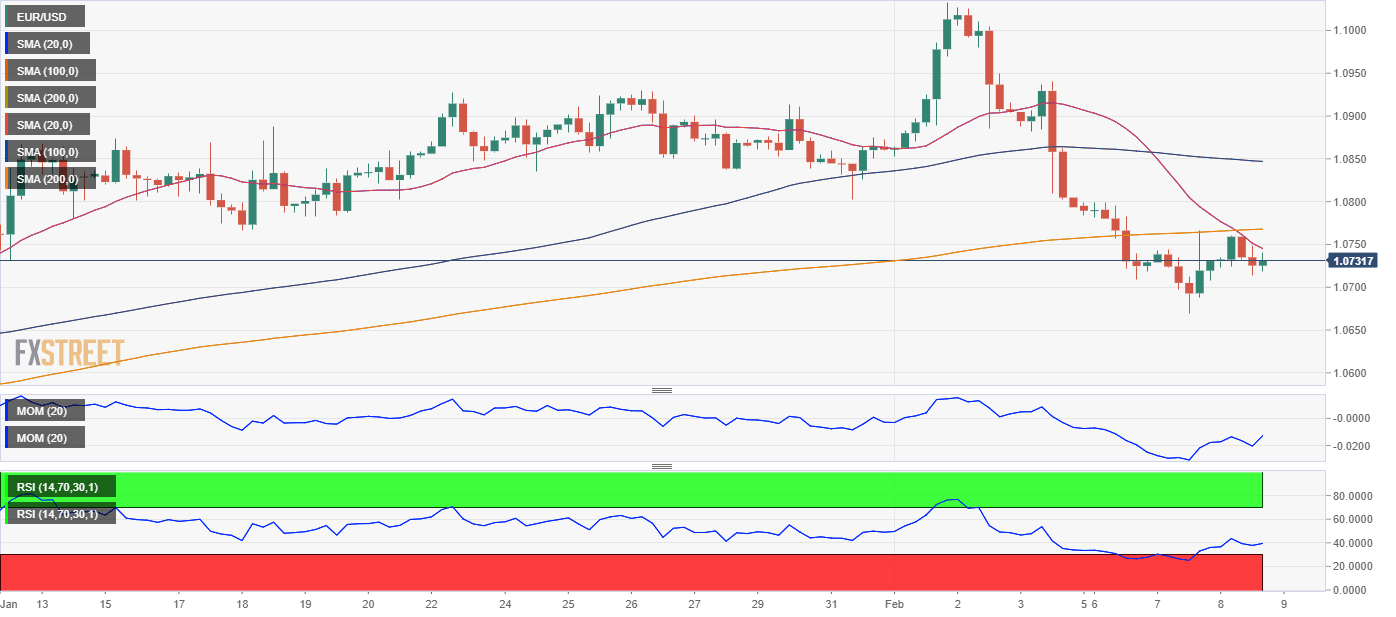

The EUR/USD pair spent most of Wednesday seesawing in the 1.0730/60 price zone and is currently hovering around 1.0730. The daily chart shows that the pair is developing below a flat 20 SMA while meeting sellers on attempts to run past a Fibonacci resistance level, the 61.8% retracement of the 2022 slide at 1.0745. Furthermore, technical indicators remain within negative levels, although without directional strength. Finally, the 100 SMA is crossing above the 200 SMA in the 1.0320 area, which somehow limits the bearish potential.

Technical readings in the 4-hour chart skew the risk to the downside. The pair develops below all of its moving averages, with the 20 SMA crossing below the 200 SMA and currently converging with the aforementioned resistance level. Technical indicators, in the meantime, remain within negative levels, the Momentum aiming marginally higher below its midline, while the RSI indicator has turned marginally lower at around 40.

Support levels: 1.0700 1.0660 1.0615

Resistance levels: 1.0745 1.0790 1.0840

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.