EUR/USD Forecast: Future price action hinges on US PCE

- EUR/USD reclaimed the area beyond 1.0700.

- The US Dollar faced renewed downside pressure.

- Markets now look at the release of US PCE.

The irruption of selling interest in the US Dollar (USD) prompted the USD Index (DXY) to give away part of the recent advance beyond the 106.00 level and refocus on the downside instead, allowing EUR/USD to regain balance and reclaim levels above 1.0700 the figure on Thursday.

In fact, the euro (EUR) managed to set aside some of the recent negative sentiment amidst reduced political concerns in France ahead of the June 30 snap elections.

The macroeconomic situation on both sides of the Atlantic remained steady, with the European Central Bank (ECB) contemplating further rate cuts beyond summer. Market expectations suggest two more ECB rate cuts later in the year.

On this, ECB’s rate-setter Peter Kazimir said the bank might consider another interest rate cut later this year after the reduction implemented this month, although not during the summer.

On the other side of the road, market participants were still debating whether the Federal Reserve (Fed) would implement one or two rate cuts this year, despite the Fed forecasting just one cut, likely in December.

It is worth recalling that part of the recent uptick in the US Dollar came in response to hawkish comments from Fed officials, while the widening monetary policy gap between the Fed and other major central banks also contributed to the euro's decline.

On Wednesday, FOMC Governor Michelle Bowman reiterated that her primary view is that inflation will fall further if the policy rate remains unchanged. She stated that rate cuts would be necessary if inflation stabilised around 2%. Her colleague Raphael Bostic, President of the Atlanta Fed, argued that inflation in the US "seems to be decreasing," potentially paving the way for the Fed to reduce interest rates later this year.

The CME Group's FedWatch Tool maintains a probability of around 65% of lower interest rates in September vs. a nearly 93% chance at the December 18 gathering.

In the short term, the recent ECB rate cut, compared to the Fed's decision to maintain rates, has widened the policy gap between the two central banks. This could lead to further weakness in EUR/USD.

However, the Eurozone's emerging economic recovery and perceived weakening of US fundamentals are expected to reduce this disparity, potentially providing occasional support for the pair in the near future.

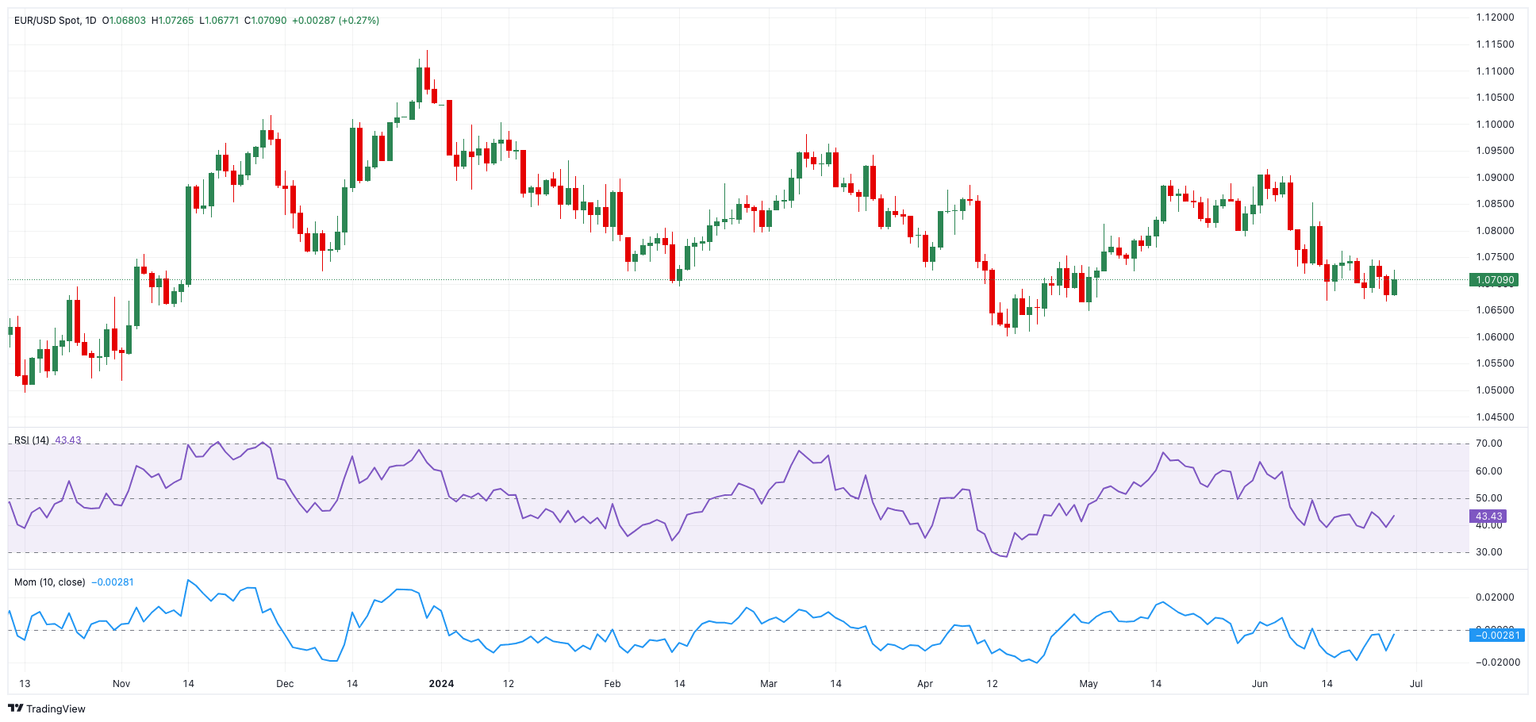

EUR/USD daily chart

EUR/USD short-term technical outlook

If bears maintain control, EUR/USD may revisit the June low of 1.0666 (June 26), then the May low of 1.0649 (May 1), and lastly the 2024 bottom of 1.0601 (April 16).

Meanwhile, occasional bouts of strength may put the pair on track to revisit the 200-day SMA at 1.0789, prior to the weekly high of 1.0852 (June 12) and the June top of 1.0916 (June 4). The breakout of this level could put the March peak of 1.0981 (March 8) back on the radar ahead of the weekly high of 1.0998 (January 11) and the psychological 1.1000 yardstick.

So far, the 4-hour chart shows some evidence of ongoing recovery. The initial resistance is at 1.0746, then 1.0761, and finally 1.0800. The initial support is at 1.0666, ahead of 1.0649 and 1.0601. The Relative Strength Index (RSI) rebounded to around 50.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.