EUR/USD Forecast: EUR/USD poised to extend decline towards 1.1000

EUR/USD Current price: 1.1046

- Fears of a Eurozone recession weighed on the Euro.

- US inflation and ECB’s monetary policy coming up this week.

- EUR/USD under selling pressure, critical support at 1.1020.

The EUR/USD pair eased towards 1.1035 during European trading hours, as the Euro got hit by poor local data fueling concerns about the Eurozone’s economic performance. At the same time, the US Dollar remained resilient amid caution ahead of first-tier events scheduled for later this week.

The EU released September Sentix Investor Confidence, which fell for a third consecutive month, printing at -15.4. The accompanying report showed the economy is on the brink of a recession and that the poor performance of the German economy plays a major role in this. The United States (US) macroeconomic calendar will remain light on Monday, as the country will release July Wholesale Inventories and Consumer Credit Change for the same month.

However, the US will publish the August Consumer Price Index (CPI) on Wednesday, expected to have risen by 2.6% in the previous twelve months. Such a reading will be still above the Federal Reserve (Fed) goal of around 2%, but will be better than the 2.9% posted in July. Additionally, the European Central Bank (ECB) will announce its decision on monetary policy on Thursday. The ECB is widely anticipated to trim interest rates by 25 basis points (bps) after already delivering an interest rate cut. EU data released earlier today supports the case for a looser monetary policy amid the risk high rates imply to economic progress.

EUR/USD short-term technical outlook

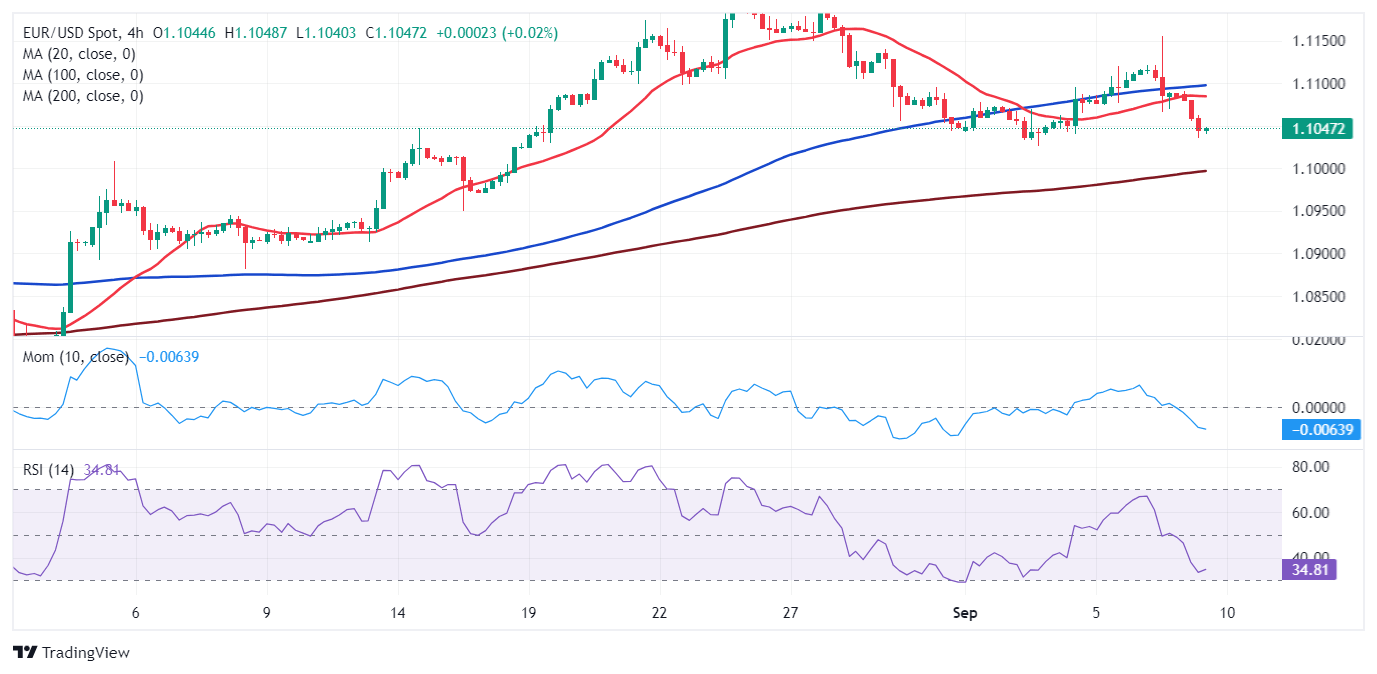

The EUR/USD pair is sharply down for a second consecutive day, and technical readings in the daily chart show the slide may continue. The pair gapped lower at the opening and fell after filling the gap. A mildly bullish 20 Simple Moving Average (SMA) provides resistance at around 1.1090, while the 100 SMA slowly advances above the 200 SMA in the 1.0850 price zone. Nevertheless, technical indicators head firmly south, and the Momentum indicator has already crossed below its 100 level, in line with continued selling pressure.

In the near term, and according to the 4-hour chart, the risk skews to the downside. The pair has extended its slide below the 20 and 100 SMAs, with the shorter one slowly gaining downward traction. Technical indicators have stabilized as the pair bounced from the aforementioned intraday low, but remain within negative levels, without signs of downward exhaustion. An immediate support level comes at 1.1020, with a break below it likely resulting in another steep leg south.

Support levels: 1.1020 1.0975 1.0930

Resistance levels: 1.1090 1.1115 1.1150

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.