EUR/USD Elliott Wave: Calling the decline and selling the rallies at the blue box

Hello fellow traders. Another instrument that has given us nice trading set up recently is EURUSD Forex Pair. In this technical article, we’re going to take a look at the past charts of $EURUSD presented in the member's area of the Elliottwave-Forecast. EURUSD is showing bearish impulsive sequences in the cycle from the May peak. We got a short-term recovery wave 4 that has given us the opportunity to enter short trades again. In the further text, we’re going to explain the forecast and trading strategy.

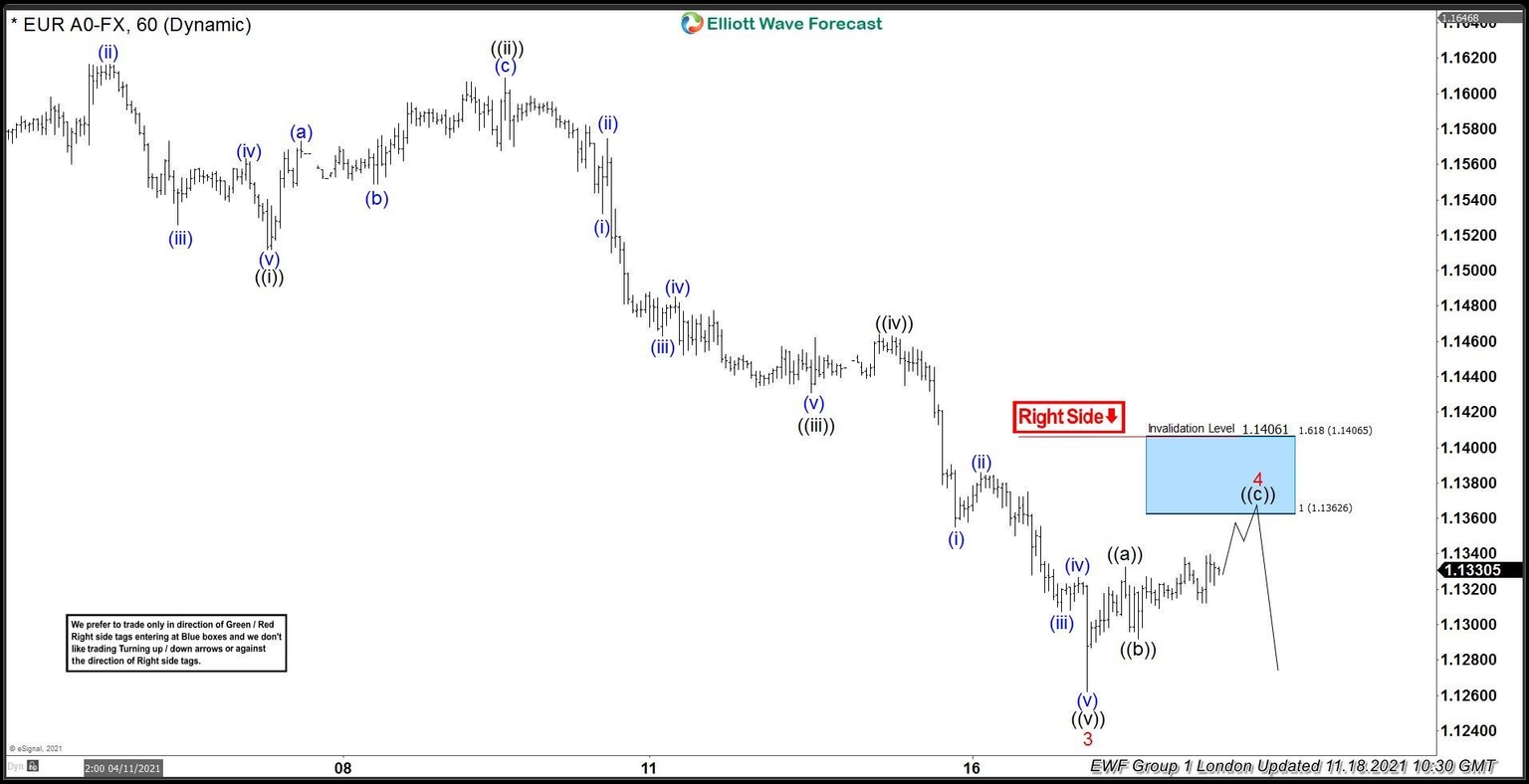

EUR/USD 1 hour Elliott Wave analysis 11.18.2021

EURUSD is giving us 4 red recoveries that are unfolding as Elliott Wave Zig Zag Pattern. It’s having ((a))((b)) ((c)) inner labeling. Recovery looks incomplete at the moment, suggesting more short-term strength. The Forex Pair is looking for a 1.1362-1.1406 area, to complete 4 red recoveries. At the marked blue box area, we expect intraday sellers to appear and to pull price lower toward new lows or in 3 waves pull back alternatively. Invalidation level for the trade is broken above 1.618 fib extension (1.14065).

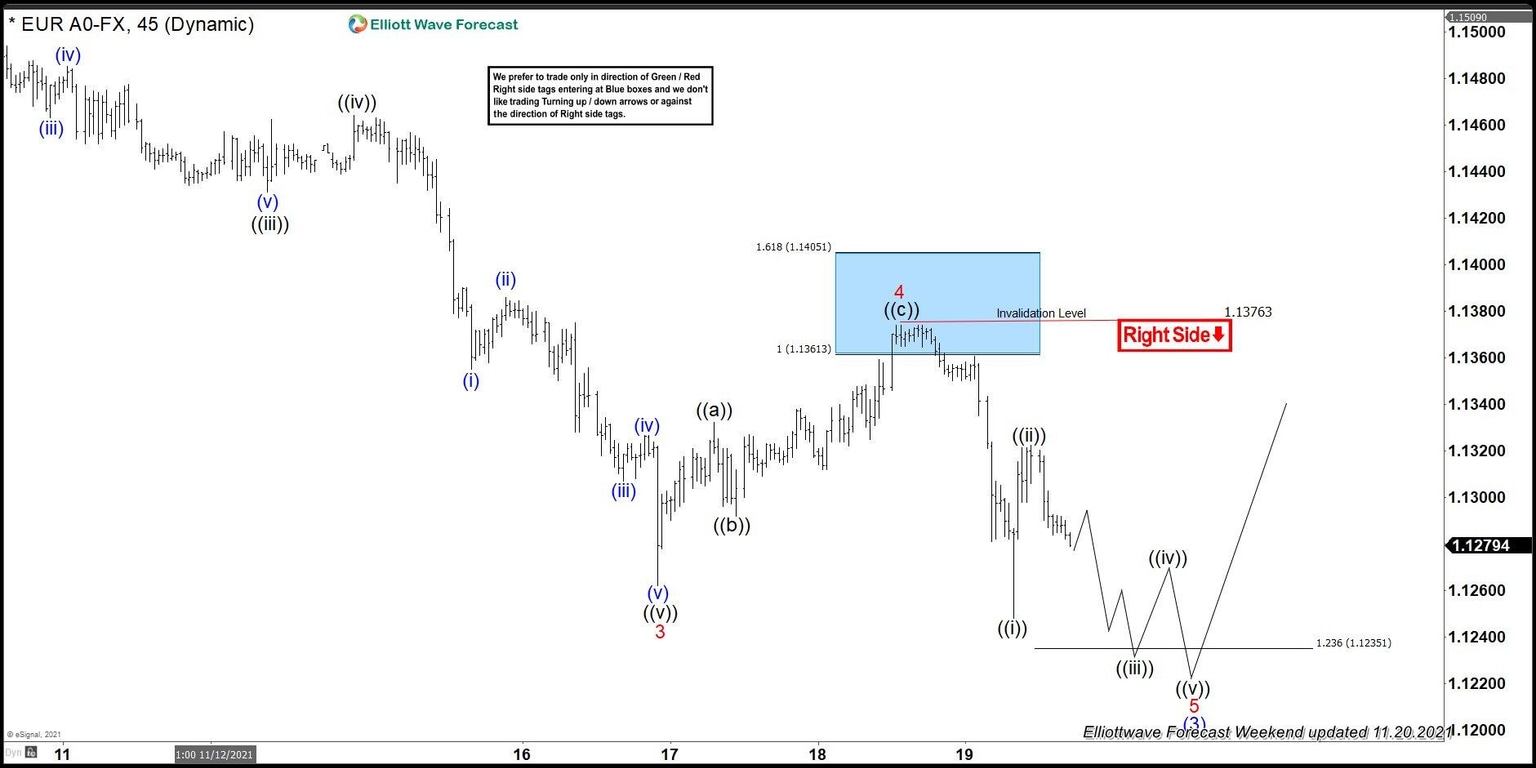

EUR/USD 1 hour Elliott Wave analysis 11.20.2021

Sellers appeared at the blue box and we got good reaction from there. The decline from the blue box unfolded as 5 waves and the price made a break toward new lows. As a result, short positions from the blue box are Risk-Free and partial profit is taken. At this stage, the pair remains bearish against the 1.3763 high. As our members know, Blue Boxes are no enemy areas, giving us an 85% chance to get a reaction.

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com