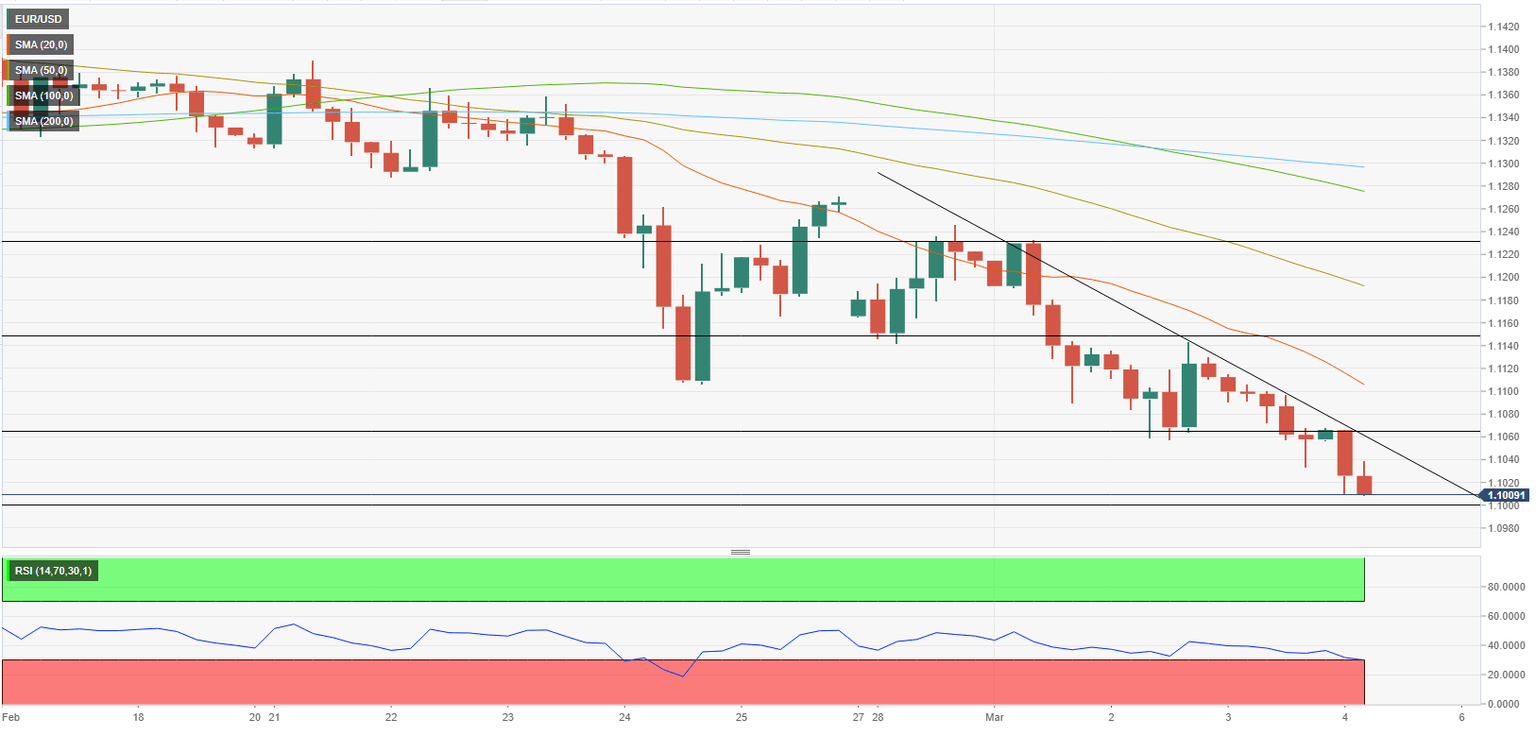

EUR/USD Forecast: Bears to retain control unless euro reclaims 1.1060

- EUR/USD has extended its weekly slide toward 1.1000.

- Former support level at 1.1060 now acts as first resistance for the pair.

- 1.0960 aligns as the next bearish target if 1.1000 support fails.

EUR/USD has met renewed bearish pressure during the Asian trading hours and has extended its weekly decline to a fresh 22-month low near 1.1000. Unless the pair stages a technical correction and reclaims 1.1060, buyers are unlikely to be convinced of a steady rebound and show interest in the euro.

The greenback is preserving its strength on the last day of the week amid the souring market mood following Russia's attack on Ukraine's Zaporizhzhia nuclear power plant. According to Reuters, a Ukrainian regional authority said that the power plant was seized by Russian military forces. Mirroring the risk-averse atmosphere, the US Dollar Index is trading at its highest level since May 2020 at 98.05 and the 10year US Treasury bond yield is down 2.6% at 1.796%.

Later in the session, Eurostat will release January Retail Sales data ahead of the US Bureau of Labor Statistics' February jobs report. Investors expect Nonfarm Payrolls in the US to rise by 400,000 in February following January's increase of 467,000. Unless the NFP data offers a huge negative surprise, the dollar is likely to preserve its strength after FOMC Chairman Powell repeated numerous times that the labour market was quite strong.

The European economy is likely to suffer more than the US economy from a prolonged conflict between Russia and Ukraine, suggesting that the fundamental outlook continues to favour the dollar in current circumstances.

Bloomberg reported earlier in the day that the European Central Bank (ECB) could "press pause" on the exit plan from the stimulus with the Russia-Ukraine was causing uncertainty on the outlook. Additionally, gas flows along the Yamal-Europe pipeline has reportedly stopped, reviving concerns over even higher gas prices and energy inflation.

EUR/USD Technical Analysis

The Relative Strength Index (RSI) on the four-hour chart is now slightly below 30, showing that the pair is technically oversold. Hence, 1.1000 (psychological level) support could hold in the short term and the pair could stage a correction before the next attempt. In case buyers fail to defend that support, the next bearish target is located at 1.0960 (static level).

On the upside, former support of 1.1060 now aligns as initial resistance. The descending trend line coming from Monday reinforces that resistance as well. As long as this level stays intact, sellers should continue to dominate the pair's action. Above 1.1060, 1.1100 (psychological level, 20-period SMA) could be seen as the next resistance before 1.1150 (static level).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.