Eurozone Inflation Preview: EUR/USD has the wind in its back, and only a dual dip could down it

- Preliminary eurozone CPI data for May will likely show depressed inflation.

- A drop of the headline figure below 0% and core prices under 0.8% could weigh on the euro.

- Without shocking figures, the common currency has room to rise.

Investors have been ignoring inflation amid the coronavirus pandemic – yet deflation does matter and can have a significant impact.

Why EUR/USD traders should care

While every consumer likes a bargain, an ongoing drop in prices may have a detrimental effect on the economy. When shoppers begin expecting costs to fall, they may defer expenditure to the future. In turn, manufacturers produce fewer products, lay off workers, which in turn have less money to spend.

Mario Draghi, the previous ECB president, worked hard to avoid such a scenario. Coronavirus puts his successor, Christine Lagarde, to the test. Is the eurozone already experiencing negative inflation? That would make the problem more urgent and impact the euro.

Moreover, as European countries are curbing COVID-19, the European Central Bank is set to pay more attention to keeping the headline Consumer Price Index "at or close to 2%," as its mandate dictates. A drop below 0% is becoming closer.

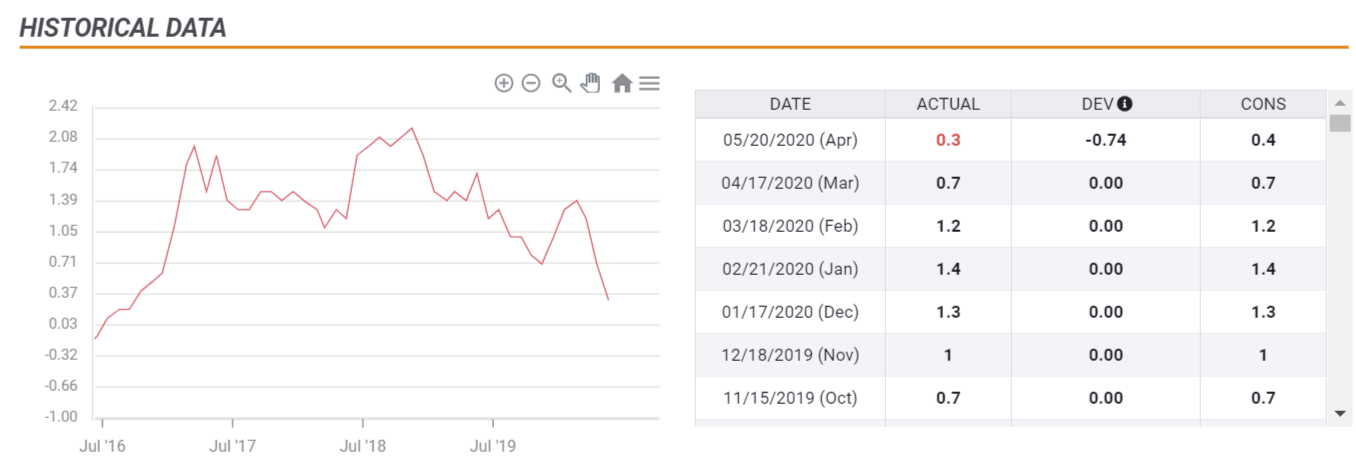

Headline CPI tumbled down to 0.3% yearly in April, driven by falling energy costs. Oil had a turbulent May but traded below last year's levels throughout the month. Petrol will likely put pressure on CPI, with expectations standing at 0.2%. A drop to 0% – stagnation – or even outright deflation, cannot be ruled out.

In that case, the ECB may consider further cutting its deposit rate. But will it be enough to push down the euro?

Euro enjoys tailwind

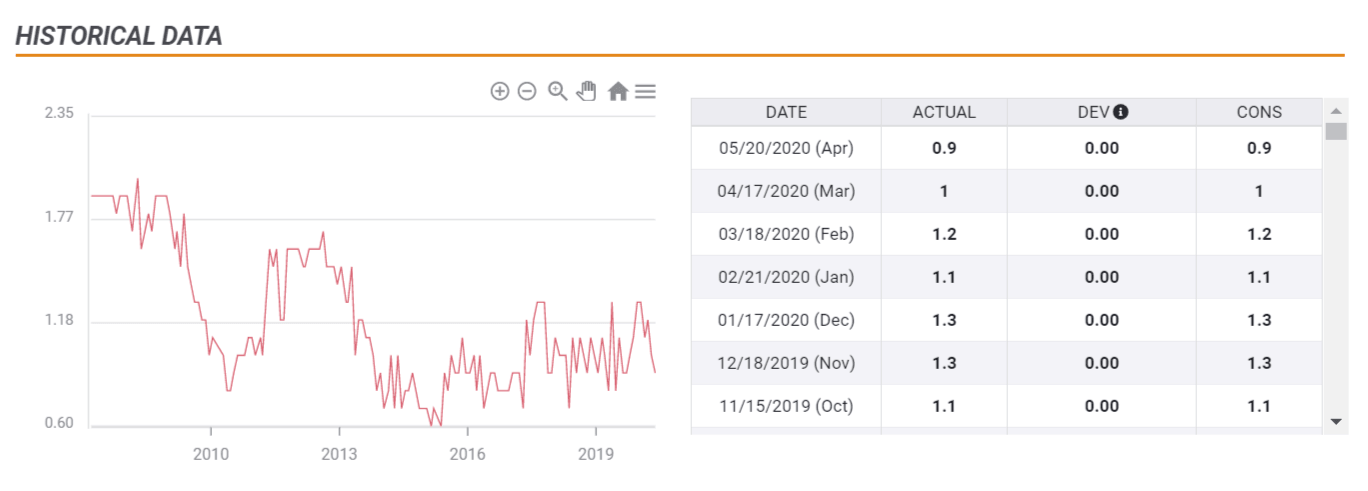

A sub-zero inflation rate may be insufficient to down the common currency. First, crude prices tend to fluctuate, and despite the ECB's strict mandate, officials have also been looking at core CPI in recent years. That is expected to remain stable at 0.9%, which is below pre-coronavirus levels, but within the ranges seen in recent years.

Secondly, the euro enjoys the Franco-German agreement for a €500 billion euro fund that will include borrowing by European institutions and will be deployed in the form of grants. While a group of countries called "The Frugal Four" have raised objections, the backing of the continent's largest economies should be sufficient to pass it over the line.

Thirdly, coronavirus statistics have been encouraging in Europe's largest countries. Italy and Spain have been accelerating their preparations to return to normal as the disease's spread seems to have been arrested.

Assuming all these factors remain in play at the time of the publication, it would probably take core inflation to dive to 0.7% or lower to weigh on the euro. That would already be significantly below expectations.

A mix of deflation in the headline figure and a blow to core CPI would already show the economic damage is deeper than projected and would require more action from the ECB.

See: Negative Rates: Only good for downing currencies?

In any other case, EUR/USD would likely trade choppily in range or even rise, especially if Core CPI rises to the round number of 1% or even exceeds it.

Conclusion

The euro is benefitting from several positive developments and only a dual drop of headline CPI below 0% and a fall in underlying inflation to 0.7% or lower would weigh on the common currency. Otherwise, EUR/USD will likely hold its ground and even advance.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.