EUR/USD Forecast: Bulls maintain the pressure

EUR/USD Current price: 1.0853

- Market participants await critical inflation figures for the United States and the Eurozone.

- European Central Bank President Christine Lagarde speaks about the ECB Annual Report.

- EUR/USD trades just below a Fibonacci resistance level with an increased upward momentum.

The EUR/USD pair is marginally higher on Monday, trading in the 1.0850 price zone ahead of the United States (US) opening. The US Dollar is under selling pressure after struggling for direction on Friday, although major pairs remain within familiar levels. The market mood tumbled during Asian trading hours following news from late last week that Moody’s Investors Services removed credit rantings from several Chinese companies, spurring concerns about the country’s economic health.

The sentiment improved partially in Europe, as most local indexes trade with gains, but investors remain cautious ahead of stellar inflation-related figures scheduled throughout the week. Next Thursday, the US will release the Core Personal Consumption Expenditures (PCE) Price Index, the Federal Reserve’s (Fed) favorite inflation gauge. Also these days, Europe and Germany will unveil the preliminary estimates of the February Harmonized Index of Consumer Prices (HICP), while China will publish the official NBS Producer Manager Indexes (PMIs).

In the near term, the focus is on the European Central Bank (ECB) President Christine Lagarde, who is due to speak about the ECB Annual Report in Strasbourg and US Treasury auctions in the American afternoon.

EUR/USD short-term technical outlook

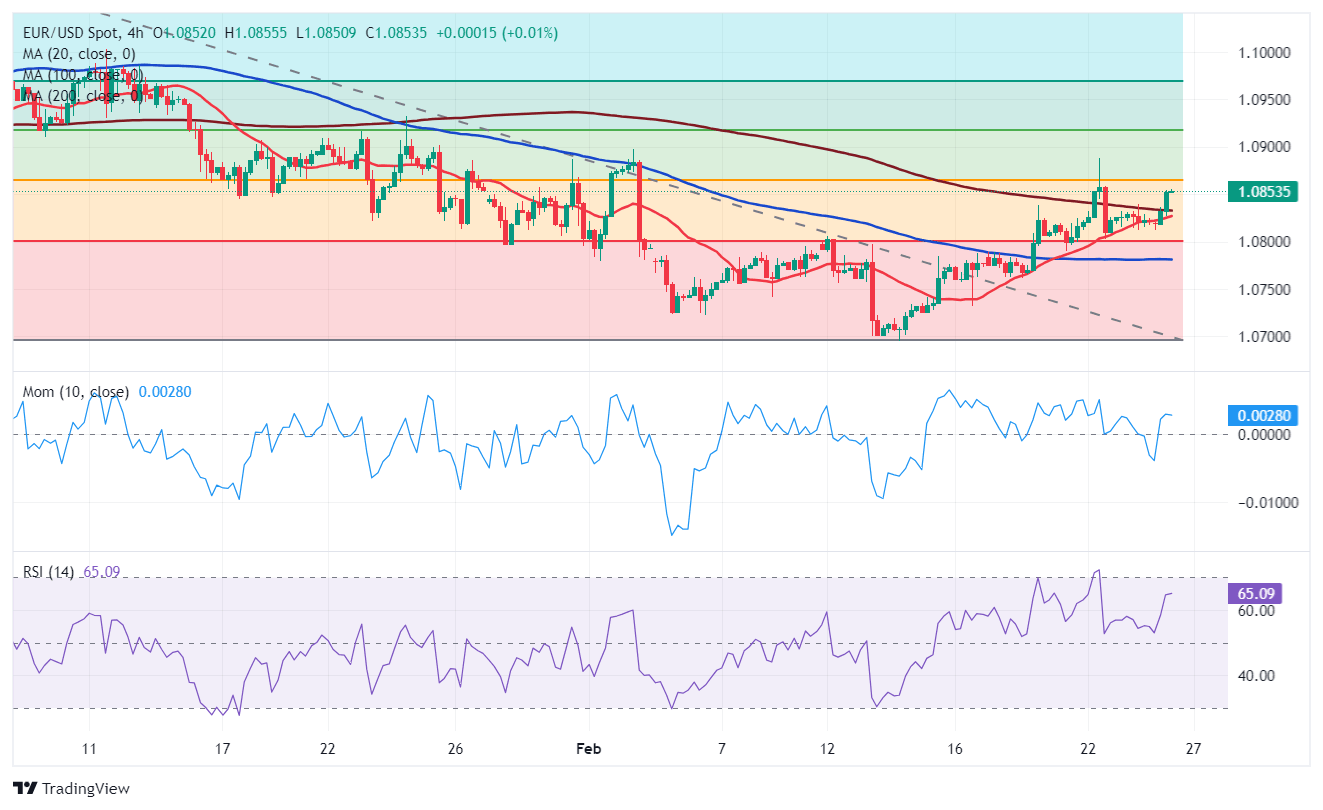

The EUR/USD pair trades just below the 38.2% Fibonacci retracement of the 1.1139-1.0694 daily slump at 1.0865, and technical readings in the daily chart favor an upward extension. The pair met buyers around a mildly bullish 100 Simple Moving Average (SMA) while extending its gains beyond a directionless 200 SMA, the latter at 1.0825. At the same time, technical indicators aim north within positive levels, suggesting buyers retain control.

For the near term, technical readings in the 4-hour chart also indicate that the risk skews to the upside. EUR/USD trades above all its moving averages, while the 20 SMA aims to cross above a mildly bearish 200 SMA. Technical indicators, in the meantime, turned sharply higher within positive levels, in line with another leg north.

Support levels: 1.0825 1.0770 1.0720

Resistance levels: 1.0865 1.0910 1.0950

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.