EUR/USD Forecast: Confident bulls aim for 1.0900 and beyond

EUR/USD Current Price: 1.0842

- Easing banking-related concerns maintain financial markets in risk-on mode.

- US Treasury yields tick higher ahead of the American open.

- EUR/USD pressures its intraday high, aiming to extend gains towards 1.0900.

The EUR/USD pair kept grinding higher throughout the first half of Tuesday, pressuring its daily high in the 1.0840 area ahead of Wall Street's open. The market optimism amid receding stress about the banking sector's health underpins the Euro and high-yielding assets in general. Asian shares ended a two-day losing streak and closed in the green, helping European and American futures to remain afloat.

The US Dollar eases even though Treasury yields are up. The 10-year note yields 3.56%, while the 2-year now offers 4.02%. Higher yields could be explained by falling bond prices in a risk-on scenario. Meanwhile, a scarce macroeconomic calendar keeps sentiment as the major market lead. The Eurozone did not publish relevant macroeconomic figures, while the United States has just released the preliminary estimate of the February Goods Trade Balance, which posted a deficit of $91.6 billion, worse than anticipated, and Wholesale Inventories for the same period, up a modest 0.2% MoM. Later in the American session, the country will publish March CB Consumer Confidence, foreseen contracting for a third consecutive month to 101.0 from 102.9 in February.

EUR/USD short-term technical outlook

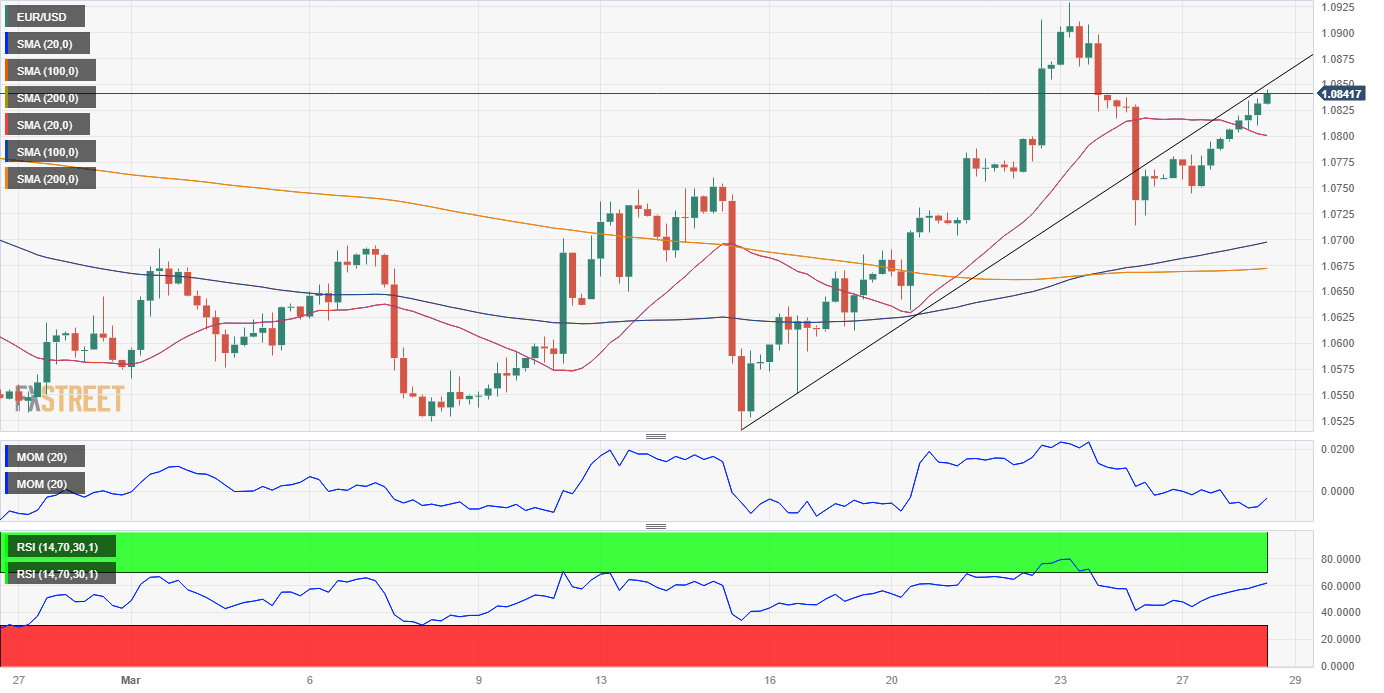

The EUR/USD pair is up for a second consecutive day, enough to trim Friday's losses. It kept recovering after bottoming at 1.0750 on Monday, as buyers defend the downside at around 1.0745, the 61.8% Fibonacci retracement of the 2022 yearly decline. In the daily chart, the pair develops above bullish moving averages, with the 20 Simple Moving Average (SMA) extending its bullish slope above an also bullish 100 SMA. At the same time, technical indicators head north within positive levels, flirting with two-month highs.

In the near term, and according to the 4-hour chart, the chances of an upward extension have increased. The pair has recovered above a mildly bearish 20 SMA, finding buyers on a pullback to it. At the same time, the 100 SMA crossed above the 200 SMA, both in the 1.0660/90 region, with the shorter gaining ground above the longer one. Finally, technical indicators head firmly higher, the Momentum within neutral levels, but the Relative Strength Index (RSI) indicator already at 62, reflecting substantial buying interest and in line with further gains ahead.

Support levels: 1.0790 1.0745 1.0700

Resistance levels: 1.0860 1.0910 1.0950

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.