EUR/USD Forecast: Five reasons for a correction before the next move higher

- EUR/USD has hit 1.11 – the highest since March – amid hopes for EU stimulus, dollar weakness.

- The sharp run may be followed by a temporary rethink and a drop.

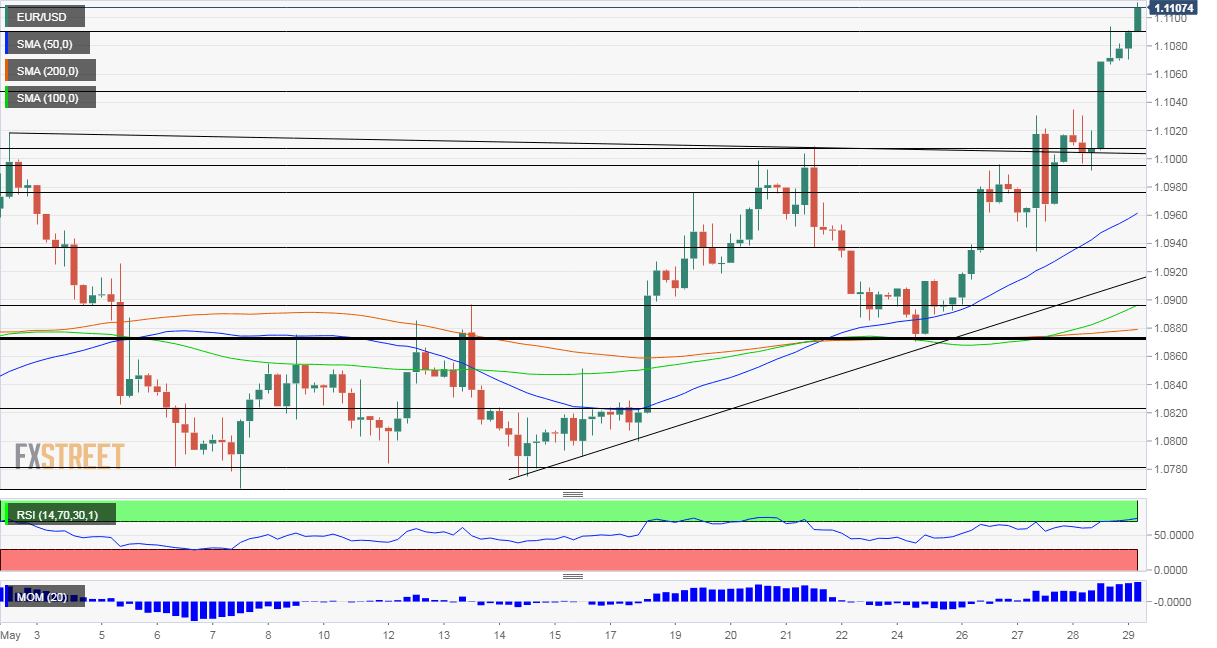

- Friday's four-hour chart is showing stretched conditions.

Another day, another round number smashed – at 1.11, the world's most popular currency pair is trading at the highest since March. The primary driver during the week has been the European recovery plan, which is a major shift in policy and may kickstart economic recovery. Another reason is dollar weakness, despite growing Sino-American tensions. EUR/USD may struggle to extend its gains, due to the following reasons:

1) Frugal Four fighting back

The European Commission's ambitious plan, which includes €500 billion of grants funded by mutual borrowing – coronabonds in all but name – is a good reason for the euro's rise. The backing of Germany and France should be sufficient to pass the program over the line.

However, the "Frugal Four" – Austria, the Netherlands, Sweden, and Denmark – previously voiced their objections. While the continent's largest economies usually get what they want, any public rejection by these hawkish countries may cast doubts and trigger a correction.

2) Dollar strength ahead of Trump

The US is set to retaliate for China's new security law – tightening Beijing's grip on Hong-Kong. After Secretary of State Mike Pompeo certified that the city-state is no longer autonomous, President Donald Trump is set to deliver a speech announcing measures to retaliate against China.

These could move between token sanctions on Chinese officials to more severe steps related to trade. So far, the world's largest economies pledged to uphold the trade deal, yet investors may fear that it could change. Washington may opt for a tougher stance also after Beijing talked about a "peaceful reunification" with Taiwan, a statement seen as a threat to the island nation.

Stocks are on the back foot while the dollar is also down – that is an anomaly that has been unseen for a long time. Uncertainty ahead of Trump's speech may cause a return to usual behavior – dollar strength. Once the dust settles, the greenback may resume its falls.

See Trump to hold China news conference on Friday, risk-off themes will be in play

3) Depressing data

The calendar is packed with events. Preliminary eurozone consumer prices for May are set to fall, reminding investors that the European Central Bank has additional reasons to maintain its accommodative policy.

Eurozone Inflation Preview: EUR/USD has the wind in its back, and only a dual dip could down it

In the US, Personal Income, Personal Spending also the Federal Reserve's preferred gauge of inflation may also paint a gloomy picture, weighing on sentiment.

See Core PCE, Personal Spending and Income Preview: The fall of records, where the wage earner leads, the consumer is sure to follow

4) End of month flows

The last day of the week is also the final trading day of May. Money managers adjust their portfolios and may push EUR/USD closer to the range seen throughout the month.

While such choppy moves are unlikely to change the trend, they could cause jitters in the European afternoon, around the London fix.

5) Overbought conditions

The Relative Strength Index on the four-hour chart is just above 70 – pointing to overbought conditions and a potential downside correction. Momentum remains to the upside and the currency pair is trading well above the 50, 100, and 200 Simple Moving Averages. All in all, the trend is positive but a setback is on the cards before the next leg higher.

Support awaits at 1.1090, which was a peak in the winter, and it is followed by 1.1050, also a battle line. Further down, the former peak of 1.1010 now turns into support. It is followed by 1.0975, a swing high, and then by 1.0940 and 1.0895.

Some resistance is at 1.1111, which is 0.90 on USD/EUR, followed by the late-March peak of 1.1150. Further above, 1.12 and 1.240 are in play.

More Looking toward the recovery: currency drivers and what to watch out for

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.