EUR/USD Forecast: Bulls battling to extend the advance beyond 1.1800

EUR/USD Current Price: 1.1783

- US inflation ticked higher in July, further boosting the positive ruling mood.

- Equities continue to rally, providing support to the shared currency.

- EUR/USD is heading north but a bullish continuation not yet confirmed.

The EUR/USD pair hit a lower low for the week at 1.1710, although the latest dollar’s strength has somehow receded, with the greenback trading unevenly against its major rivals. However, and given the positive momentum of equities, the dollar’s bullish potential seems limited at the time being.

In the data front, the EU published June Industrial Production, which improved by less than anticipated, printing at -12.3% YoY vs the previous -20.4%. Monthly basis, production increased by 9.1%, below the previous 12.3% and the expected 10%. The US has just published July inflation data. The monthly consumer price index was up 0.6% in the month, matching the previous month reading and beating expectations of 0.3%. Yearly basis, the CPI was up 1%, while the core yearly reading printed at 1.6%, both beating expectations.

EUR/USD short-term technical outlook

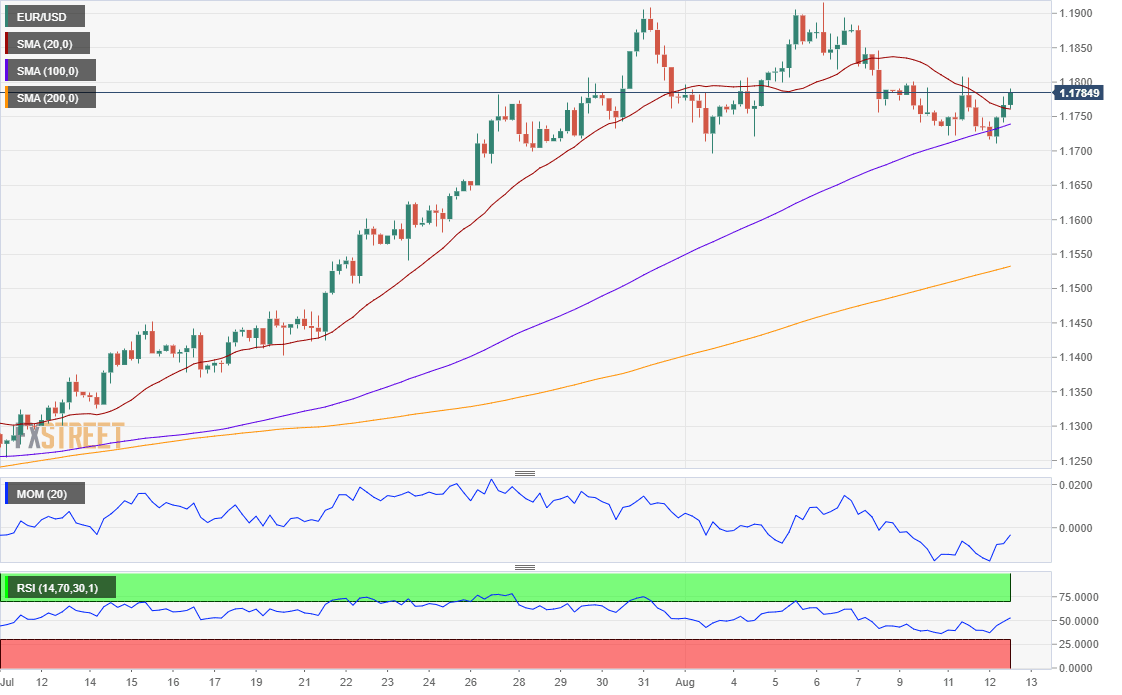

The EUR/USD pair is trading in the 1.1780 price zone, at the higher end of its weekly range. The 4-hour chart shows that it’s currently advancing above a bearish 20 SMA, after finding buyers around a bullish 100 SMA. Technical indicators, in the meantime, head north but remain stuck to neutral levels. The pair would need to advance beyond 1.1830 to confirm an upcoming bullish extension towards this year high at 1.1915.

Support levels: 1.1740 1.1690 1.1650

Resistance levels: 1.1830 1.1870 1.1915

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.