EUR/USD Forecast: Capped by sellers around 1.0950

EUR/USD Current Price: 1.0921

- Coronavirus-related curves in Europe are giving encouraging signs.

- US markets to resume activity after a long weekend.

- EUR/USD could turn bearish on a break below 1.0890, a Fibonacci support level.

The EUR/USD pair is trading at around 1.0920, having peaked at 1.0967 at fallen to 1.0902 in thin trading, as most markets are close due to Easter Monday. Weekend developments have had a limited impact so far in currencies, although things could start moving with Wall Street’s opening, as US markets will return to normal.

In the coronavirus front, there are more encouraging signs coming from Europe, as Italy seems to have finally passed the peak, reporting the lowest number of deaths in three weeks. Also, Spain’s fatalities decreased, while Germany reported the smallest number of new contagions. Concerns come from Asia, as China reported over 100 new cases, all from abroad, while Japan also informed an increase in cases.

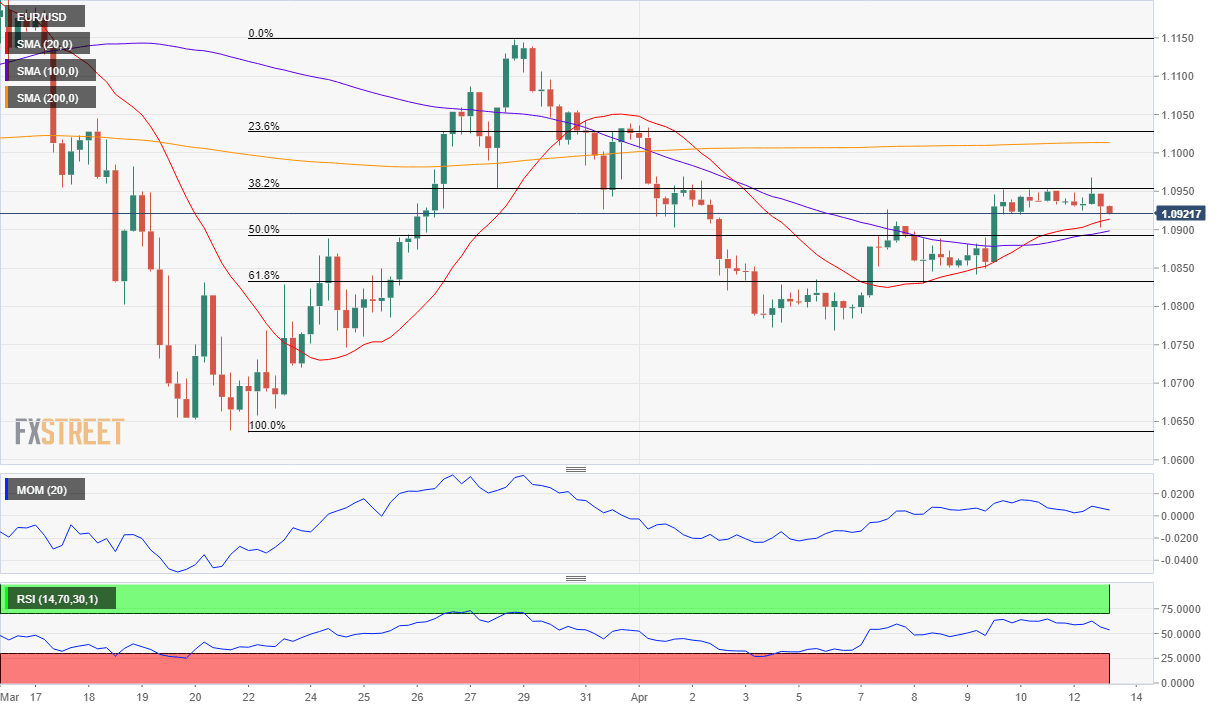

EUR/USD short-term technical outlook

The EUR/USD pair is technically neutral according to the 4-hour chart, with technical indicators hovering within positive levels but lacking clear directional strength. The price, in the meantime, is holding between directionless moving averages, with the 20 and 100 SMA converging a few pips below the current level. A relevant resistance comes at 1.0950, the 38.2% retracement of the latest daily advance. The 50% retracement of the same rally provides support at 1.0890.

Support levels: 1.0890 1.0850 1.0820

Resistance levels: 1.0950 1.0990 1.1020

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.