EUR/USD Forecast: Dollar gives signs of self-strength

EUR/USD Current Price: 1.2012

- USD dollar advanced despite lower equities and retreating US Treasury yields.

- US Treasury Secretary Janet Yellen said that rates might rise to prevent overheating the economy.

- EUR/USD is under pressure and near a critical Fibonacci support level at 1.1980.

The EUR/USD pair edged marginally lower, ending the day around 1.2010 after hitting a daily low of 1.1998. The American dollar has strengthened against most of its major rivals, despite fluctuating stocks behavior. European indexes firmed up for most of the session, leading to gains in US futures, but there was a sudden U-turn ahead of Wall Street’s opening that led to substantial losses in European and American stocks. Wall Street bounced off intraday lows, reached after US Treasury Secretary Janet Yellen said that at some point, “interest rates will have to rise somewhat to make sure that our economy doesn't overheat.”

The US published the March Goods Trade Balance, which posted a deficit of $ 91.6 billion and Factory Orders for the same month that advanced a modest 1.1%, missing the market’s expectations. May IBD/TIPP Economic Optimism came in at 54.4, down from 56.4 in the previous month.

The macroeconomic calendar will include on Wednesday the Markit Services PMIs for the EU and the US. The latter will publish the ISM Services PMI, foreseen at 64.3 from 63.7 previously.

EUR/USD short-term technical outlook

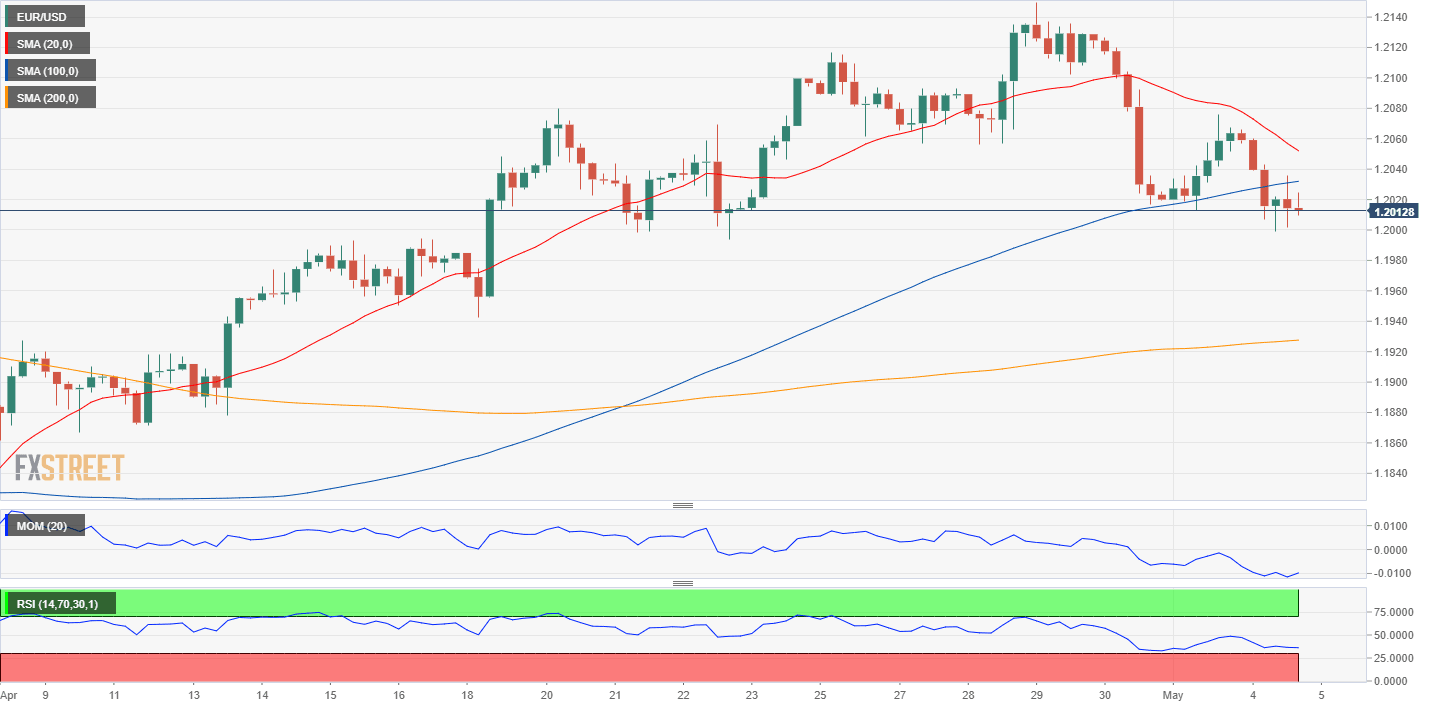

The EUR/USD pair is at risk of falling further. The 4-hour chart shows that it has been unable to recover above its 100 SMA once below it, while the 20 SMA extended its slide above the longer one. Technical indicators have bounced from near oversold readings but remain well into negative levels, with the RSI flat at around 41, a sign of decreased buying interest. The 38.2% retracement of the latest bullish run comes at 1.1980, with a break below it opening the door for a steeper decline.

Support levels: 1.1980 1.1930 1.1875

Resistance levels: 1.2045 1.2090 1.2130

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.