EUR/GBP setting up for further falls?

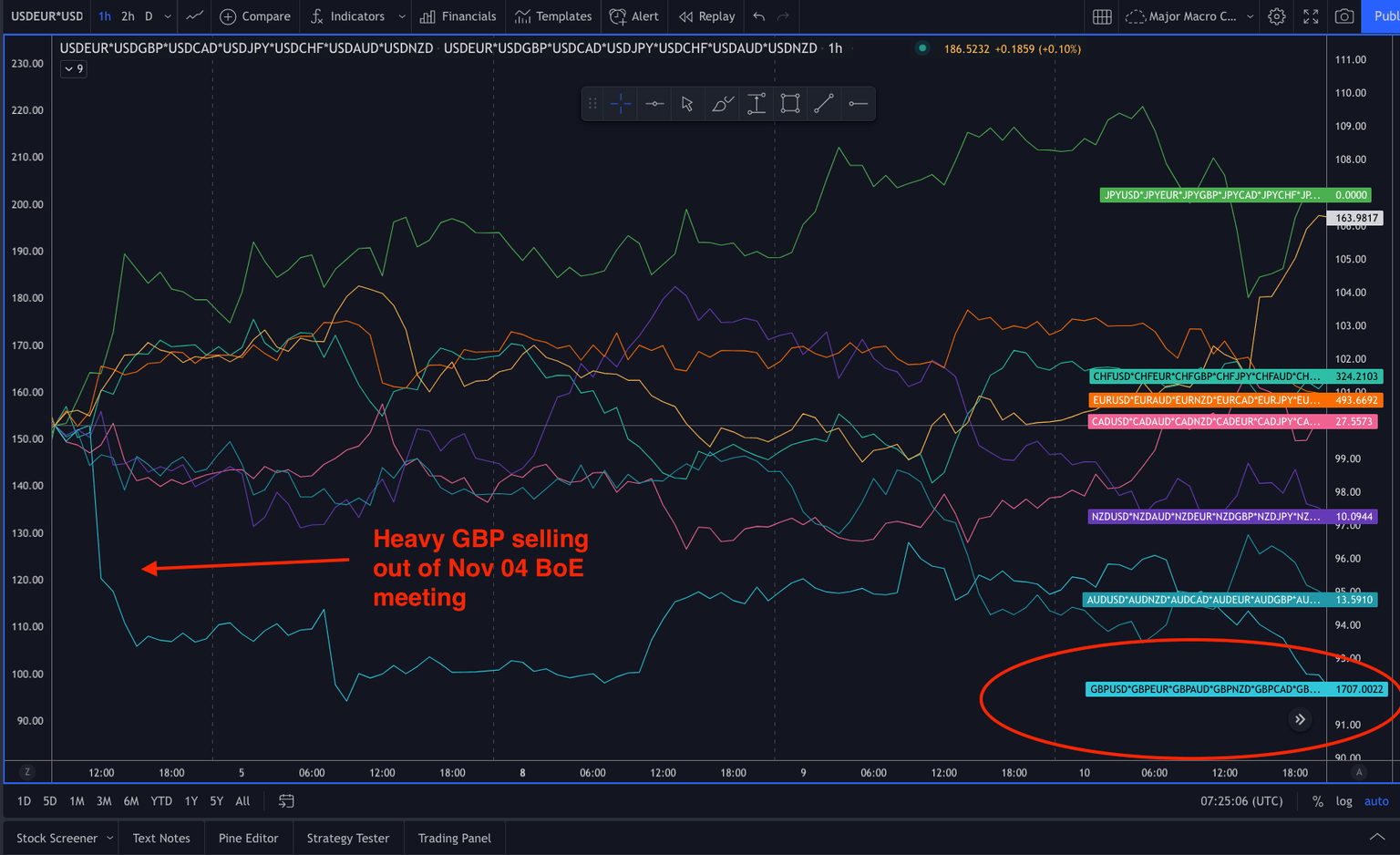

The Bank of England is still expected to hike rates to 1% by 2022 according to the Bank of England’s latest communication at their last meeting at the very start of November. This last meeting was an important one for markets as the BoE let markets down by signalling a rate hike, but then backtracking at the meeting. Sonia futures had fully priced in a 15bps rate hike by the end of this year. This was the response in the GBP after the meeting.

Recent data has been robust

Since this last meeting, the recent economic UK labour data has shown a positive surprise with 247K jobs added vs only 185K expected. The unemployment rate was good at 4.3% vs 4.4% expected and UK average earnings were higher. One of the biggest concerns for the Bank of England has been wanting to see the condition of the UK labour market after the end of the furlough scheme before hiking interest rates. The last CPI reading saw a headline reading of 4.2% and the BoE expect a peak of 5% early next year. There is one more CPI reading just before the next BoE meeting on November 16. The last UK Flash Composite PMI shows buoyant jobs growth. These figures should reassure the MPC about the economy’s ability to withstand a modest increase in interest rates. Sonia futures now are pricing in the following interest rate expectations.

EUR/GBP

The slightly off communication from the BoE and the stronger recent data do make for an interesting next central bank meeting. The volatility caused in the GBP last time means that traders will be slower to front-run the event and will be certainly watching carefully for any new communication. One pair that will interesting is the EURGBP. If the BoE does start to move higher on interest rates, but Europe is under pressure from rising COVID cases there may be a gap opening up between the BoE and the ECB. EURGBP should remain a sell on deeper rallies for now. The recent EUR strength has been due to the euro’s funding currency status. The unwinding of the JPY and CHF on risk-off tones has not only strengthened them, but also the euro. So, the recent euro strength could be a good fading opportunity.

Author

Giles Coghlan LLB, Lth, MA

Financial Source

Giles is the chief market analyst for Financial Source. His goal is to help you find simple, high-conviction fundamental trade opportunities. He has regular media presentations being featured in National and International Press.

-637743758220130651.png&w=1536&q=95)