- EUR/USD is rising as the dollar retreats alongside yields after the US bond auction.

- Washington's fiscal impasse, vaccine hopes, and jobless claims are in play.

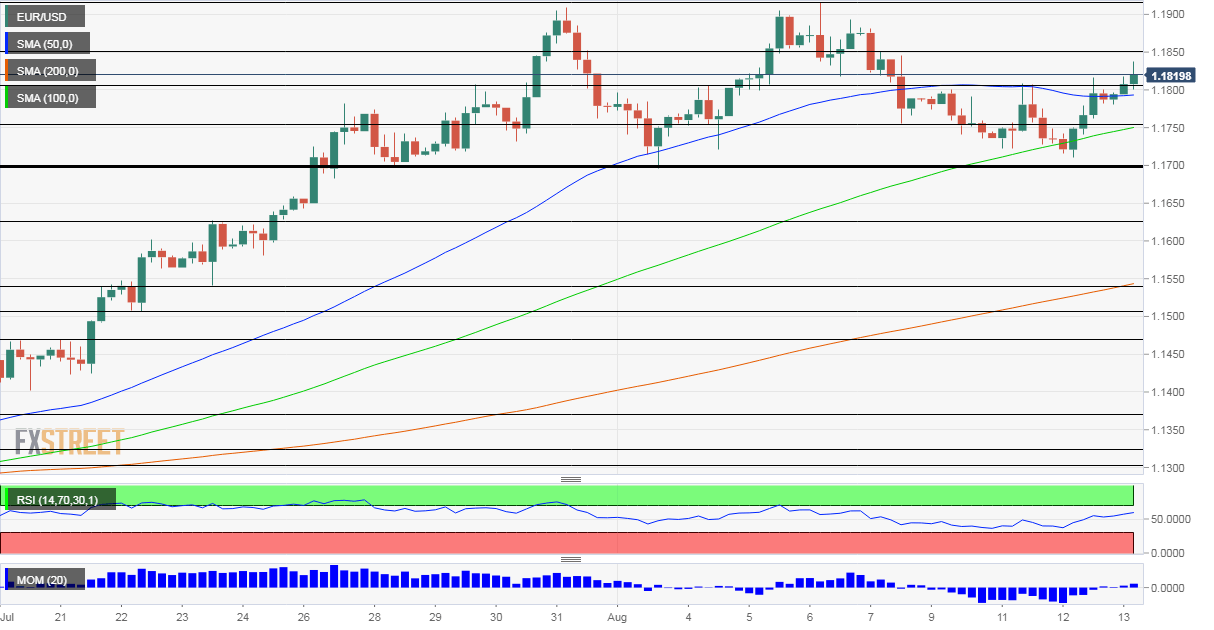

- Thursday's four-hour chart is showing that bulls are in control.

Buy low, sell high – that ancient logic seemed to work in bond markets, this time with a substantial impact on the dollar. Investors sold off US treasuries ahead of the massive $38 billion auctions on Wednesday, pushing bond yields higher and boosting the dollar.

Once Uncle Sam issued that debt at a relatively high yield, traders piled into bonds, pushing yields lower and taking the air out of the dollar.

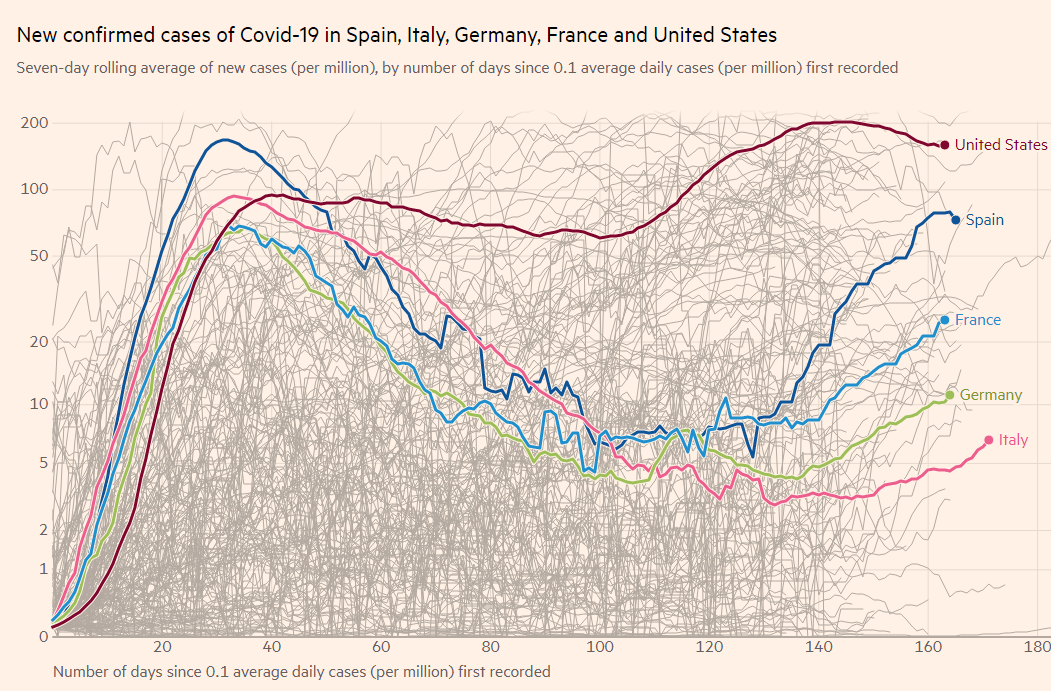

Moving away from that auction, there are other reasons to see EUR/USD gaining ground. First, the US coronavirus situation is better than it used to be but is improving at a snail's pace. The old continent – despite an upswing in infections – is better positioned.

Source: FT

More importantly, the burning issue in Washington is the impasse on Capitol Hill – Democrats and Republicans are still "far apart" on reaching an accord on the next fiscal relief package. Federal Reserve officials have been urging lawmakers to act, raising their rhetoric.

Mary Daly, President of the San Francisco branch of the Federal Reserve, said that there is little evidence to support the claim that high unemployment benefits discourage seeking work in a deep recession. Eric Rosengren, her colleague from the Boston Fed, said that the US failure to control the virus is hiring the recovery and that temporary job losses could turn permanent.

Despite concerns about the US economy, investors are optimistic about a vaccine, as efforts are accelerating – especially after Russia's controversial announcement about developing immunization. The S&P 500 briefly hit a new high on Wednesday, and the risk-on mood is pushing the safe-haven dollar down.

Later in the day, weekly jobless claims will provide an updated view of the US economy. Applications dropped sharply last week after several weeks of worries. Another upbeat figure could help the greenback recover, but nothing is certain.

See Jobless Claims Preview: Lower claims sign of an economic acceleration?

All in all, the deck is stacked against the dollar and in favor of the euro, at least for now.

EUR/USD Technical Analysis

Euro/dollar has recaptured the 50 Simple Moving Average on the four-hour chart and momentum turned positive. Moreover, the world's most popular currency pair bottomed out above the 1.17 level – setting a higher low. The Relative Strength Index remains below 70, thus outside overbought conditions.

All in all, bulls are in control.

Resistance awaits at 1.1850, which provided support last week, and then by 1.1915, the two-year high set around the same time. The next level is the psychologically critical 1.20.

Support awaits at 1.1805, which capped EUR/USD earlier in the week. Further down, 1.1750 and the 1.17 level mentioned earlier await EUR/USD.

More Traders are looking at the shiny thing and not the big picture

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up. The pair traded at 0.6518.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: Slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.