EUR/USD Forecast: A more serious recovery targets 1.0197

- EUR/USD keeps the buying interest unchanged near parity.

- Speculation of a Fed’s 100 bps rate hike lose traction.

- Focus will be on the US calendar later in the NA session.

EUR/USD alternates gains with losses amidst the broad-based lack of a clear direction in the global markets and ahead of key data releases due later in the US calendar.

In addition, a prudent stance might have started to swell among market participants ahead of the key FOMC event on September 21.

On the above, the greenback is expected to remain propped up by constant expectations of a ¾-point rate hike by the Fed later in the month, although a 100 bps raise remains on the table as per CME Group’s FedWatch Tool, which places the possibility of this outcome at nearly a 25%.

Furthermore, EUR/USD could face extra volatility in the next hours in response to results from key US fundamentals. Indeed, investors are expected to closely follow Thursday’s releases, as they should provide further detail on whether the US economy has already embarked on a slowdown, with potential effects on the Fed’s decision-making process.

Technical Outlook

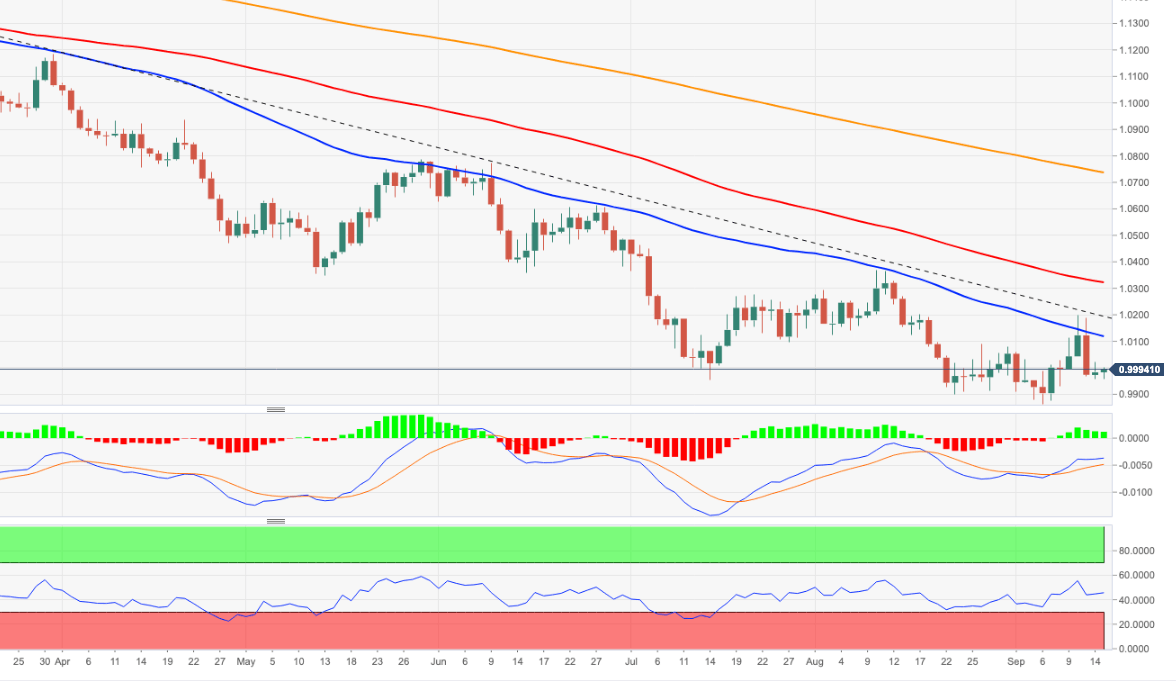

Immediately to the upside for EUR/USD emerges the multi-month resistance line near 1.0180. The move above this region remains a conditia sine qua non for a more sustained advance in the short-term horizon with the next target at the September high at 1.0197 (September 12). Beyond the latter comes the temporary 100-day SMA, today at 1.0320 prior to the August top at 1.0368 (August 10).

On the other hand, the recent low at 0.9950 should offer minor contention ahead of the nearly 2-decades low at 0.9863 (September 6).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.