EUR/USD Forecast: Depressed around 1.0900

EUR/USD Current Price: 1.0904

- The German Business Climate improved in May according to the IFO survey.

- A holiday in the US anticipates further consolidation ahead for major pairs.

- EUR/USD at risk of extending its slide after posting a fresh 5-day low.

The EUR/USD pair hovers around the 1.0900 level in a quiet start to the week, with the shared currency founding support in a better than anticipated German IFO Survey. According to it, the Business Climate in the country improved in May to 79.5 from 74.2. Expectations also improved, although the assessment of the current situation worsened. Holidays in the UK and the US keep the macroeconomic calendar empty and majors confined to familiar levels.

Meanwhile, tensions between the US and China weighed on the market’s mood. Nevertheless, European indexes are firmly up, while US futures are also higher.

EUR/USD short-term technical outlook

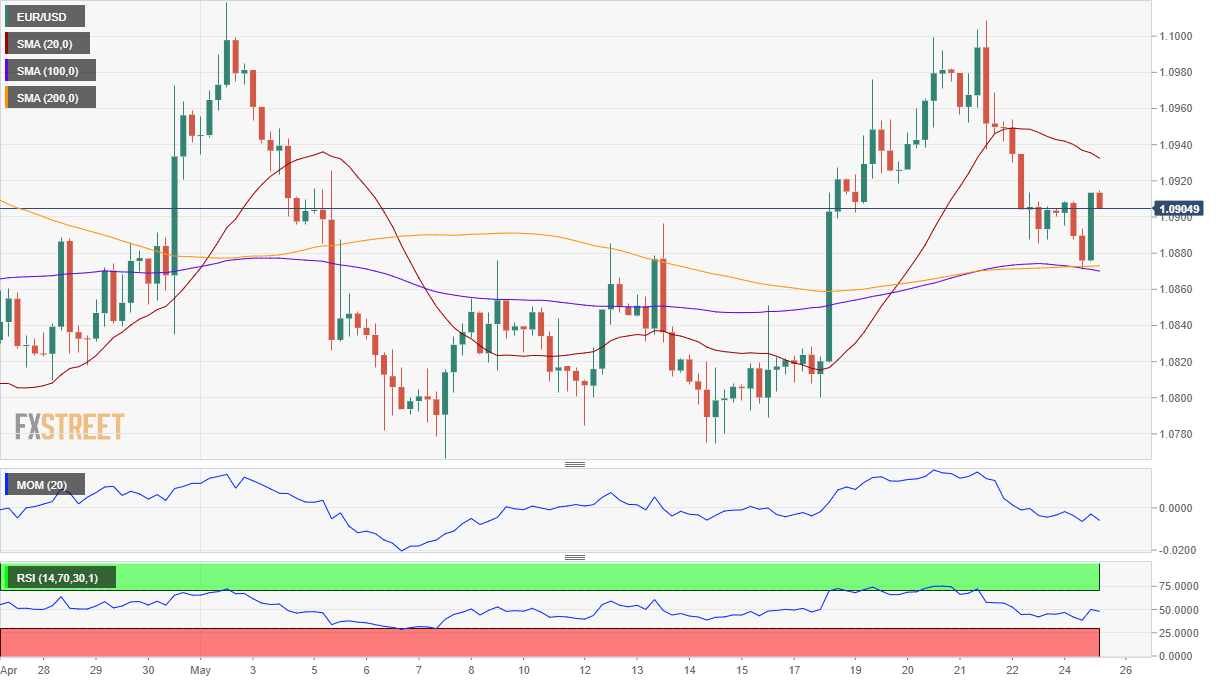

The EUR/USD pair is still on the bearish side, as it reached a 5-day low of 1.0870, now barely trading above its daily opening. The 4-hour chart shows that it met buyers around the 100 and 200 SMA, both converging with the mentioned level, while the 20 SMA maintains its bearish slope above the current level. Technical indicators, in the meantime, have bounced from oversold readings, but lack enough strength to confirm further advances.

Support levels: 1.0870 1.0830 1.0790

Resistance levels: 1.0925 1.0960 1.1000

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.