EUR/USD Forecast: Euro stays vulnerable, tests key support

- EUR/USD has failed to hold above 1.0900 following Monday's recovery.

- A four-hour close below 1.0860 could open the door for additional losses.

- CPI inflation in the US is expected to jump to 8.5% in March.

EUR/USD has turned south, once again, after having failed to hold above 1.0900 on Monday. The pair is testing key support at 1.0860 and it could extend its slide in case this level turns into resistance.

The steep decline witnessed in Wall Street's main indexes provided a boost to the greenback in the second half of the day on Monday and forced EUR/USD to erase its daily recovery gains. In addition to the risk-averse market environment, the ongoing rally in the US Treasury bond yields provided a boost to the dollar.

A survey conducted by Reuters showed that 85 of 102 polled economists expected the Fed to hike the policy rate by 50 basis points (bps) in May. 56 of them saw the Fed raising the rate by another 50 bps in June.

Later in the session, the US Bureau of Labor Statistics will release the March inflation report. The Consumer Price Index (CPI) is expected to jump to a fresh multi-decade high of 8.5% in March. A stronger-than-expected CPI print could open the door for another leg higher in the US Dollar Index (DXY). On the other hand, a soft inflation reading could trigger a correction in the DXY and help EUR/USD limit its losses.

US Consumer Price Index March Preview: Federal Reserve policy affirmed.

Earlier in the day, the data from Germany revealed that the Harmonised Index of Consumer Prices (HICP) rose to 7.6% in March, matching the flash estimate and the market forecast. The ZEW Economic Sentiment Index for the eurozone and Germany will be looked upon for fresh impetus as well. In case the survey points to a sharp deterioration in business confidence in April, EUR/USD could stay on the back foot ahead of the US data.

EUR/USD Technical Analysis

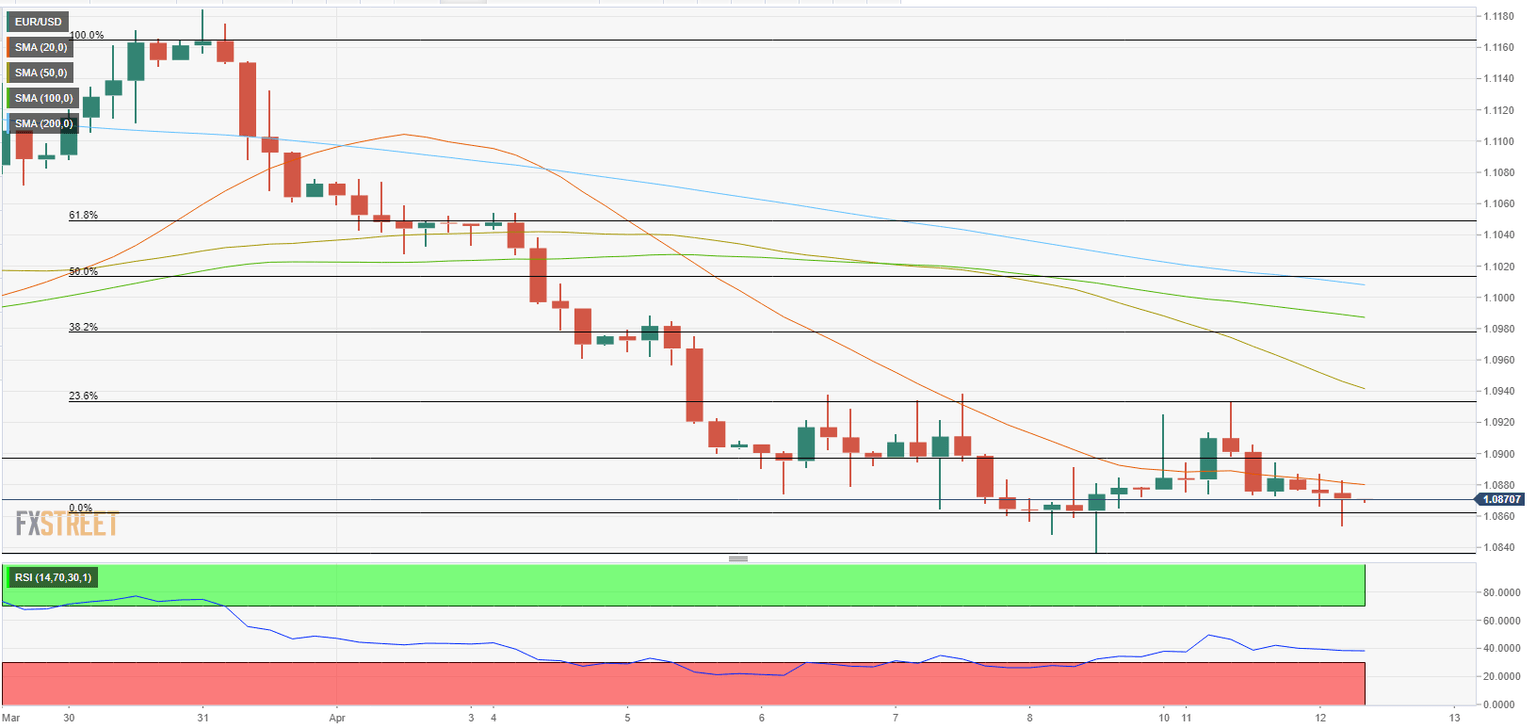

1.0860 aligns as key support for EUR/USD. Although the pair dropped below this level last week and early Tuesday, it failed to make a four-hour close below it. If this support fails, 1.0835 (April 8 low) could be seen as interim support ahead of 1.0800 (psychological level).

On the upside, 1.0900 (psychological level) forms the first hurdle before 1.0940 (Fibonacci 23.6% retracement of the latest downtrend, 50-period SMA on the four-hour chart) and 1.0980 (Fibonacci 38.2% retracement, 100-period SMA).

Meanwhile, the Relative Strength Index (RSI) indicator stays near 40, suggesting that the pair has some more room on the downside before turning technically oversold.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.