EUR/USD Analysis: Hovers below 50-day SMA/38.2% Fibo. confluence ahead of US CPI

- EUR/USD comes under some selling pressure on Tuesday amid a modest USD strength.

- Rebounding US bond yields underpins the USD; less hawkish Fed expectations cap gains.

- Traders now look to the US CPI for some impetus ahead of the ECB decision on Thursday.

The EUR/USD pair meets with some supply during the Asian session on Tuesday and snaps a three-day winning streak to a nearly one-month high touched the previous day. A modest recovery in the US Treasury bond yields assists the US Dollar to stall its recent sharp pullback from a multi-week high, which, in turn, is seen exerting downward pressure on the major. The uptick in the US bond yields comes after the US authorities moved to limit the fallout from the sudden collapse of Silicon Valley Bank (SNB). In fact, the Federal Reserve on Sunday announced that it will make available additional funding to eligible depository institutions to help assure banks can meet the needs of all their depositors. Adding to this, President Joe Biden said the administration's swift actions to ensure depositors can access their funds in SVB and Signature Bank should give Americans confidence that the US banking system was safe.

The upside for the USD, however, is likely to remain capped amid expectations that the US central bank will slow, if not halt, its interest rate-hiking cycle in the wake of the strain on the US banking system. Apart from this, rising bets for another jumbo 50 bps rate hike by the European Central Bank (ECB) should continue to underpin the shared currency and contribute to limiting the downside for the EUR/USD pair. Traders might also refrain from placing aggressive bets and prefer to move to the sidelines ahead of the key data/event risks. This week's rather busy US economic docket kicks off with the release of the latest consumer inflation figures on Tuesday, followed by the Producer Price Index (PPI) and monthly Retail Sales figures on Wednesday. Apart from this, investors will take cues from the ECB monetary policy decision, scheduled to be announced on Thursday, to determine the next leg of a directional move for the major.

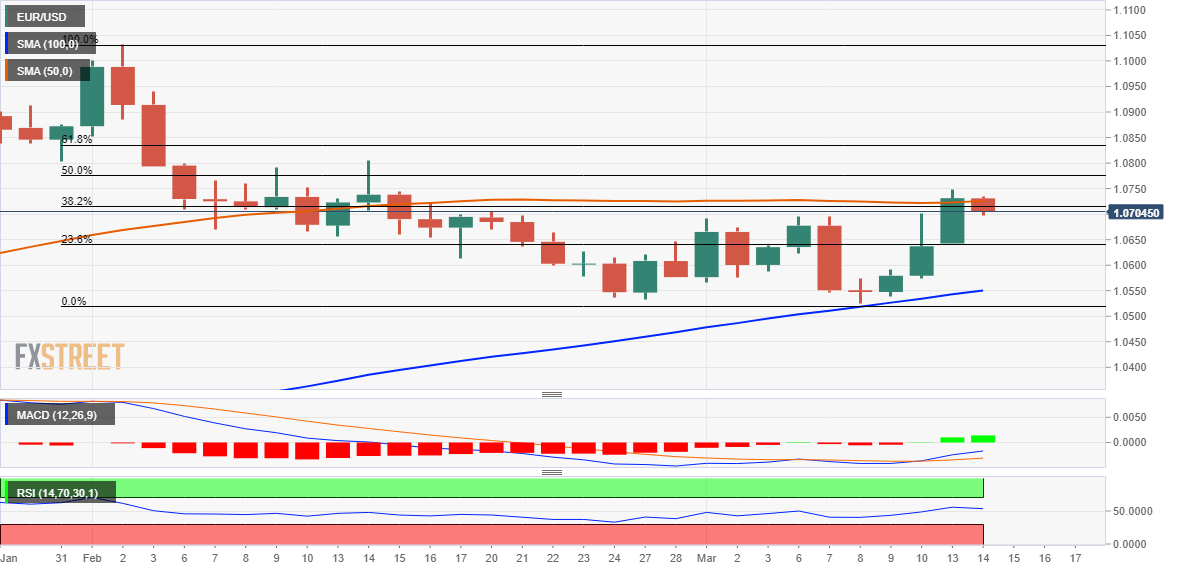

The aforementioned mixed fundamental backdrop makes it prudent to wait for strong follow-through selling before confirming that the recent bounce from a technically significant 100-day Simple Moving Average (SMA) has run out of steam. Nevertheless, the EUR/USD pair, for now, seems to have stabilized around the 1.0700 mark and is more likely to consolidate in a narrow band heading into the crucial US macro data and the ECB event.

Technical Outlook

From a technical perspective, the overnight failure to build on the momentum beyond the 1.0725-1.0730 confluence and the subsequent pullback warrants caution for bullish traders. The mentioned hurdle comprises the 50-day SMA and the 38.2% Fibonacci retracement level of the recent pullback from the 1.1035 region, which should now act as a pivotal point. A convincing breakthrough, leading to a subsequent move beyond the overnight swing high, around the 1.0750 zone, will set the stage for additional gains. The EUR/USD pair might then aim to surpass the 50% Fibo. level, around the 1.0775 region, and reclaim the 1.0800 mark before eventually climbing to 61.8% Fibo. level, around the 1.0835-1.0840 region.

On the flip side, any further decline below the 1.0700 mark is likely to find decent support near the 1.0645 zone (23.6% Fibo. level). Sustained weakness below might prompt some technical selling, which, in turn, will make the EUR/USD pair vulnerable to weaken further below the 1.0600 mark and challenge the 100-day SMA, currently around the 1.0540 region. The latter should act as a strong base for spot prices, which if broken decisively will be seen as a fresh trigger for bearish traders and pave the way for deeper losses.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.