EUR/USD Forecast: Bears not done yet

EUR/USD Current Price: 1.1636

- German IFO survey showed that Business Climate improved by less than expected.

- US weekly unemployment claims increased in the week finished September 18.

- EUR/USD is bearish and poised to break below the 1.1600 level.

The EUR/USD pair has extended its weekly decline to 1.1626, a fresh two-month low, and trades nearby ahead of the US opening. The American currency advances for a fourth consecutive day amid demand for safety, amid fears related to slowing growth within the current pandemic context. A worse-than-expected IFO report added pressure on the shared currency. The German survey showed that the Business Climate in the country improved in September to 93.4, missing expectations of 93.8.

The US has just published Initial Jobless Claims for the week ended September 18, which came in at 870K worse than the 843K expected and the previous 866K. Continuing Jobless Claims for the week ended September 11 increased to 12.58M. Later today, US Federal Reserve Chief’s Powell and Treasury Secretary Mnuchin will testify before a Senate special commission.

EUR/USD short-term technical outlook

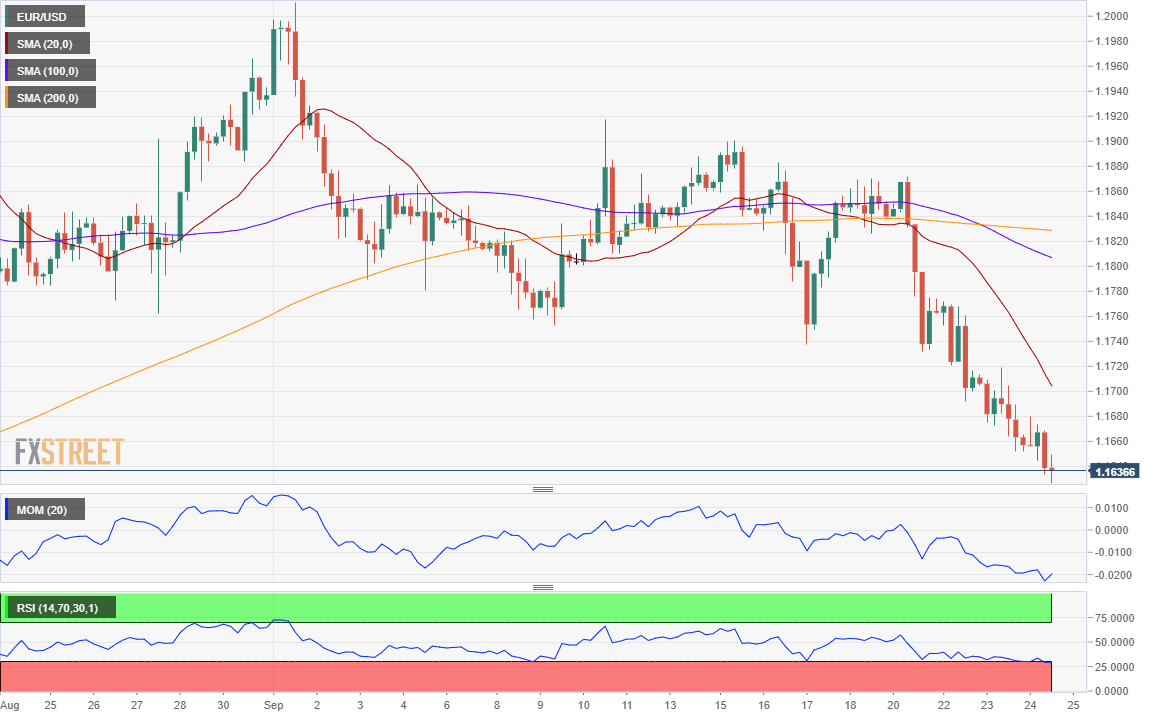

As said, the EUR/USD pair is trading near its daily low, bearish, according to intraday technical readings. The 20 SMA heads lower almost vertically, currently at around 1.1715, while the larger ones grind lower well above it. The Momentum indicator resumed its decline within negative levels, while the RSI consolidates around 30, all of which favors a lower low during the upcoming session.

Support levels: 1.1620 1.1580 1.1535

Resistance levels: 1.1670 1.1715 1.1750

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.